Could This Be One Of The Biggest Winners Of The Electric Car Boom? (SPONSORED POST)

The following is a Sponsored Post which discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

The same nightmare that haunts electric vehicle producers with massive production plans is a waking dream for cobalt/lithium explorers like LiCo Energy Metals (TSX:LIC.V; OTCQB:WCTXF), who are now poised for a breakout with a major new project in Chile that comes amid tight future supply for two of the most critical minerals of our time.

If you thought lithium was set to soar because the future supply picture looks dire in the face of the EV explosion onto the mainstream, you might be surprised to learn that cobalt is an equally, if not more, important part of our energy future.

The lithium-ion batteries that Tesla (Nasdaq:TSLA), for one, needs to feed its electric vehicles actually use more cobalt than lithium by weight. And as it stands, automakers aren’t going to be able to produce at high demand unless they have enough batteries.

We are poised on the edge of a massive outbreak of electric vehicles; our obsession with lithium-bound consumer electrics continues to grow at blurring rate; and the powerwall and energy storage solutions are not just futuristic talk—they are already very real.

In this dramatic world-changing backdrop, lithium-ion batteries are leading the race, and LiCo Energy Metals is strategically positioned to take part in this energy coup. But the real coup for this small-cap company is the new acquisition (this recently announced property option in Chile is subject to TSXV approval) in the main lithium exploitation artery of Chile’s mining heartland—a deal surrounded by major producers of the world’s cheapest and highest-grade lithium.

Here are 5 reasons to keep a close eye on LiCo’s cobalt and lithium exploration progress right now:

1 Critical Chemistry: The Cobalt Coup

LiCo’s Teledyne Cobalt Project is a high-grade, advanced-stage cobalt project in the heart of a historical mining district in Ontario, Canada. Covering 11 claims across over 1,368 acres, this project already boasts CAD$25 million in inflation-adjusted infrastructure.

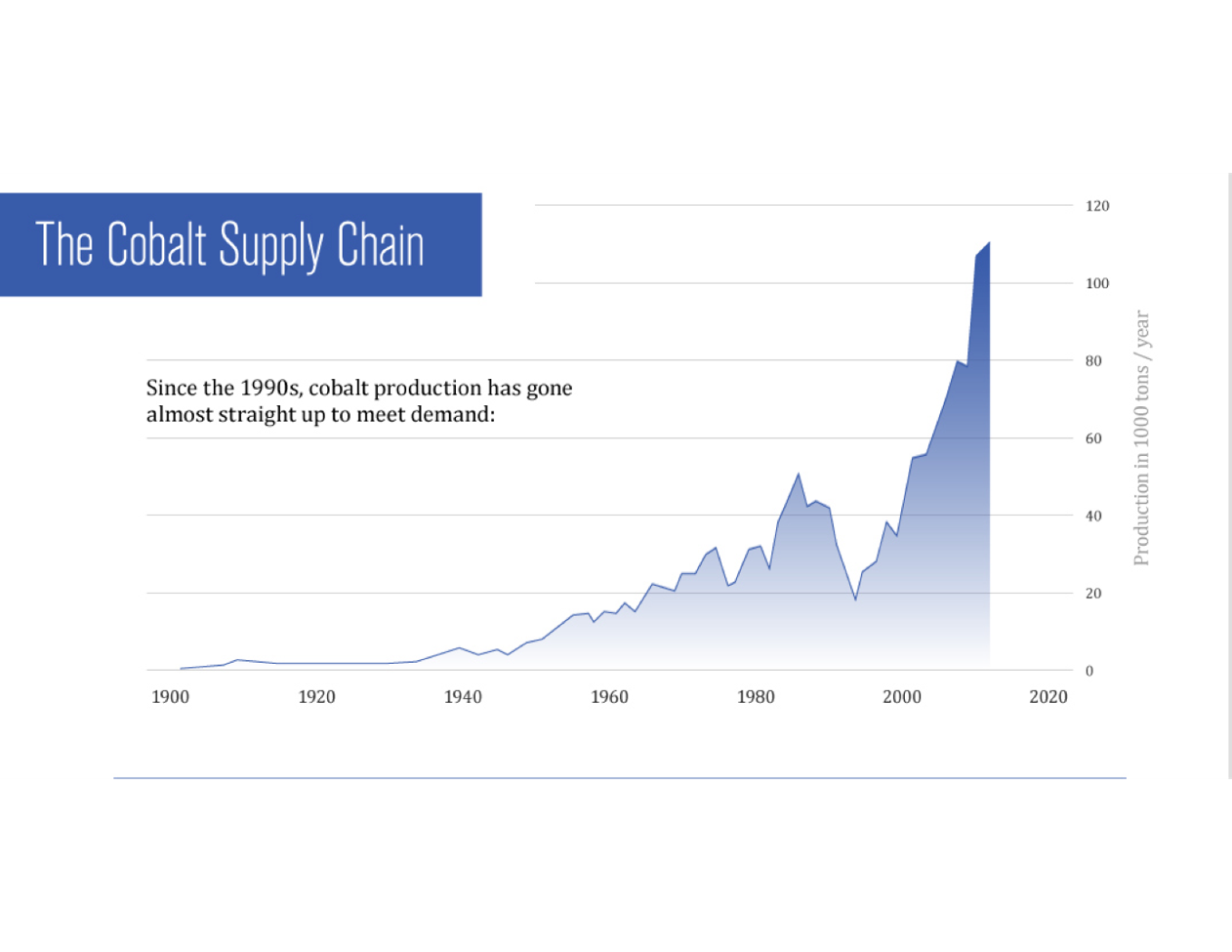

This is why it’s really important: We need more cobalt than we’ve got, and the mass production of lithium-ion batteries at global gigafactories actually requires more cobalt than lithium.

The cobalt in this equation becomes even more valuable when you consider that almost 95 percent of global cobalt comes from copper and nickel mining, as a by-product. That makes its supply heavily dependent on copper and nickel demand and means it will be difficult to come by at a decent price.

The numbers speak for themselves. In 2015, the battery industry accounted for 41 percent of global cobalt demand, according to the Cobalt Development Institute (CDI). However, over the next 10 years, CDI expects that to increase to 65 percent, and it will be unsustainable unless new cobalt resources are brought into production.

That’s why this is a game for new explorers who are targeting specific cobalt plays with an eye to becoming a real part of this energy revolution by cornering new supply for a demand equation that shows every indication of starvation.

2 Cobalt AND Lithium: The Hottest Duo on Earth

As future supplies of lithium and cobalt promise to fall well below soaring demand, the aim of the game is to stake out new potential lithium acreage and get an early foothold on cornering the market share for what is no less than an energy revolution.

So not only does LiCo have a cobalt exploration project, but it also has two lithium projects to add to this strategic mix, the Dixie Valley Exploration Project and the Black Rock Desert Project, both in Nevada—ground zero for the U.S. lithium boom.

Dixie Valley and Black Rock Desert are early-stage, conceptual lithium brine projects in locations that can’t be beat. For Dixie Valley, LiCo has 348 placer claims over nearly 7,000 acres, and in Black Rock, we’re looking at 128 placer claims over nearly 2,600 acres (subject to tsx venture approval.)

The land rush is already on in full force in Nevada, and the state’s geology is brilliant. The Clayton Valley area, and beyond, is all highly prospective lithium grounds in tectonically active territories bounded by faults. It’s also the home of the only producing lithium mine in the U.S.--Albermarle’s (NYSE:ALB) Silver Peak Mine. This is where a lot of new entrants to the lithium game are clustering, and it’s ground zero in the land rush. It’s also in the backyard of Tesla’s gigafactory.

3. Supply Tighter than Anything We’ve Ever Seen.

The surge this year in spot prices in China, coupled with the ravaging hunger for lithium batteries and power storage solutions, has triggered fears that we are on the edge of a major supply problem—but it’s a euphoric problem for lithium exploration companies and it has opened up the playing field to new entrants.

Tesla has flooded the mainstream U.S. market with its newest model; EVs have already entered the profit stage in Norway, and will soon be followed by the Netherlands, helped out by some EV-market-loving laws that demand that every single car in the country be electric by 2025. In Asia, too, EVs are bursting the traditional car bubble.

Volkswagen (OTCPK:VLKAY) is sure that a whopping 25 percent of its car sales by 2025 will be EVs, and the World Energy Council expects 1 in 6 cars sold in 2020 will be EVs. Finally, according to Bloomberg, by 2022 EVs will be cheaper than traditional vehicles.

And with a mind-boggling 12 battery gigafactories on the books globally, we’re looking at a supply and demand equation that is overwhelming in favor of the new lithium miner. It’s not only Tesla: LG Chem (OTC:LGCEY), Foxconn, BYD (OCTPK:BYDDY) and Boston Power are all building new battery factories, too—among others. Imagine the manufacturing capacity here that requires monumental amounts of lithium and cobalt that we simply won’t have.

In 2015, the battery industry accounted for 35 percent of global lithium demand, according to the United States Geological Survey (USGS). More to the point, this industry bought 11,375 tonnes of refined lithium. Then we have cobalt, which is even more astonishing, considering that the battery gigafactories aren’t even online yet. According to the Cobalt Development Institute (CDI), the battery industry represented 41 percent of global cobalt demand in 2015, or about 40,600 tonnes.

With both cobalt and lithium exploration projects—it’s hard to find a junior set-up that is more strategically positioned than this to take advantage of the fundamental reality of this energy revolution.

4 Spot Prices Soar

Cobalt spot prices have increased some 40 percent since March, and are up by more than 20 percent over the previous six months through October, when they hit US$13.40/lb, up from US$10.80/lb.

(Click on image to enlarge)

In 2015, cobalt prices were falling quarter-on-quarter, and on into Q1 2016, but Q2 and Q3 of 2016 saw a recovery, with prices now trending between US$13 and US$14/lb. Roskill anticipates demand for cobalt to grow at roughly 5 percent per year with demand for cobalt in Li-ion battery applications expected to increase at nearly 7 percent per year, to 2025.

And current prices are further supported by temporary shutdowns at key mines. But it all means we’re looking at a deficit already in the New Year, so it’s a tight market that can continue to support a jump in prices.

Lithium spot prices more than tripled in a matter of months at the beginning of 2016, up to April, when they retreated only slightly.

While there may be a few ups and downs, overall, there is no sign of a halt to the lithium breakout as it drives a clear and visible energy revolution. In 2015, lithium consumption nearly tripled. Since 2010, the market has grown by 10,000 tons per year, led by the lithium-ion battery market. Lithium prices have been surging since the second half of 2015, and short-term contract prices have been on the rise since the first half of 2016. For 2017—if current contract negotiations are anything to go by—analysts expect to average over US$10,000 for lithium hydroxide and over US$15,000 for lithium carbonate.

5 Strategic Footprint, Strategic Minerals

Everyone has known about the lithium boom for months—it’s the talk of the energy space. But Cobalt, well, that’s one the best kept secrets in the lithium-ion battery mix, and it’s the secret ingredient that stands to turn new miners into mineral barons. LiCo is the best of both worlds, with a strategic footprint in the two key elements that are of critical mass to energy revolution.

This grassroots Canadian company understands that right now, this game is all about exploration and finding new supply.

The company has CAD$1.8 million in the treasury, and is running a CAD$700,000 exploration program on its cobalt property.

For the investor, the real value in this is that this is a 100 percent cobalt mine—it’s not simply where cobalt comes out as a by-product of copper or nickel. This is what the supply picture is demanding, and exactly what LiCo is uniquely offering. And because Ontario is one of the top mining locations in the world, there is a flurry of interest in and around this area, pushing a land rush potential like that for lithium in Nevada. Every day we get further into the lithium-ion battery game, these properties become more valuable.

But it’s not stopping with these three portfolio plays in Nevada and Ontario. There’s an untapped geological wonderland out there, and now is the time to scoop it up.

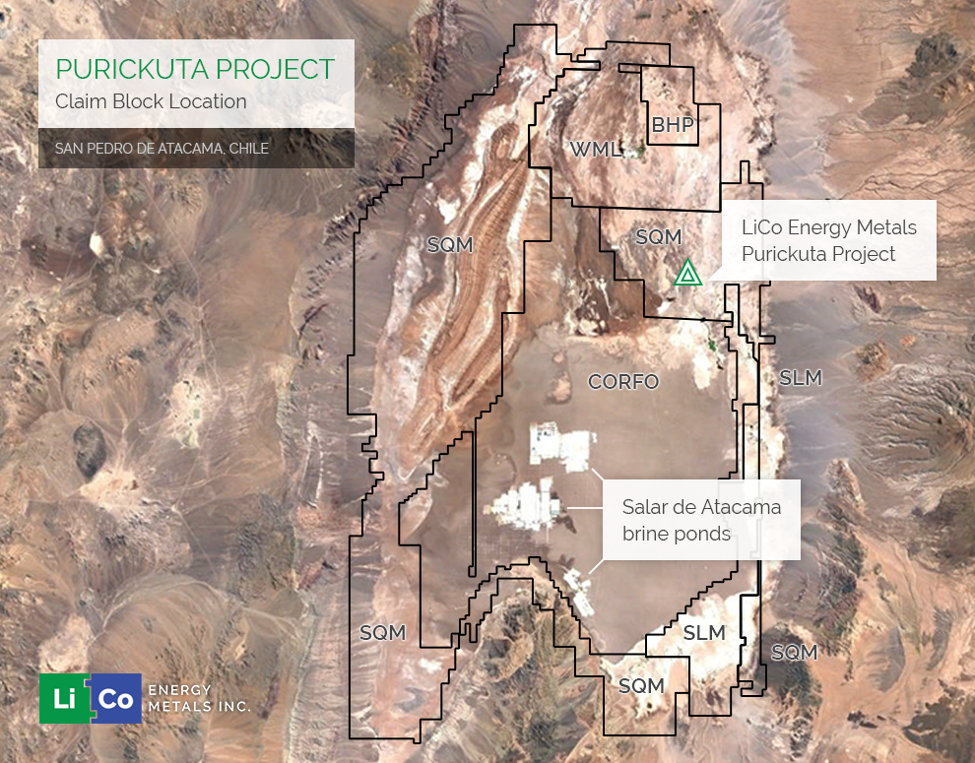

The real coup de grace, however, is this: LiCo has just announced that they have signed a letter of intent to acquire interest in a major exploration project in Chile’s prized lithium development, Salar de Atacama, home to around 37 percent of the world’s entire lithium production. This recently announce property option in Chile is subject to TSXV approval, and once approved LiCo will take on up to a 60 percent interest in the Purickuta Project—and will be exposed to one of the best new lithium supplies in the world. The project covers 160 hectares and is one of a few exploitation concessions granted within the highly sought-after Salar de Atacama.

(Click on image to enlarge)

It is surrounded by major lithium mining and is right in the middle of an existing exploitation concession owned by mining major Sociedad Quimica y Minera (SQM) and only 3 kilometers north of another exploitation concession of CORFO (the Chilean Economic Development Agency). But this is lithium central, so that’s just the tip of the iceberg. Some 22 kilometers south-east of this project, SQM and Albemarle have large-scale production facilities, which produce, combined, over 62,000 tonnes of Lithium Carbonate Equivalent annually. They account for 100 percent of Chile’s existing lithium output.

For a small-cap miner, one might think it doesn’t get any better that this—but it does. Salar de Atacama’s lithium is easier and cheaper to produce than anywhere else in the world because its high-grade lithium and potassium has a high rate of evaporation and extremely low annual rainfall.

So what LiCo is stepping into here is a low-cost resource definition opportunity and a near-term production opportunity. More specifically, it’s set itself up with a brilliant new play that has the highest-grade of lithium in the world, is already close to existing pumping, solar evaporation installations, power, labor, transportation and other infrastructure, and fits perfectly within the company’s capabilities to quickly define reserves and set up production facilities.

So when anyone asks whether it makes sense for a junior to step into the cobalt game, the answer is a resounding yes. LiCo has not only strategically secured key lithium exploration targets—including the sweetest spot in the world--but it’s also a first-mover on the pure cobalt scene, hedging against the coming hunger for a mineral that we only get when nickel and copper are involved. First movers are typically rewarded, so we’ll be looking very closely at this company in the coming months as it forges ahead with exploration of minerals that are in high demand and ever-shortening supply.

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to ...

more

What other stocks can benefit from the #ElectricCar craze? It's definitely the future of the auto industry.

Not for nuthin' but the chart of LIT (Lithium fund) is in a very bullish pattern.

Sounds promising! $WCTXF

"According to Bloomberg, by 2022 #ElectricCars will be cheaper than traditional vehicles."

Can't wait, though at the breakneck speed of advances in tech these days, I would have thought it would be even sooner.

I don't feel comfortable sitting on a gigantic lithium battery. That is just a personal preference. I don't really see electric cars gaining widespread acceptance, but if the price difference is huge, there could be an expanded customer base.

How about a nuclear fuel rod. :-)

I am pretty cool with cobalt 59, but any number higher could be radioactive, right? I didn't do well in Chemistry but I think I have that right, Gary. I just don't like Lithium. Also electric cars are limited in what they can do. It takes awhile to fill them up!

Interesting article. I'm curious to know what my go to expert on #lithium, @[Juan Carlos Zuleta](user:9576), has to say about this. $TSLA $WCTXF

Interesting, I hadn't realized that more #cobalt is used in ion-lithium batteries than #lithium itself! Who knew? I'll be taking a closer look at #LiCo Energy Metals $WCTXF

How rare is #cobalt relative to #lithium?