Constellation Energy: An AI Trade With The Right Balance Of Risk And Reward

Image Source: Pexels

Constellation Energy Corp. (CEG) is an Artificial Intelligence (AI) infrastructure power play and the largest owner of nuclear power plants in the US. It is a regulated utility that also sells power on the wholesale market. The stock is priced well below high-profile AI names, providing an attractive risk/reward profile as a trade, explains Carl Delfeld, editor of Cabot Explorer.

Since Constellation operates in the unregulated price utility market, it can charge any rate the market can bear. While data and semiconductor chips are often thought of as the most important AI fuel, the tech industry has a nearly infinite demand for 24-hour-a-day power for AI data centers.

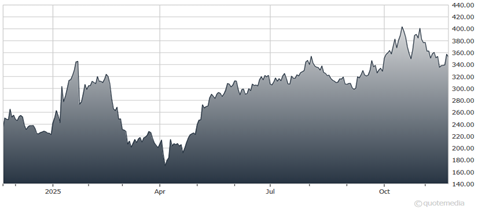

Constellation Energy Corp. (CEG) Chart

The US has added only three new big nuclear reactors since the 1990s. But the tide has turned as demand for more output and lower prices at home has soared. In addition, China has become a leader in nuclear technology, with about 100 nuclear power plants in their pipeline.

Constellation’s latest quarterly earnings demonstrated fundamental momentum, with adjusted operating earnings hitting $1.91 per share, up 20%. Power generation was up 5%, and nuclear output reached 95% capacity factor.

Based on forward earnings expectations, it is a more conservative play on AI trends.

My recommended action would be to consider purchasing shares of Constellation Energy.

About the Author

Carl Delfeld is chief analyst of Cabot Explorer published by Cabot Wealth Network. He is also the managing editor of Far East Wealth and chairman of the William H. Seward Center for Economic Diplomacy. Over the past three decades, he has held senior positions in business, finance and government, was a Forbes Asia columnist and author of Red, White & Bold: The New American Century.

More By This Author:

IXC: A Fund To Profit From A Resurgence In Energy PricesAI Stocks: Does Burry's Hyperscaler Depreciation Thesis Hold Water?

XLE: This Is No Replay Of 2015 In The Oil Patch