Cornerstone Building Brands - Chart Of The Day

Summary

- 100% technical buy signals.

- 13 new highs and up 14.11% in the last month.

- 222.13% gain in the last year.

The Barchart Chart of the Day belongs to the building products company Cornerstone Building Brands (NYSE: CNR). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 5/17 the stock gained 3.46%.

Cornerstone Building Brands, Inc., together with its subsidiaries, designs, engineers, manufactures, markets, and installs external building products for the commercial, residential, and repair and remodel markets in the United States, Canada, Mexico, and internationally. The company operates through three segments: Windows, Siding, and Commercial. Its Windows segment provides vinyl, aluminum, wood, and aluminum clad-wood windows and patio doors; and steel, wood, and fiberglass entry doors under the Ply Gem, Simonton, Atrium, American Craftsman, Silver Line, Great Lakes Window, and North Star brands. The company's Siding segment offers vinyl siding and skirting, composite siding, steel siding, vinyl, and aluminum soffit, aluminum trim coil, aluminum gutter coil, fabricated aluminum gutter protection, PVC trim and moldings, and window and door trim products, as well as injection-molded accents, such as shakes, shingles, shutters and vents, vinyl fencing and railing, and stone veneer. Its Commercial segment designs, engineers, manufactures and distributes a range of metal products, such as metal building systems, metal roofing and wall systems, insulated metal panels, steel curtain roll-up and self-storage doors, and coil coatings. The company was formerly known as NCI Building Systems, Inc. and changed its name to Cornerstone Building Brands, Inc. in May 2019. Cornerstone Building Brands, Inc. was founded in 1984 and is headquartered in Cary, North Carolina.

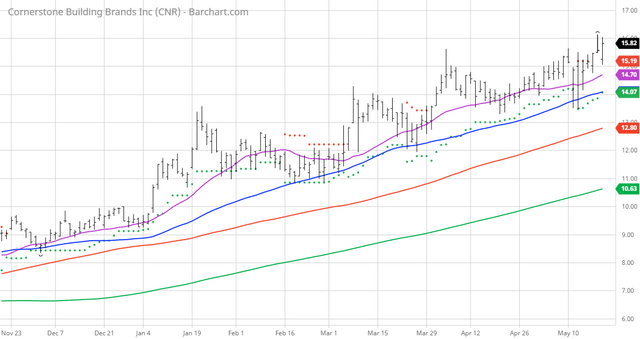

Barchart technical indicators:

- 100% technical buy signals

- 189.91+ Weighted Alpha

- 222.13% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 14.11% in the last month

- Relative Strength Index 63.57%

- Technical support level at 15.34

- Recently traded at 16.05 with a 50 day moving average of 14.10

Fundamental factors:

- Market Cap $1.96 billion

- P/E 20.89

- Revenue expected to grow 17.40% this year and another 3.90% next year

- Earnings estimated to increase 322.90% this year, an additional 42.10% next year and continue to compound at an annual rate of 34.70% for the next 5 years

- Wall Street analysts issued 1 strong buy, 1 buy and 2 hold recommendations on the stock

- 2,506 investors are monitoring the stock on Seeking Alpha

Disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to be buy recommendations as these stock are ...

more

What's your thoughts on how the political environment and violence in the streets will impact the overall value of the stock market?