CRM: Excellent Quarter But The Stock Is Overextended

(Click on image to enlarge)

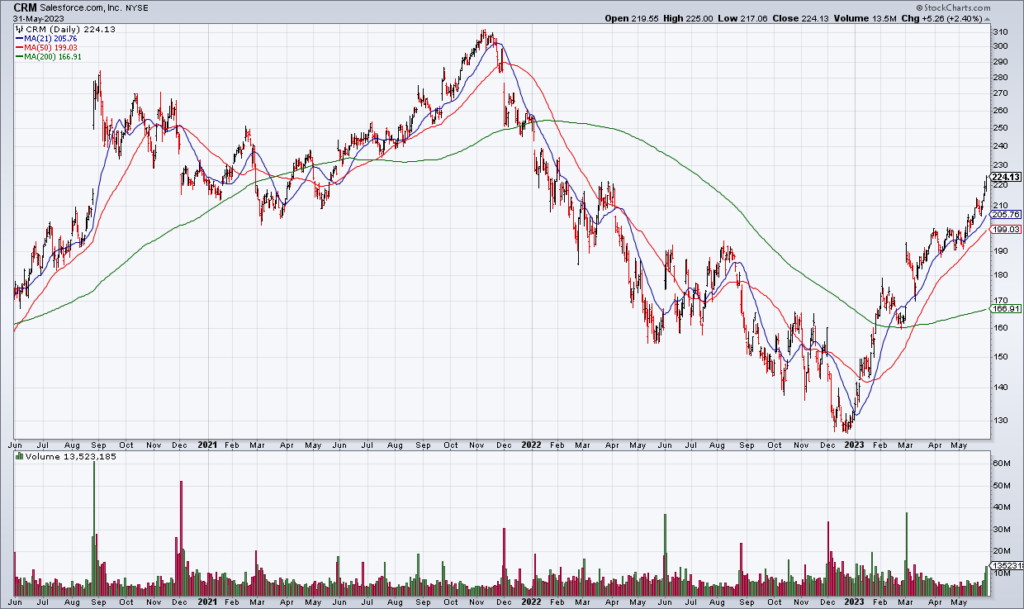

Salesforce (CRM) just reported an excellent 1Q23 – but maybe not enough to push the stock higher in the short term. CRM raised full-year operating margin guidance to 28% from 27% and as a result, they now expect EPS to come in at $7.41-$7.43 – compared to $7.12-$7.14 three months ago.

This is really good but maybe not enough given how overextended the stock was going into the report. For example, CRM was 34% above its 200 DMA at today’s close. As a result, the stock is down ~5% in the after-hours at the moment. If you sold the CRM $240 June 2 calls I recommended in this morning’s post, you can breathe now as they are likely to be worthless.

More By This Author:

CRM Earnings Preview; How To Play An Overextended Stock

Nvidia’s Monster Quarter An “iPhone Moment” For AI?

The Two Types Of Successful Investors