Counter Volatility With These 3 Top Low-Beta Stocks

Image: Shutterstock

Stocks have been punished this week following various economic data and Jerome Powell’s speech, with the major indices heading toward their third consecutive weekly close in the red. The Fed served up a 50-basis-point rate hike this week, which was widely expected and a step down from the previous 75-basis-point hikes.

Still, the continuing tightening of monetary conditions tells us that the fight against inflation certainly isn’t over, and the Fed has repeatedly reiterated that it remains laser-focused on restoring price stability.

Of course, the Fed is aware of the impact rate hikes have, but crushing inflation has remained the goal regardless of other factors. Simply put, some pain is necessary.

Three low-beta stocks – Dillard’s (DDS - Free Report), Employers Holdings Inc. (EIG - Free Report), and Arrow Financial Corp. (AROW - Free Report) – could all be considerations for investors looking to shield themselves against volatility.

Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

Let’s take a closer look at each one.

Arrow Financial Corp.

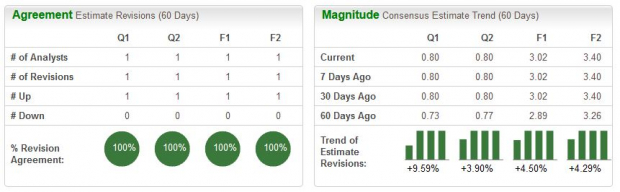

Through its subsidiaries, Arrow Financial Corp. delivers a wide selection of banking and insurance services, including online and mobile banking, wealth management, and more. The company has seen its earnings outlook turn bright over the last several months, pushing it into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

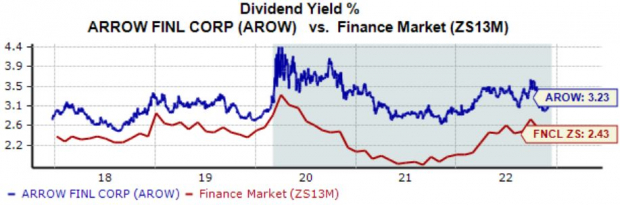

For those that seek income, Arrow Financial has that covered; the company’s annual dividend currently yields a rock-solid 3.2%, nicely above its Zacks Finance sector average of 2.4%. Worthy of highlighting, the company has grown its payout by 4% over the last five years.

Image Source: Zacks Investment Research

Dillard’s Inc.

Dillard's is a large departmental store chain featuring fashion apparel and home furnishings, with locations primarily in the Southwest, Southeast, and Midwest regions of the United States. The company sports the highly-coveted Zacks Rank #1 (Strong Buy), witnessing positive earnings estimate revisions across several timeframes.

Image Source: Zacks Investment Research

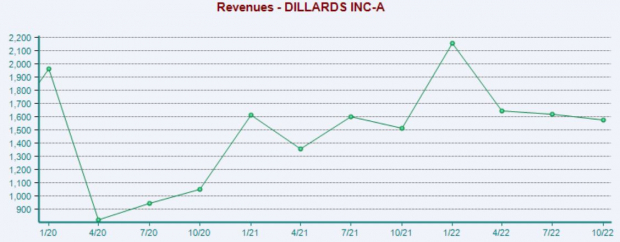

Dillard’s has been on an impressive earnings streak, exceeding the Zacks Consensus EPS Estimate by triple-digit percentages in seven of its last ten reports.

Just in its latest release, DDS exceeded bottom-line estimates by more than 120% and delivered a 3.6% revenue surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Employers Holdings Inc.

Employers Holdings is a specialty provider of workers’ compensation insurance focused on select small businesses engaged in low to medium-hazard industries. Similar to the stocks above, the company has seen its earnings outlook improve significantly, pushing it into a Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

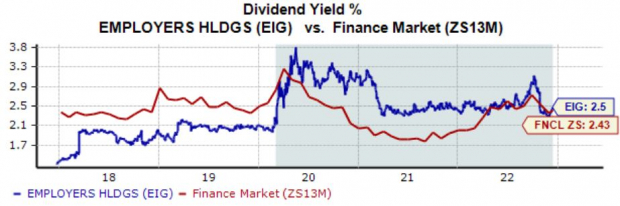

EIG rewards its shareholders via its annual dividend, currently yielding 2.5%, a tick above its Zacks Finance sector average. Impressively, the company has upped its dividend payout five times over the last five years, translating to an 8.4% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

Bottom Line

A hawkish Federal Reserve has been a thorn in the side of many stocks in 2022, with volatility widespread. Other than energy, the market landscape has been dim. During times of heightened volatility, adding low-beta stocks can help blend in an extra layer of portfolio defense.

Stocks with a beta of less than 1.0 are less sensitive to the market's movements, whereas stocks with a beta of higher than 1.0 are more sensitive to the market's movements. All three low-beta stocks above – Dillard’s (DDS - Free Report), Employers Holdings Inc. (EIG - Free Report), and Arrow Financial Corp. (AROW - Free Report) – could be of interest to investors looking to blend in a defensive approach.

All three sport a Zacks Rank #1 (Strong Buy), indicating that their near-term earnings outlooks have turned bright.

More By This Author:

Should Investors Buy Big Tobacco Stocks?Surviving Market Volatility: 3 Low Beta Stocks To Consider

3 Top Stocks Pushing 52-Week Highs

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more