Micro Marvel - Coya Therapeutics

Image Source: Pexels

This comes from our MicroMarvel series of articles highlighting undercovered stocks with less than a billion dollars in Market Capitalization. These articles are not intended to be buy recommendations. They highlight stocks that may have limited trading volume and may be highly volatile, so if you do decide to add them to your portfolio I highly recommend you use stop losses and limit orders.

- 100% technical buy signals.

- 15 new highs and up 43.21% in the last month.

- 74.87+ Weighted Alpha

Today's MicroMarvel is the biotechnology company Coya Therapeutics (COYA). I found the stock by using Barchart's screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and having a Trend Seeker buy signal, then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 2/13 the stock gained 28.89%.

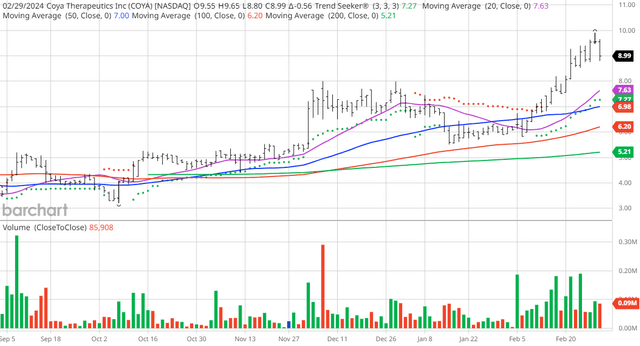

COYA Price vs Daily Moving Averages (Barchart)

Coya Therapeutics, Inc., a clinical-stage biotechnology company, engages in the development of proprietary medicinal products to modulate the function of regulatory T cells (Tregs). The company's product candidate pipeline is based on therapeutic modalities, such as Treg-enhancing biologics, Treg-derived exosomes, and autologous Treg cell therapy. It is developing COYA 101, an autologous regulatory T-cell product candidate that has completed Phase 2a clinical trial for use in the treatment of Amyotrophic Lateral Sclerosis. The company's product candidates in IND-enabling studies include COYA 301, a low-dose interleukin 2 Treg-enhancing biologic for use in the treatment of Frontotemporal Dementia; and COYA 302, a biologic combination for subcutaneous and/or intravenous administration intended to enhance Treg function while depleting T effector function and activated macrophages for use in the treatment of neurodegenerative and autoimmune diseases. It is also developing COYA 201, an antigen directed Treg-derived exosome product candidate that is in preclinical stage for use in the treatment of neurodegenerative, autoimmune, and metabolic diseases; and COYA 206, an antigen directed Treg-derived exosome product candidate, which is in discovery stage. The company has a collaboration with Dr. Reddy's Laboratories SA for the development and commercialization of COYA 302, an investigational combination therapy for treatment of amyotrophic lateral sclerosis. The company was incorporated in 2020 and is headquartered in Houston, Texas.

Barchart Technical Indicators:

- 100% technical buy signals

- 74.87+ Weighted Alpha

- 120.72% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50, and 100-day moving averages

- 15 new highs and up 43.21% in the last month

- Relative Strength Index 66.02%

- Technical support level at $9.38

- Recently traded at $8.99 with a 50-day moving average of $7.64

Fundamental Factors:

- Market Cap $96 million

- Wall Street projected Revenue will grow 48.10% next year

- Earnings are estimated to increase 81.40% this year

Analysts and Investor Sentiment -- I don't buy stocks just because everyone else is buying, but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street issued 2 strong buy recommendations on the stock

- Their price targets are a consensus of $13 for a gain of 45%

- Only 599 investors monitor the stock on Seeking Alpha

More By This Author:

Chart Of The Day: Howmet Aerospace - Is The Sky The Limit?

Talkspace - The Future Of Medical Services

Chart Of The Day: Stantec - Consulting Is Profitable

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours.

very good momentum