Corning Still Has Substantial Growth Drivers

In my view, Corning (GLW) stock should be included in every diversified large cap dividend stocks portfolio. Although the current annual yield of about 2.0% is not very high, the company is committed to returning substantial capital to its shareholders by stock buybacks and increasing dividend payments.

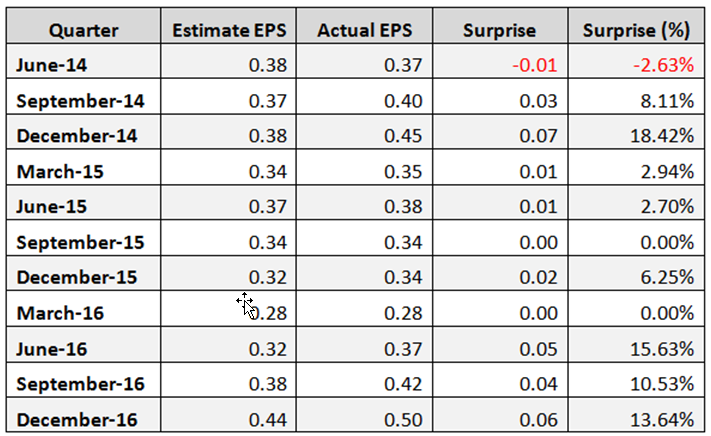

On January 24, Corning reported strong fourth quarter and full year 2016 financial results, which beat earnings-per-share expectations by a significant margin of $0.06 (13.6%). The company posted adjusted revenue of $2.55 billion in the period, also beating Street forecasts of $2.48 billion. Corning has beaten earnings per share in most of its previous quarters, as shown in the table below.

As a result, GLW's shares surged 5.7% on the same trading day (the company reported before market open).

Fourth quarter results represent significant growth year over year. Last quarter GAAP earnings-per-share of $1.47, were up 765%, and core earnings-per-share of $0.50, were up 47%. Also, GAAP sales were up 11%, and core sales were up 6% from the same quarter a year ago. The company achieved in the fourth quarter a record Gorilla Glass volume, due to the rapid adoption of Gorilla Glass 5. What's more, Corning saw an acceleration of growth in its Optical Communications segment, and continued moderation in price declines in its Display Technologies segment.

In the report, Wendell P. Weeks, chairman, chief executive officer, and president, said:

"Corning delivered outstanding fourth-quarter results, continuing the momentum that began earlier in the year. Our very strong finish to the year was highlighted by year-over-year core sales growth of 6%, core earnings growth of 24% and core EPS growth of 47%. We are encouraged by this strength, and expect growth in these year-over-year measures in the first quarter of 2017."

Gorilla Glass in Automotive

A high growth driver could be glass for automotive. Automakers around the world are working to reduce the weight of their vehicles to meet strict mobile emissions regulations. Corning Gorilla Glass for Automotive is now available to help automakers achieve this objective by enabling a weight reduction in the glazing of more than 50 percent versus conventional soda lime glass. Corning Gorilla Glass for Automotive can be used in all openings of a vehicle, including windshields, sidelights, sunroofs, and back-lights. It can also be used in automotive interior touch panels. In fact, Gorilla Glass is already used in the BMW i8 as an acoustic glass partition to shield sound from the rear engine. In January, the company announced a joint venture with Saint-Gobain Sekurit to develop, manufacture, and sell lightweight automotive glazing solutions. Saint-Gobain is a leading global producer of automotive glazing. Corning will continue to produce and market Gorilla Glass to this joint venture and other glazers, retaining 100% ownership of the glass business

Dividend and Share Repurchase

According to Corning, it continued to deliver on its commitment to focus its portfolio and utilize its financial strength to return more than $12.5 billion to shareholders by share repurchase and increasing dividend payment and to invest $10 billion in growth and sustained leadership through 2019.

Corning has been paying uninterrupted dividends since 2007. In February 2016, the company raised its quarterly by 12.5% to $0.135 per share. Moreover, the company has promised to increase its dividend by at least 10% annually through 2019. The annual dividend yield is at 2.02%, and the payout ratio is only 15%. The annual rate of dividend growth over the past three years was very high at 11.5% and over the last five years was also high at 18.6%.

Corning Stock Performance

Year to date, the GLW stock is up 10.1% while the S&P 500 Index has increased 2.6%, and the Nasdaq Composite Index has gained 5.3%. Since the beginning of 2012, GLW stock price has grown only 105.9%. In this period, the S&P 500 Index has increased 82.7%, and the Nasdaq Composite Index has risen 117.5%.

GLW Daily Chart

GLW Weekly Chart

Charts: TradeStation Group, Inc.

Valuation

Corning's valuation is good. The trailing P/E is low at 13.62, and its forward P/E is at 14.92. The price to cash flow ratio is very low at 5.83, and the current ratio is high at 3.30. Moreover, its Enterprise Value/EBITDA ratio is pretty low at 10.21, and the PEG ratio is at 1.53.

Ranking

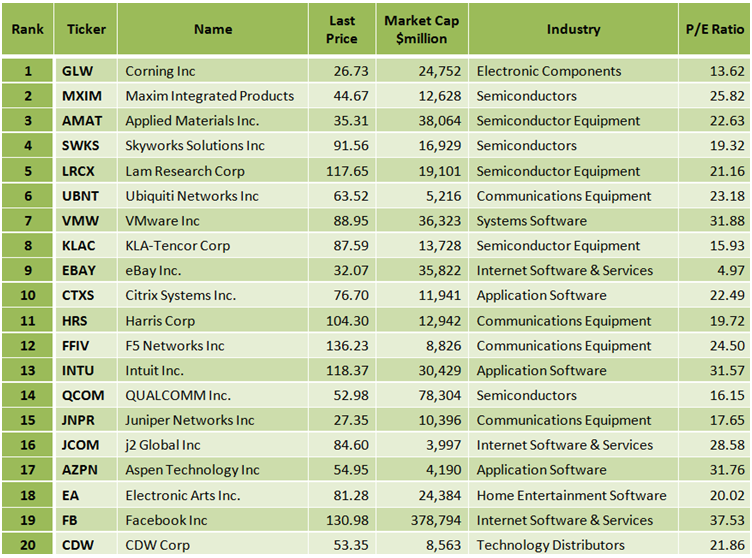

According to Portfolio123’s "ValueSheet" ranking system, GLW's stock is ranked first among all 146 Russell 1000 tech stocks. The 20 top-ranked Russell 1000 tech companies according to the ranking system are shown in the table below:

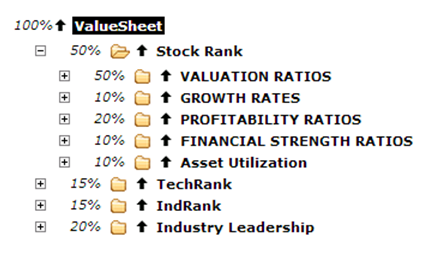

The "ValueSheet" ranking system is quite complex, and it is taking into account many factors like; valuation ratios, growth rates, profitability ratios, financial strength, asset utilization, technical rank, industry rank, and industry leadership, as shown in Portfolio123’s chart below.

Back-testing over eighteen years has proved that this ranking system is very useful.

Summary

Corning delivered strong fourth quarter results and it expects year-over-year growth in the first quarter of 2017. Also, the company is committed to returning substantial capital to its shareholders by stock buybacks and increasing dividend payments. What's more, according to Portfolio123’s "ValueSheet" ranking system, GLW's stock is ranked first among all 146 Russell 1000 tech stocks. All these factors bring me to the conclusion that GLW's stock is a smart long-term investment.