Corcept Therapeutics: Discounted Biotech Company Offers Exceptional Risk Profile And Lucrative Proprietary Pipeline

Corcept Therapeutics (CORT) is a deeply undervalued small cap company that will be the dark horse of the biotech industry in 2019.

The rapid growth company sells Korlym, a medication available to Cushing’s syndrome patients who do not qualify for surgery. Efficient marketing of the drug has allowed Corcept to grow revenues at a 90% CAGR over the past five years while only penetrating about 15% of the total addressable market. This trend is all but certain to continue on the heels of a litigative victory over Teva, which secured Korlym revenues and exclusivity through 2021.

With earnings projected to grow over 60% in 2019, Corcept is a propitious investment opportunity for the value investor.

“I think we will look back at this moment as one where the bright future of Corcept came fully into view.”

- Joseph Belanoff, CEO

At first glance, Corcept Therapeutics may seem like a value trap with a fickle revenue structure. In my initial assessment, I was put off by the fact that Korlym is the sole revenue source for Corcept, an obvious indication of a precarious business structure in most cases. My sentiment quickly changed, though, when I recognized the certitude of future revenues & hidden value of the Corcept pipeline.

Reliable Revenues

Corcept’s blockbuster drug, Korlym, is the go-to treatment option for people suffering from Cushing’s syndrome who do not qualify for surgery. Though no patients pay full price out of pocket, an annual supply of the drug runs about $200,000. An estimated 20,000 people in the US suffer from Cushing’s syndrome, with 3,000 new cases each year. Roughly half of these patients do not qualify for surgery, meaning the Korlym TAM is about $2 billion with $300 million added annually.

The current patient base of Korlym is 1,400 (est.), meaning only 14% of the market has been penetrated. Management has done well to optimize future prescription growth by sparsing the Korlym physician network across 48 states. This structure is highly conducive to prescriber growth. Over half of the prescriptions for Korlym in 2018 were written by new physicians (i.e. by physicians who had never previously prescribed Korlym), a clear indication of robust growth.

It came as no surprise when big pharma generic kingpin Teva filed an Abbreviated New Drug Application for a generic version of Korlym last February, which wiped out 38% of Corcept’s market cap. In the year since, Corcept shares have failed to recover in spite of positive litigative updates and successful protective measures put in place for Cushing’s segment revenues.

In October, U.S. District Judge Susan Wigenton effectively quashed the lingering threat to Korlym sales. Judge Wigenton solidified the 30-month stay of generic approval called for by the Hatch-Waxman amendments by denying Teva's motion to dismiss allegations of patent infringement filed by Corcept. This keeps Korlym generic competitors at bay until at least late-2021 (FDA’s review of the Teva ANDA can start in October 2020, which means the earliest time frame for GDUFA approval is August 2021).

In the meantime, Corcept is preparing to replace their crown jewel with a superior compound. Relacorilant, another glucocorticoid inhibitor, has yielded higher clinical efficacy rates than Korlym in treatment of Cushing’s syndrome (through phase II). The trial data also indicate that relacorilant has no affinity for progesterone receptors [PR], an issue inherent to Korlym which causes dangerous hormone imbalances and reproductive complications in women. These side effects tie into more significant issues surrounding Korlym that have limited Corcept’s Cushing’s syndrome segment from reaching its full potential.

Perhaps the most important distinguisher of Korlym and relacorilant is the controversial nature of mifepristone, the active ingredient of Korlym. French chemist Georges Teutsch synthesized mifepristone in 1981 while working on a research project for the development of glucocorticoid receptor antagonists. After mifepristone was discovered to be a progesterone receptor antagonist, Sanofi predecessor Roussel-Uclaf conducted worldwide trials for medical abortion.

Thirty years later, mifepristone is one of two active ingredients in the RU-486 "abortion pill". Many in the medical community refuse to prescribe (or be prescribed) Korlym for this reason despite its clear efficacy in the treatment of Cushing's syndrome. More importantly, the connection has landed Korlym on insurers’ lists of medications that require prior authorization. This requirement delays distribution to approved Cushing’s patients and prevents access to the rest. Of note, those who are not approved by their providers (or do not have insurance) can temporarily receive the drug for free via the Support Program for Access and Reimbursement for Korlym offered by Corcept.

A phase III pivotal trial for relacorilant is under way; Corcept announced the first patient dosed in November. The trial is scheduled to be completed by January 2021. Assuming all goes well, the window of time between the end of the 30-month generic stay on Korlym and the FDA approval of relacorilant will be at least narrow enough to mitigate any potential detriment to Corcept revenues, if not non-existent. Depending on the outcome of incipient litigation, generic entry may be disallowed for several years after the 30-month stay, when relacorilant has long replaced Korlym.

Management has obtained orphan drug designation for relacorilant for the treatment of Cushing’s syndrome. Patents covering relacorilant’s composition of matter and method of use have also been secured with expiry in 2033.

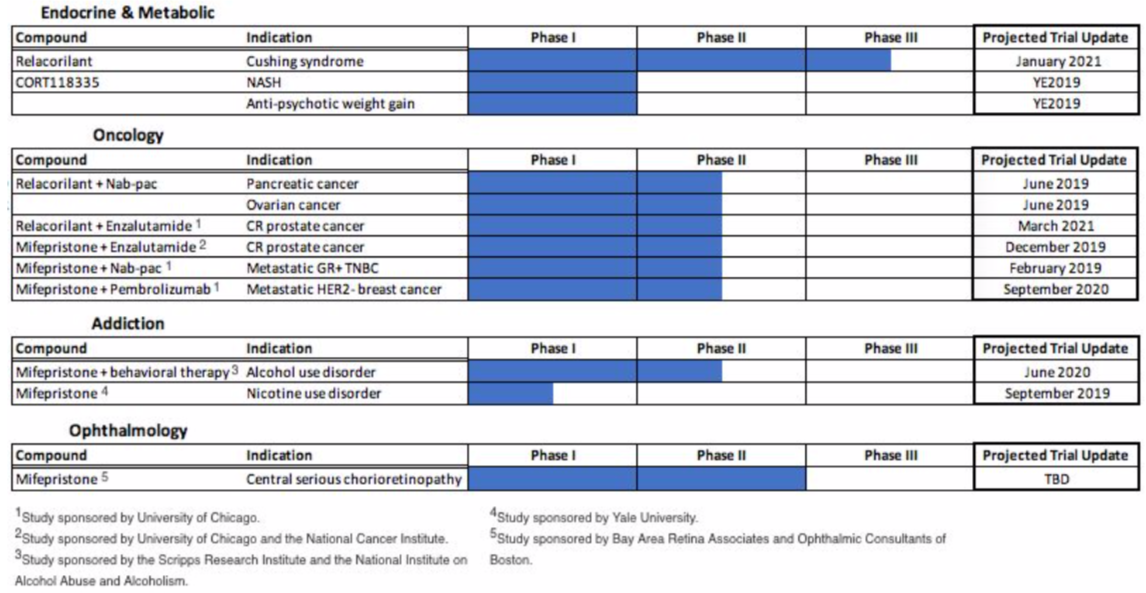

Proprietary Library

Corcept has developed a library of over 300 next-gen cortisol modulators, three of which are the focus of current clinical development: mifepristone (Korlym), relacorilant, and CORT118335. Twelve trials for these compounds are ongoing for an array of indications, the majority of which are sponsored by renowned research institutions like Yale University, the National Cancer Institute, University of Chicago, and the National Institute on Alcohol Abuse.

Preliminary phase II data out of the relacorilant nab-pac combination trials are encouraging to say the least. Four of nine patients with metastatic pancreatic cancer exhibited stable disease; four of seven patients with metastatic ovarian cancer exhibited stable disease and one of seven exhibited a complete response. All of these patients have undergone at least one failed chemotherapy-based treatment previously (average 3.4 previous treatments). A clinical update for these trials is expected in June.

Corcept owns intellectual properties rights on the use of cortisol modulators + anticancer agents for the treatment of indications specified in the sponsored trials.

CORT118335 is another clinical stage cortisol modulator proprietary to Corcept. The compound is currently being tested for the treatment of weight gain associated with antipsychotic medications and for the treatment of NASH. In placebo controlled human trials, Corcept found that "cortisol modulation with Korlym significantly mitigates the metabolic side effects cause by Zyprexa and Risperdal (the two most popular antipsychotics)." The results were published in the Advances in Therapy and Obesity Society journals. Further clinical development of Korlym for this indication was hindered by the aforementioned mifepristone controversy.

Last quarter, management commented that early indications show CORT118335 to be "more potent [than Korlym] in preventing and reversing antipsychotic induced weight gain."

Similarly, Korlym has been shown to reverse the effects of Nonalcoholic Steatohepatitis in patients being treated for Cushing’s syndrome but limitations have disallowed Korlym’s clinical development for the treatment of NASH. Management also commented that CORT118335 has shown greater efficacy in the treatment of NASH on animal models.

Antipsychotic induced weight gain and NASH are two medical conditions without any FDA-approved treatment options.

Weight gain associated with antipsychotic use occurs in approximately 30-50% of the tens of millions of Americans that are prescribed these medications.

The TAM for NASH in America is expected to hit $20 billion in five years. Investors can expect seven pipeline trial updates (five data readouts) this year.

Valuation

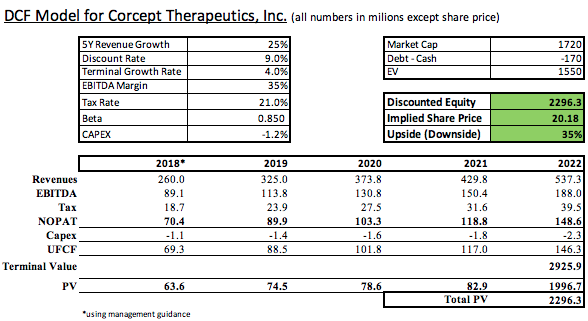

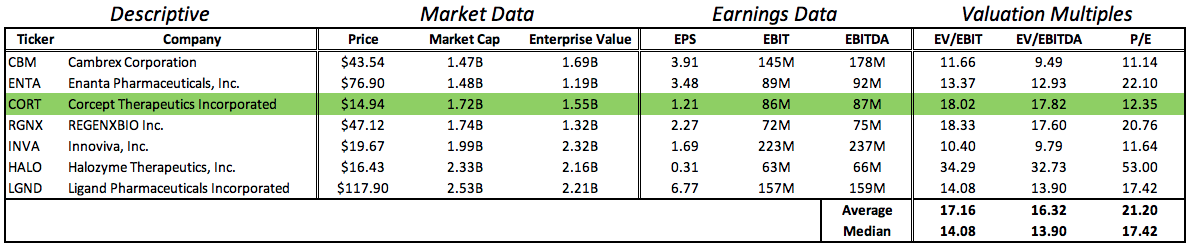

Constructing valuation models for small cap companies, especially in the biotech industry, is not an elementary nor a straightforward process. Analysts inevitably disagree with which methodologies are warranted and which are most efficacious. Generally, though, discounted cash flow analysis and comparative company analysis (comps) are regarded as efficient valuation strategies.

Standards for a conservative discounted cash flow model are also a subjective topic. I’ve constructed the model below using assumptions based on my own research into Corcept and the expectations put forth by several Street analysts.

In constructing a model for comparative company valuation multiple analysis, I included biotech industry companies within $1 billion market cap of Corcept that have positive earnings in the trailing twelve months. I’ve excluded Vanda Pharmaceuticals because of outlying multiples (i.e. PE ratio of 130).

These models agree on the current discounted market valuation of Corcept Therapeutics. The fair value of a share of Corcept is at least $20, or 34% higher than the current trading price.

Management is actively adding to shareholder value with a $100 million share buyback program scheduled to be completed in September. Corcept bought back 674,000 shares of common stock for $8.9 million in the third quarter of 2018; $91.1 million remains in the buyback program.

In conclusion

Revenues from Corcept’s Cushing’s syndrome segment have major room for growth with less than 15% TAM penetration, and the expansion strategy in place is optimal. This revenue stream has been secured until late-2021 with recent litigative success, and much further if relacorilant continues its pattern of clinical success.

This is a massive margin of safety for long exposure here, which I believe will expand as Corcept rolls out a vast library of proprietary cortisol modulators into several untapped markets.

Barring a major market-wide downtrend, I expect shares of Corcept Therapeutics to gain at least 35% this year.

Disclosure: I have no positions in any stocks/funds mentioned in this article, and have no plan to initiate exposure in any stocks/funds mentioned in this article in the next 48 hours. I wrote this ...

more

Interesting pick. I wasn't familiar with this company.

Thanks for reading, Harry.

Impressive.

Thanks Walter!

Nice find!

Thanks for reading!