Copa Holdings: A Higher-Yielding Airline In A Group Not Known For Juicy Dividends

Image Source: Unsplash

I was recently traveling in both San Francisco and Miami. So, I decided to see if there are any transportation-related stocks with a decent dividend – and I did find one non-US based airline: Copa Holdings SA (CPA), highlights Kelly Green, editor of Dividend Digest.

It was a week of different transportation methods: Cable cars, subway, historic streetcars, buses, airplanes, the Brightline train, Uber, Lyft, and self-driving taxis.The technology was vastly different among them all. My favorites were the two on either end of my spectrum — the cable cars and the self-driving taxis.

One of the core principles of a long-term dividend portfolio is to invest in companies that are integral to society and will be for many years to come. Transportation falls into that category. The technology will change and the mode of transport will differ depending on the distance traveled, but people will always need and want to travel from one place to another.

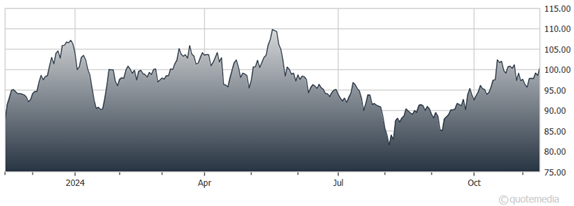

Copa Holdings SA (CPA) Chart

Of all the modes of transportation that I used last week, a handful are publicly traded: JetBlue Airways Corp. (JBLU), Uber Technologies, Inc. (UBER), Lyft Inc. (LYFT), and Waymo’s parent company, Alphabet Inc. (GOOG). It should be noted that JetBlue, Uber, and Lyft do not pay dividends. Additionally, Alphabet pays $0.80 annually for a yield of just 0.44%.

None of these would work with our two-pronged dividend strategy. But Copa Holdings is different. It’s based in Panama and its shares trade on the NYSE. The company has yet to announce its third-quarter earnings, but it reported a Q2 net profit of $120.3 million, or $2.88 per share.

For Q2, management noted that passenger traffic for 2024 was up 10.6% year-over-year. The airline has been recognized as the “Best Airline in Central America and the Caribbean” by Skytrax for the past nine years.

Copa Holdings stock currently pays its investors $1.61 per quarter for an annualized yield of 6.49%. And it’s definitely the best opportunity I’ve seen to collect a dividend from air travel.

In sum, make sure transportation stocks aren’t a category you overlook. We never know when a rogue piece of news or a transitional period could give us a discounted share price and a yield worth our time and money.

About the Author

Kelly Green, senior editor at Mauldin Economics, has been a researcher for as long as she can remember. She was always fascinated with taking things apart and asking hundreds of questions—whether it was a car or a complex math equation.

Ms. Green turned to a career researching the lucrative field of high-yielding equities. She fell in love with exploring the ins and outs of income-investing opportunities and sell-side options trades. Over the next few years, Kelly would work as co-editor of several income-focused newsletters, chief researcher, and portfolio analyst. She also wrote an educational series for investors covering topics ranging from making first trades to how to trade options.

More By This Author:

KMI & TRP: Two Energy Companies Set To Profit From LNG ExportsGLW: Ignore The Latest EU Kerfuffle And Buy The Glass Supplier

Fed: Why They Will Cut Rates (But Probably Should NOT)

Disclosure: © 2024 MoneyShow.com, LLC. All Rights Reserved. Before using this site please read our complete Terms of Service, ...

more