Consumer Businesses Are Stronger Than Ever… Where Are The Investors?

Chime debuted on the Nasdaq this summer, and the moment was significant on several fronts. It marked a success story in venture-backed consumer tech, a category that has been largely out of favor in recent years. While some may see Chime’s IPO as a one-off, we view it as the most visible sign of a broader trend we’ve been observing across our own VC portfolio: a resurgence in consumer tech. Chime’s IPO symbolizes not only renewed strength in a long-overlooked segment, but also points to the potential for blockbuster outcomes - the kind that tend to emerge most often in consumer-facing businesses.[1]

As investors at an early stage venture fund, we are well-positioned to see where the future is headed. We see early ideas, and then early performance, before it reaches the mainstream. And within our own portfolio of early and growth companies, we’ve seen both resilience and absolute performance in our consumer portfolio that does not reflect the overall sentiment and investment appetite of venture investors over the last number of years. We’re excited to share more of those insights and trends here.

A Steep Pullback and Its Ripple Effects

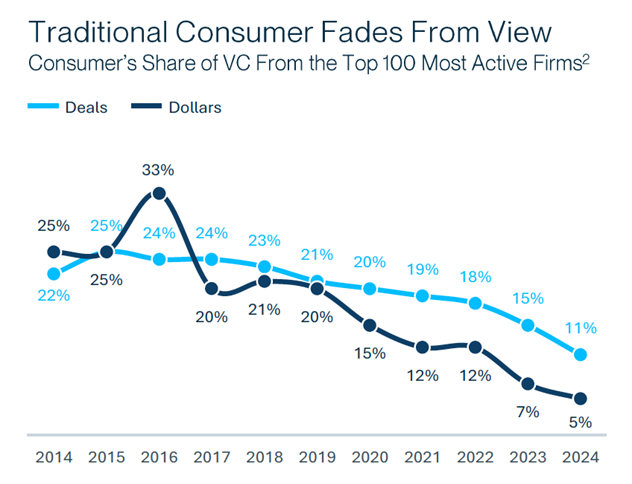

The retreat from consumer tech among private market investors has been well-documented. SVB’s Q1 2025 “State of Consumer Internet” report found that among the top 100 most active venture firms, just 5% of dollars went towards consumer-focused companies, down from 15% in 2020.[2] This reflects a broader industry-wide decline in investments into consumer companies since 2021, especially in earlier stage companies.[3]

We’ve felt the effects of this retreat firsthand. One founder in our portfolio, still pre-product, recounted being asked to present CAC-to-LTV ratios, a question not only misaligned with their stage but emblematic of how much early-stage consumer investing muscle memory had eroded. Another founder I spoke with noted that this year’s Spring 2025 Y Combinator batch contained just four consumer companies.[4]

This has produced knock-on effects with respect to founders. Fewer investors putting capital into the space has meant fewer founders building consumer companies. With this dynamic at play, it’s no wonder that we can count the number of large consumer tech funding rounds in the past 12 months on our hands. Large rounds into Polymarket and Bilt are very much the exception rather than the norm.

Public Markets Are Telling a Different Story

In contrast to the caution dominating private markets, public investors are recalibrating. We created an index of consumer tech stocks and found that the average company in this basket was up 63% YoY, compared to a 23.8% return for the average Nasdaq-100 company. Excluding the Mag 7 companies from this analysis makes the contrast even more stark: the average consumer tech company returned 71.2%, compared to 23.5% for the average non-Mag 7 Nasdaq 100 company.[5]

Outside of a few stocks that saw uncorrelated gains (like Roblox and Reddit), the general trend seems to be based on strong fundamentals. Profitable companies like Uber, Robinhood, and Netflix drove the index to 70% earnings growth during the period.[6] Compared to the Nasdaq 100’s 21.6% YoY earnings growth rate as of Q1 2025.[7] these consumer companies have been outperforming, and it’s reflected in their price.

The Quiet Strength of Consumer Businesses

These performance trends aren’t restricted to public stocks. We’ve seen a marked acceleration in the past 6–12 months for consumer companies within our own portfolio of both early and growth stage companies. Of our portfolio of investments made since 2019, four of the top five performers are consumer companies or monetize primarily via consumers. These companies are generating substantially more revenue and growing much more quickly than their B2B counterparts.

This bucks the prevailing macro narrative around the U.S. consumer, where rising delinquencies and household debt have stoked concern. We’re primarily focused on financial tech, and these trends underline an important point we’ve always been aware of: consumer fintech often thrives in times of financial anxiety. When people worry about their money, they become more motivated to manage it, optimize it, and explore new ways to spend and save. That behavioral shift creates fertile ground for innovation and adoption. Zooming out, we believe that those same strategies to optimize, save costs, or explore new opportunities speak to the psychology of consumers driving towards tech solutions generally, not just in financial services.

The Accidental Consumer Tech Company

This analysis has so far ignored a glaring counter example, where private market investors have been clamoring to invest: OpenAI. Not only did the company spark the AI frenzy we see across the markets today, it’s been the most successful consumer tech company in recent memory. Initially a research lab, the company released ChatGPT to demonstrate the power of their tech, and the unexpected viral success of that product quickly turned the company into a household name. OpenAI has embraced this in the last year, with a number of hires and strategic shifts that indicate their conviction in this new path. The accidental nature of ChatGPT’s success shows that, even in the eyes of one of Silicon Valley’s most successful founders, consumer tech was an afterthought. We believe that, going forward, this success will be seen as the start of a greater trend towards consumer tech, as opposed to a one-off.

The Next Tailwind: AI-Driven Personalization

We believe AI is the next tailwind in consumer tech. The promise of hyper-personalized, adaptive, and automated services is no longer hypothetical. It’s here.

From our vantage point, AI presents a “double tailwind”: a foundational platform shift and an accelerating pull from consumers. We’re already seeing the impact across our early-stage portfolio: companies using AI to help people manage their subscriptions, purchase their homes, and autopilot their money.

What we’ve seen so far is only the beginning. We believe that this tech is powering a trillion dollar market in fintech alone[8]- and obviously an even bigger opportunity across consumer services as a whole. As AI tools improve and expectations rise, we believe the next generation of consumer tech companies will not just benefit from the AI wave, they will define it.

[1] This blog post offers a good explanation of these dynamics: https://nextbigteng.substack.com/p/cracking-the-consumer-investing-code

[4] https://www.ycombinator.com/companies?batch=Spring%202025

[8] https://www.restive.com/blog/the-dawn-of-aifi

About the Contributor

Cameron Peake is a Partner at Restive Ventures. She identifies, supports, and manages a portfolio of early-stage technology companies building at the intersection of technology and financial services, defining the next trillion dollar industries. She was previously the Founder and CEO of the financial technology company Azlo, where she was recognized as a Fortune 40-under-40 leader for her work to support businesses during COVID. She has spent nearly two decades launching, building, and scaling financial companies around the world.

More By This Author:

How Much Could The Trade War Affect American Corporate Profits?Alpha And Beta, Meet Zetta

Real Assets & Inflation Hedging

Disclaimer: "All posts are the opinion of the contributing author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views ...

more