Correction, Or Bear Market?

On February 21st, I was helping an investment advisor I consult with pick stocks for a new client’s portfolio. He lamented that there were not enough stocks at good valuations. This is one of the hardest parts of being an investment advisor: a client expects the advisor to build a portfolio of stocks which should do well, but sometimes, especially in late-stage bull markets, most stocks are overvalued. I reminded him, “The Constitution does not guarantee anyone the right to good stock picks.” He agreed, but he still had to tell his client that the client would be better off mostly in cash, waiting for better values to appear. I did not envy him the task. When the client thinks your job is to pick stocks, it’s hard to convey the message that the best course is not to pick anything at all.

After a week of covid-19 fueled stock market panic, I expect he’s having a much easier time persuading his client to wait. Now the question becomes “How much longer should we wait?”

Calling market bottoms is nearly as difficult as not buying at market peaks. Right now, the stock market has been falling because investors understand that the covid-19 pandemic is damaging the economy and company profits. The extent of that damage remains to be seen, but the consensus seems to be that covid-19 will lead to no economic growth or even a slight decline in the world economy in 2020. Given that stock prices are highly sensitive to current and future growth prospects, my guesstimate is that the pandemic alone could justify a 10 percent to 20 percent decline in the stock market.

The S&P 500 has already fallen 12 percent. If my 10% to 20% guesstimate is right, we could have already seen “enough” decline to account for the likely economic damage of the covid-19 pandemic. Is it time to buy the dip?

I believe it is always wise to hedge one’s bets, and so I have begun to buy a few of the stocks I believe have become better values in the last week (GPP, CIG, SCHN, MIXT). Despite these small buys, my overall stance remains cautious.

The covid-19 pandemic is not happening in a vacuum. For most of the last year, I have been warning readers that I believe that most stocks are trading at dangerously high valuations. Until recently, stocks, and especially clean energy stocks, have continue to rise.

Understanding Market Cycles

In general, bull and bear market cycles happen because changes in investor sentiment react to and amplify the effects of business cycles. When the economy has been good for a long time, not only are company profits high, but the memory of past declines fades for investors, making them less risk-averse. This rising confidence leads them to be willing to accept greater risk for the same potential return, allowing them to buy stocks at higher earnings multiples. This expansion in earnings multiples allows stock prices to rise faster than earnings for an extended period, and this long term growth is what we call a bull market.

A bear market works in the opposite direction, only faster. It’s easier to lose confidence than gain it back, so bear markets tend to be shorter and more abrupt than bull markets. They usually start with some real-world event or catalyst that reminds investors that the economy is not all rainbows and unicorns. It could be a series of disappointing earnings at big companies, rising interest rates, increasing mortgage defaults, or a health scare.

This catalyst is usually bad for the economy, and the stock market will decline in order to reflect companies’ lower earnings expectations. This is a market correction, like the 12% decline we had in the last week of March. Sometimes, that is all that happens: investors realize that the event was a temporary blip, and the long bull market resumes after a brief pause.

In other cases, the catalyst or unexpected event and market correction cause many investors to look around and question their assumptions. Are there more risks out there that they have been ignoring?

As investors question their assumptions, they become more risk-averse and start to sell their riskiest stocks. The stock market declines further, as earnings multiples begin to contract. This decline makes other investors begin to question their own assumptions, and soon the market decline becomes a self-fulfilling prophecy.

Covid-19: Correction, or Bear Market?

It is at that critical point between correction and bear market that we find ourselves now. On Monday, March 2nd, more confident investors rushed in to “buy the dip” after the previous week’s big decline. Will these optimists outnumber the other investors who are beginning to question their assumptions about risk and stock valuation? As yet, it is too early to tell.

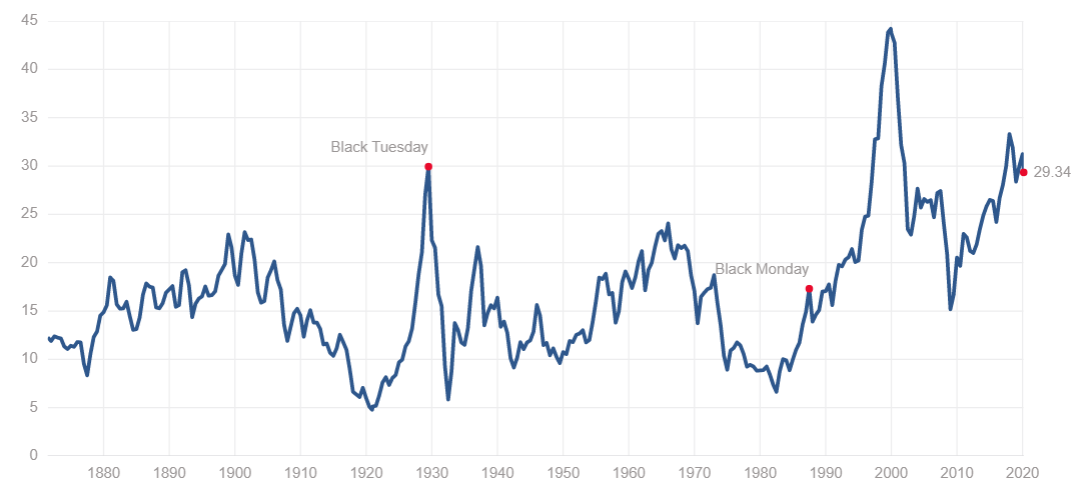

I do have a guess, however. My guess is that fear will win, and we are at the beginning of a new bear market. I think a bear market is likely for two reasons. First, valuations are historically very high. A good measure of this is the Shiller Cyclically Adjusted P/E Ratio (CAPE) shown in the chart below:

While the CAPE has not achieved the historic highs seen in the dot-com bubble, it is at approximately the same level it was at the start of the great depression in 1930, and well above its level at the start of the housing crisis in 2008. From a valuation perspective, if investors do begin to question their valuation assumptions, there is plenty of room for those assumptions to fall.

The second reason I am guessing that this correction will lead to a new bear market is the apparent incompetence and unwillingness of the Trump administration to confront the growing health crisis. I think the inaction and obfuscation at the highest levels of our government are likely to make the pandemic far worse that it would have been if our political leaders had taken it seriously.

As investors see the disease and the measures taken to combat it begin to affect their daily lives, I think it will also affect their feelings about risk in general. The fear of catching covid-19 could easily morph into fear of stock market declines. That fear, if it grows, will set off the viscous cycle of declining stock prices and growing risk aversion that cause bear markets.

Ten Clean Energy Stocks

But I digress. This article was actually meant to be the monthly update of my Ten Clean Energy Stocks Model Portfolio.

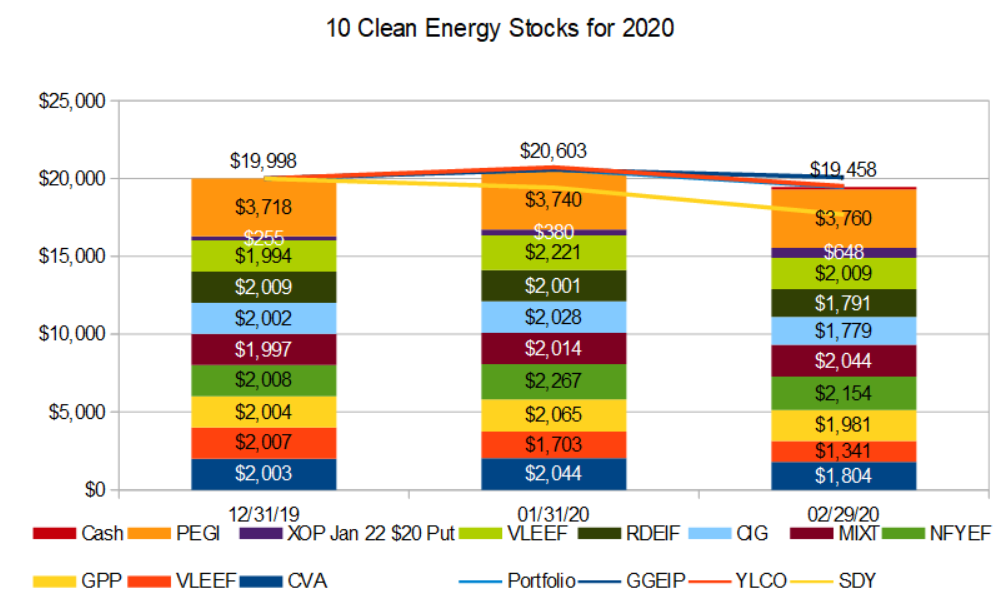

As you can see from the chart, the portfolio as a whole was down slightly for the year at the end of the month (-2.7%) compared to a 2.5% decline of its clean energy income benchmark YLCO and an 11.5% decline for the broad market income benchmark, SDY. My real-money managed portfolio, GGEIP is barely hanging on to positive territory, up 0.4% for the year to date.

With earnings coming quickly over last week and this, I have a good deal to say about the individual stocks as well as broad market conditions, but I think I will break this update into two parts in order to get the thoughts on the market situation to readers as quickly as possible.

Disclosure: Long PEGI, CVA, GPP. VLEEF, NFYEF, RAMPF, MIXT, CIG, RDEIY, VEOEF, SCHN, Puts on XOP.

Disclaimer: Past performance is not a guarantee or a reliable indicator ...

more