Correlation Between Social Media Chatter And Nike's Stock Plunge

Image Source: DepositPhotos

The recent dramatic decline in Nike's (NKE) stock price following the release of its Q4 earnings report offers a prime example of how social media sentiment can significantly impact market behavior. Using our KOIOS system, an AI-powered chatter analysis platform, analysts could closely monitor the online conversation surrounding NKE and pinpoint its correlation with the stock's performance.

The period under scrutiny was divided into two distinct phases: pre-June 27th, characterized by relatively stable market conditions, and post-June 27th when Nike entered a crisis mode following the release of its disappointing Q4 earnings.

The KOIOS system tracked social media chatter related to Nike from June 7th to July 7th, recording 19,829 mentions across various platforms. This translates to an average of approximately 100 posts per day. However, the system detected a significant surge in mentions leading up to and following the release of Q4 earnings on June 27th.

- Spike in Chatter: On June 25th, the system recorded 140 posts, which escalated to 352 mentions on June 26th. The day of the stock drop, June 27th, witnessed a staggering 3,148 mentions. The peak, however, occurred on June 28th, with a massive 6,319 mentions.

-

Chatter Volume and Sentiment: The KOIOS system generated two key alerts: a significant increase in chatter volume and a surge in negative sentiment. These alerts coincided with the stock price drop and a corresponding increase in trading volume.

-

Bot Influence: While the system identified that 48% of the overall chatter was generated by bots, the remaining organic user content exhibited a clear correlation between chatter volume and sentiment analysis. The sentiment graph, which aligns mentions by sentiment with the stock price, vividly illustrates the surge in negative sentiment during the stock drop.

(Click on images to enlarge)

Organic chatter analysis:

Sentiment analysis:

Sentiment and volume analysis including bots:

Sentiment and volume analysis excluding bots:

The KOIOS system's analysis of social media chatter surrounding Nike's Q4 earnings and subsequent stock price decline underscores the critical role of social media in influencing market behavior. The correlation between increased chatter volume, negative sentiment, and the stock's plummeting value provides valuable insights for investors and analysts. As social media continues to shape public opinion and market trends, AI-powered tools like KOIOS will become increasingly essential for navigating the complexities of the modern financial landscape.

Disclaimer: This article is based on data provided by the KOIOS system and does not constitute financial advice.

Saw this and thought it made a lot of sense:

#Nike is down 30%+ YTD (wiping $60B+). A former Nike branding exec wrote a viral post and blames it on three decisions Nike made in 2020 under incoming CEO John Donahue.

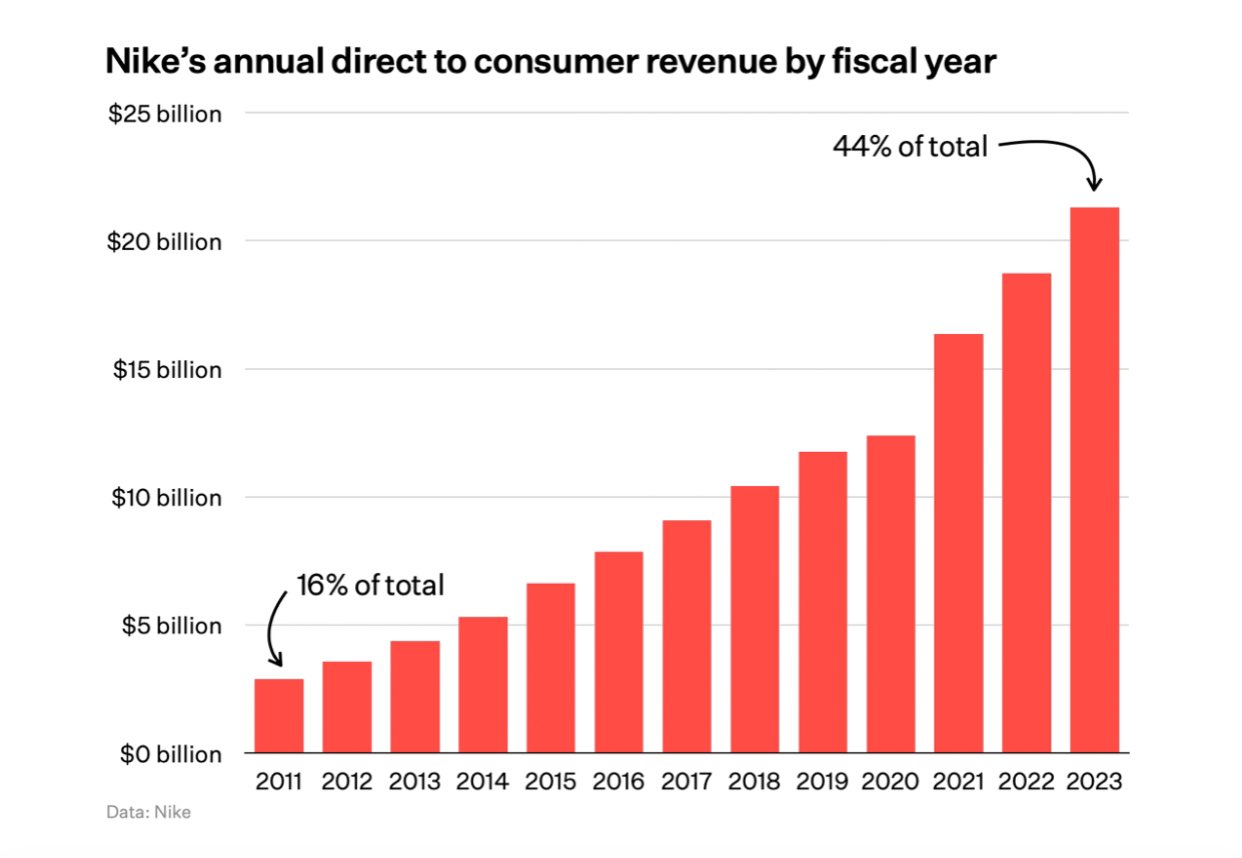

The plan prioritized the direct-to-consumer (DTC) business but backfired:

ELIMINATE CATEGORIES: Mckinsey advised Nike to get rid of categories (running, basketball, soccer) and re-classify everything into “Women”, “Men” and “Kids”.

The logic was that Nike was duplicating resources and a pivot to DTC would provide enough customer data to inform product decisions instead of relying on the category experts (eg. a basketball vet that spent 20+ years at Nike). A lot of these experts were fired and Nike lost their insights.

This was a clear L because Nike quietly brought back categories at end 2023.

END WHOLESALE LEADERSHIP: Nike ended hundreds of relationships with wholesales partners and prioritized Nike website over retail.

The change looked genius during COVID but as customers returned to brick ‘n mortar, Nike’s product were nowhere to be found. It had burnt bridges with partners, who were happy to give shelf space to upstarts (this wasn’t covered but I think On and Hoka took advantage of this for running).

There was also a lack of feedback from retailers, which led to inventory issues (the “data-driven” insights from online sales proved to not be a panacea).

PRIORITIZE DIGITAL MARKETING: Nike changed its marketing budget to focus on driving users to Nike digital properties and membership platforms.

For decades, Nike spent 10% of sales on brand advertising to create an aspirational halo. The prioritization of programmatic ad spend meant Nike went from “create demand” (new customers) to “serve and retain demand” (re-targeting existing ones). The result was a slowdown in sales.

“Because of that,” writes Massimo Giunco (who spent 21 years at the company), “Nike invested a material amount of dollars (billions) into something that was less effective but easier to be measured vs something that was more effective but less easy to be measured. In conclusion: an impressive waste of money.”

***

The focus on DTC is not surprising. Donahue was formerly CEO of B2B SAAS firm ServiceNow.

Nike’s DTC business is now 44% of sales (vs. 30% before the strategy change).

The digital focus seems to have commoditized the product, impacted Nike’s brand perception and created an opening for competitors. But Giunco does think it’s fixable if Nike gets back to its marketing prowess and get off the digital ad drop (obviously take it with the grain of salt that he’s a brand guy).

***

Check out the whole piece on $NKE: Nike: An Epic Saga of Value Destruction

The New Consumer chart below: Is Nike actually good at digital? Or is it just lucky to be Nike?

Whatever happened with this? $NKE is still low compared to a month ago.

The reason Nike's doing so badly is because the quality of their shoes has been going downhill for years.

It doesn't seem suprising that an increase in negative sentiment would cause $NKE's stock price to go down. The only questions I see are:

1. What caused this sudden uptick of negative sentiment and

2. What can the company do about it?

What was the negative sentiment focused on? I'm bullish on $NKE. I'm very optimistic about Nike's future and you can't beat the brand loyalty its customers have. I won't buy any other brand of sneaker myself. I think the only place to go is up. But I'd like to know what these negative posts were concerned about so I can rebut those concerns.

Half the chatter generated by bots is a pretty big deal. Someone should tell Nike so they can get those bots shut down.

Very interesting, but I'm curious about some of these findings... did the bots initiate the negative posts about #Nike? Or did they merely amplify existing posts? Was this an organized attempt to hurt Nike's stock? And if so, who was behind it?

I agree that this is interesting information, but am not sure what to do with it. It would be more useful if we understood what the chatter actually said. Were most posts in agreement? Did they all take a negative view of the company? Why? What was the news that actually caused $NKE to drop?

There was good reason for Nike's stock to drop. It's no secret that the company has had disappointing financial results, driven by weakening consumer demand, and increasing competition. It's not doing well in China which is a major growing market. I don't think we need social media chatter to see that - just research the sticker on any reputable news site like, including right here.

But I do think investors have a right to know if there is an organized attempt to manipulate $NKE's stock price to drive it down.

Agreed. Though if that's the case, then it means $NKE is being undervalued and this could be a good buying opportunity.

I'm not clear why this is news. Doesn't social media chatter always affect stock price? Remember how much it affected GameStop and other meme stocks? What was the chatter about?