Correction For Nasdaq- More Indices To Follow?

I called Jay Powell's bluff a week ago. Remember when he said last week that we're still far from The Fed's inflation targets?

Well, I was right to doubt him. The market didn't like his change in tone Thursday (Mar. 4).

You see when bond yields are rising as fast as they have, and Powell is maintaining that Fed policy won't change while admitting that inflation may "return temporarily," how are investors supposed to react? On the surface, this may not sound like a big deal. But there are six things to consider here:

- It's a significant backtrack from saying that inflation isn't a concern. By admitting that inflation "could" return temporarily, that's giving credence to the fact that it's inevitable.

- The Fed can't expect to let the GDP scorch without hiking rates. If inflation "temporarily returns," who is to say that rates won't hike sooner than anyone imagines?

- Fool me once, shame on me, fool me twice...you know the rest. If Powell changed his tune now about inflation, what will he do a few weeks or months from now when it really becomes an issue?

- Does Jay Powell know what he's doing, and does he have control of the bond market?

- A reopening economy is a blessing and a curse. It's a blessing for value plays and cyclicals that were crushed during COVID and a curse for high-flying tech names who benefitted from "stay-at-home" and low-interest rates.

- The Senate will be debating President Biden’s $1.9 trillion stimulus plan. If this passes, as I assume it will, could it actually be worse for the economy than better? Could markets sell-off rather than surge? Once this passes, inflation is all but a formality.

Look, it's not the fact that bond yields are rising that are freaking out investors. Bond yields are still at a historically low level, and the Fed Funds Rate remains 0%. But it's the speed at which they've risen that are terrifying people.

According to Bloomberg, the price of gas and food already appear to be getting a head start on inflation. For January, Consumer Price Index data also found that the cost of food eaten at home rose 3.7 percent from a year ago — more than double the 1.4 percent year-over-year increase in all goods included in the CPI.

The month of January. Can you imagine what this was like for February? Can you imagine what it will be like for March?

I'm not trying to sound the alarm- but be very aware. These are just the early warning signs.

So, where do we go from here? Time will tell. While I still do not foresee a crash like we saw last March and feel that the wheels remain in motion for a healthy 2021, that correction that I've been calling for has already started for the Nasdaq. Other indices could potentially follow.

Finally.

Corrections are healthy and normal market behavior, and we have been long overdue for one. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017).

Most importantly, this correction could be an excellent buying opportunity.

It can be a very tricky time for investors right now. But never, ever, trade with emotion. Buy low, sell high, and be a little bit contrarian. There could be some more short-term pain, yes. But if you sat out last March when others bought, you are probably very disappointed in yourself. Be careful, but be a little bold right now too.

There's always a bull market somewhere, and valuations, while still somewhat frothy, are at much more buyable levels now.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

There is optimism but signs of concern. A further downturn by the end of the month is very possible, but I don't think that a decline above ~20%, leading to a bear market, will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Nasdaq- From Overbought to Oversold in 3 Weeks?

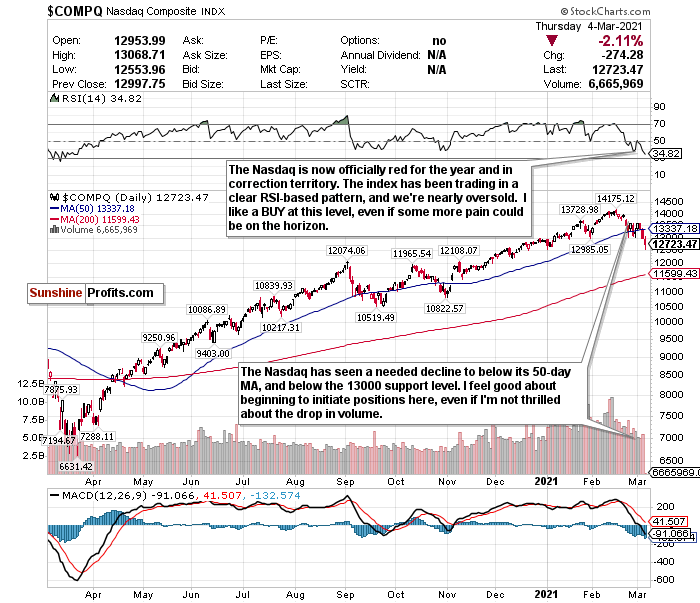

Figure 1- Nasdaq Composite Index $COMP

The Nasdaq is finally in correction territory! I have been waiting for this. It’s been long overdue and valuations, while still frothy, are much more buyable. While more pain could be on the horizon until we get some clarity on this bond market and inflation, its drop below 13000 is certainly buyable.

The Nasdaq has also given up its gains for 2021, its RSI is nearly oversold at about 35, and we’re almost at a 2-month low.

It can’t hurt to start nibbling now. There could be some more short-term pain, but if you waited for that perfect moment to start buying a year ago when it looked like the world was ending, you wouldn’t have gained as much as you could have.

Plus, it’s safe to say that Cathie Wood, the guru of the ARK ETFs, is the best growth stock picker of our generation. Bloomberg News’ editor-in-chief emeritus Matthew A. Winkler seems to think so too. Her ETFs, which have continuously outperformed, focus on the most innovative and disruptive tech companies out there. Not to put a lot of stock in one person. But it’s safe to say she knows a thing or two about tech stocks and when to initiate positions- and she did a lot of buying the last few weeks.

I think the key here is to “selectively buy.” I remain bullish on tech, especially for sub-sectors such as cloud computing, e-commerce, and fintech.

I also think it’s an outstanding buying opportunity for big tech companies with proven businesses and solid balance sheets. Take Apple (AAPL), for example. It’s about 30% off its all-time highs. That is what I call discount shopping.

What’s also crazy is the Nasdaq went from overbought 3 weeks ago to nearly oversold this week. The Nasdaq has been trading in a clear RSI-based pattern, and we’re at a very buyable level right now.

I like the levels we’re at, and despite the possibility of more losses in the short-run, it’s a good time to start to BUY. But just be mindful of the RSI, and don’t buy risky assets. Find emerging tech sectors or high-quality companies trading at a discount.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

Disclaimer: All essays, research, and information found above represent analyses and opinions of Matthew Levy, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be ...

more

why should anyone believe that Powell or any of the others there are at all concerned about the vast majority of the population of the US? Inflation robs those of us who are unable to adjust their incomes magicaly to compensate for it.

And how many of those folks with $40M of assets will be hurt at all if they fail to grow to $50M by next week?? The rest of the nation is different from Wall Street!.

Constant increasing of the wealth of the wealthy is just like supporting any other kind of addict. (I am not advocating taking away, only pausing the growth push so that others may be helped.)

And the new president with the goal of wildly flinging cash at all comers clearly does not understand much about cause and effect, does he??? Aiding those in desperate need is good, giving to those not in need is a waste of assets and serves no benefit.