COST And KMX: Two Consumer Stocks On Divergent Paths

Image Source: Pexels

Costco Wholesale Corp. (COST) just reported earnings per share and revenue above estimates. But CarMax Inc. (KMX) shares just plunged the most in the S&P 500 Index (SPX) after the in-person used car seller reported angsty consumers held back from buying cars in the past quarter

Big-box shopping club Costco reported that same-store sales increased 6.4% in the past quarter. Revenue was $86.6 billion, with profit at $5.87 a share. CFO Gary Millerchip said its average customer was getting younger, and younger buyers were snatching up memberships.

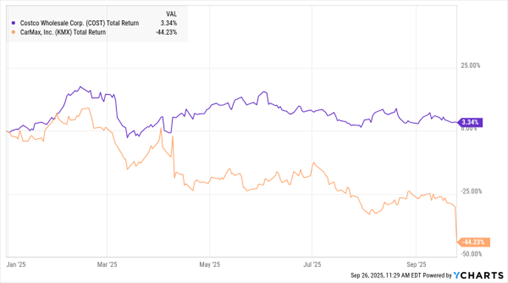

COST, KMX (YTD % Change)

Data by YCharts

Costco raised its membership fee by $5 last year. The higher ticket cost to hop on the bulk-buying ride brought in $1.7 billion, up 14% from last year. Costco did not post updated 2026 guidance, and said it was still working out ways to keep costs low in the face of tariffs.

As for KMX, the largest seller of used cars reported that sales declined in Q2. CEO Bill Nash stated that buyers accelerated their demand in Q1, anticipating the worst from tariffs and inflation. “The consumer has been distressed for a little while. I think there’s some angst,” he said. He added that customers with better credit are waiting on the “sidelines.”

Unlike Carvana Co. (CVNA), CarMax operates a ton of retail spaces – 250 to be exact. Sales fell nearly 6% from earlier in the year to $6.5 billion.

More By This Author:

PYPL: Google Deal Shows CEO Is Delivering On His Promises

BILL: An Attractive Turnaround Play In The Fintech Space

BILL Holdings: An Attractive Turnaround Play In The Fintech Space