Could This Industry Be The Top Performer Of 2015?

Manufacturing is a sector that is not known for the same volatility as high beta areas of the market such as biotech or social media stocks. Outside a global recession or a major earnings miss stocks in the sector like Honeywell (NYSE: HON) or United Technologies (NYSE: UTX) sport betas in line with the overall market. But, that does not mean this typically boring industry cannot return some really exciting profits.

The exception to this average volatility and the opportunity for for big profits from within the manufacturing space right now is rail car manufacturers. These mostly smaller plays seems to get hit hard every time there is a significant oil train derailment and explosion. In addition, these manufacturers have been hurt by the perception that the steep fall in crude since early summer will cause orders for oil tank cars, an important source of demand in recent years, to dry up.

This pessimism has left most of the firms in this part of manufacturing selling significantly under their intrinsic value. As I have been saying for months on various financial news websites, including Investors Alley, the sector should get a boost when oil prices rise or at least stabilize and the recent 25% rally from the end of the first quarter has proven that thesis correct.

More importantly, any decline in crude production growth causing demand for new oil cars to ebb should be mitigated by the demand that new safety regulations around these cars in both the United States and Canada will bring. In addition, the majority of order backlogs at these manufacturers are from other types of cars (flat cars for autos, hoppers for grains and chemicals, etc.) that reflect demand driven by an economy that is growing although not at the robust rate of previous post war recoveries.

The foundations of new safety rules were outlined late on Friday and rail car makers staged a big rally after the government formally proposed new rules around oil tank cars introducing a new tank car standard and mandating the use of new braking technology. The rules require that the oldest, least safe tank cars be replaced within three years with new cars that have thicker shells, higher safety shields and better fire protection; a later generation of tank cars, built since 2011 with more safety features, will have to be retrofitted or replaced by 2020.

This will impact over 100,000 existing tank cars over the next three years and another 75,000 or so from the reports I have seen by 2020. This will be a huge source of new demand which should more than mitigate any decline from the impact of slowing domestic production over the next few years.

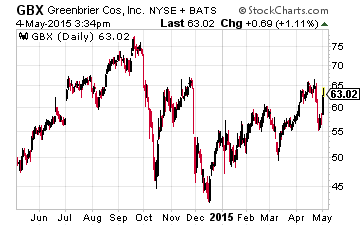

My favorite manufacturer among the rail car makers continues to be Greenbrier Companies (NYSE: GBX) even though its stock is up by approximately a third since inclusion in the Turnaround Stock Report portfolio in mid-December. The company already has an over $4 billion order backlog (more than 70% of which is from non-oil tank cars) as it did before these new safety rules come into effect. This is around one and a half years’ worth of production at current run rates.

My favorite manufacturer among the rail car makers continues to be Greenbrier Companies (NYSE: GBX) even though its stock is up by approximately a third since inclusion in the Turnaround Stock Report portfolio in mid-December. The company already has an over $4 billion order backlog (more than 70% of which is from non-oil tank cars) as it did before these new safety rules come into effect. This is around one and a half years’ worth of production at current run rates.

The company has beat the quarterly bottom line consensus by at least 30% for three of the last four quarters. Over the past month, consensus earnings estimates have moved up some 50 cents a share to almost $6.00 a share in FY2016. To put this earnings growth in perspective, Greenbrier made just over $3.00 a share of profit in FY2014. Another 10% to 15% rise in earnings should be in the cards in FY2016. The stock is still cheap at just over 10 times this year’s likely earnings.

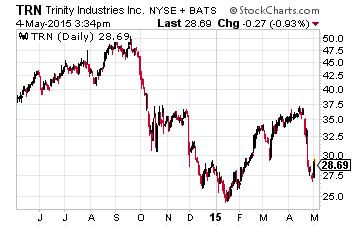

I also have a smaller position in rival Trinity Industries (NYSE: TRN) which is even cheaper than Greenbrier at under seven times earnings estimates for this fiscal year. However, the company just received a subpoena from the U.S. Department of Justice seeking documents related to its ET-2000 and ET-Plus highway guardrail products. This product has allegedly been connected to some eight deaths in recent years, even though recent crash tests showed these products to be safe. Although not a big part of Trinity’s overall business, any notice from the Feds is concerning. Those not comfortable with this litigation risk should avoid the stock even I though I believe the current stock price reflects a worst case scenario.

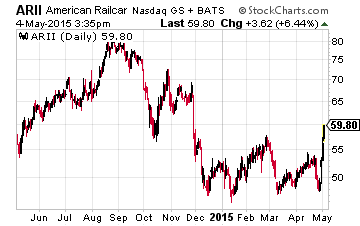

Investors looking for another play in this space to diversify their holdings in this manufacturing niche would do well to consider American Railcar Industries (Nasdaq: ARII). The shares are not expensive at 11 times this years’ profit and have the added attraction of paying a dividend yield just north of three percent as well.

With revenue and earnings growth projected to be flat for the S&P 500 year-over-year in the first half of the year, the market feels overbought here at roughly 18 times trailing earnings. That being said, equities still provide some bargains if investors are willing to look at some undervalued sectors. The rail car manufacturers sector seems to be one of those cheap niches in the current market and one that I am playing.

There’s one investment strategy that I’ve used to collect more money from than any other. It’s the one I’m using now with rail car manufacturer’s and three other sectors.

This strategy has consistently produced returns like 199.4%, 457.1% and even 1,200% since 1979.

It’s the reason I was able to retire in my early 40s and turn my attention to sharing my investment ideas with every day investors like you… people just trying to get ahead in life.

Disclosure: Long more

Hi Brett..what a great article..agree on the sector..but consider WAB NFS CP UPN KSU cheers Carol

Best wishes. But astrologically speaking planetary potential for manufacturing and global economy after October 2014 and on is with exceptions not so impressive. A variety of issues are confronting the world economy. 10 June 2015 and on seem to be generating new concerns. Psychological concerns. Natural smell- products may be sick perhaps. Somewhere people may be less tolerating. Bad smell through air could travel causing ill health.