Consider These Human Capital Management Stocks Amid A Resurgence In Market Volatility

Image Source: Unsplash

Human capital management (HCM) stocks may be catching investors' attention as fears of an escalating trade war and hotter-than-expected Personal Consumption Expenditures (PCE) data led to a sharp decline among the broader indexes on Friday.

That said, the necessity for HCM solution providers is intriguing, especially those that offer payroll services as they should be relatively unaffected by tariffs. Optimistically, the unemployment rate has remained near pre-pandemic levels at around 4%, with the need to fulfill payroll and other workforce obligations leading to consistent demand for companies like Paychex (PAYX - Free Report) and Automatic Data Processing (ADP - Free Report) .

Image Source: Federal Reserve Economic Data

Paychex CEO Comments on the Labor Market

Making an appearance on CNBC’s Mad Money this week, Paychex CEO John Gibson stated there are no signs of recession in the company’s data with the underlying labor market remaining fundamentally healthy despite market uncertainty. Indicative of such, moderate job and wage growth among small businesses helped Paychex edge top and bottom line expectations for its fiscal third quarter on Wednesday.

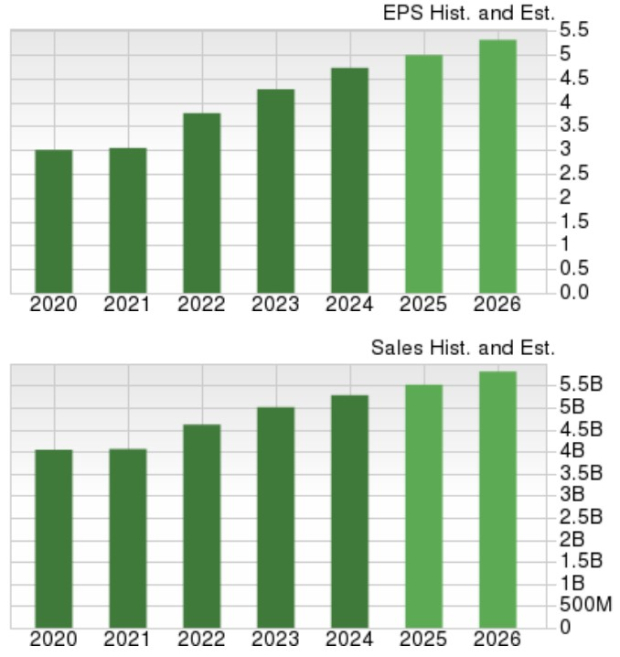

Paychex & ADP’s Steady Growth

Notably, Paychex’s total sales are now expected to rise 4% in fiscal 2025 and are projected to increase another 5% in FY26 to $5.81 billion. Annual earnings are currently slated to increase 6% this year and are projected to rise another 6% in FY26 to $5.30 per share.

Image Source: Zacks Investment Research

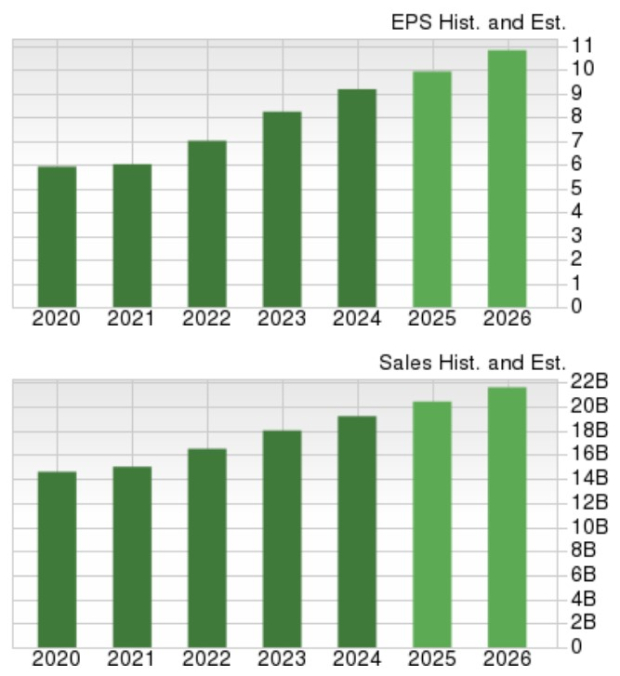

Pivoting to ADP which is one of the leaders in cloud-based HCM including payroll and talent management, its top line is forecasted to expand by 6% in FY25 and FY26 with projections edging north of $21 billion. More impressive, ADP’s EPS is projected to be up 8% in FY25 and is forecasted to spike another 9% next year to $10.82.

Image Source: Zacks Investment Research

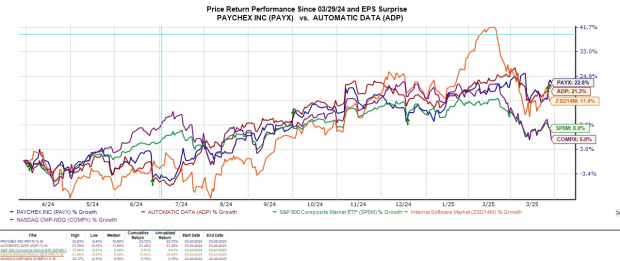

Recent Stock Performance

Correlating with the notion that investors may want to use payroll stocks as a defensive hedge is that PAYX and ADP shares are up +7% and +3% in 2025 respectively. These modest gains have been comforting considering the broader indexes have flirted with correction territory as the S&P 500 has fallen 4% year to date with the Nasdaq falling 10%.

Image Source: Zacks Investment Research

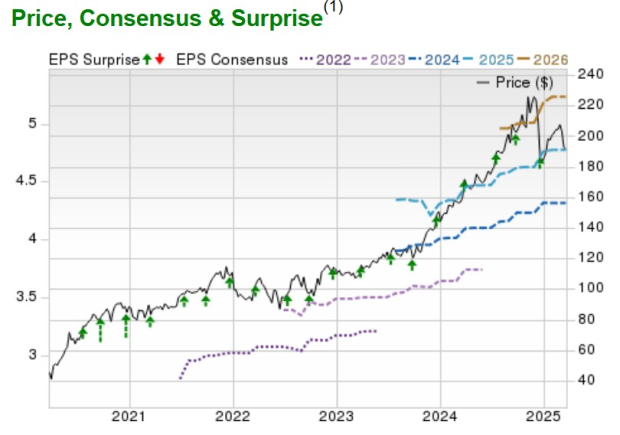

Cintas is another HCM Provider to Consider

While Cintas (CTA - Free Report) doesn’t provide payroll services, investor interest has shifted to the company’s growth narrative as a human capital provider. With its stock up +11% YTD, Cintas has seen a consistent demand for its specialized business services which include corporate identity uniform programs, restroom supplies, and first aid/safety products for diversified businesses throughout North America as well as Europe, Asia, and Latin America.

Like Paychex, Cintas was able to exceed expectations for its fiscal third quarter on Wednesday. Furthermore, Cintas continued an impressive streak of surpassing earnings estimates (quarterly) as illustrated by the green arrows in the price performance chart below. Thanks to its consistent operational performance, Cintas stock has been one of the market’s top performers in the last five years with CTA sitting on gains of over +300% during this period.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

It will be important to pay attention to payroll companies like Paychex and ADP for insight into the state of the economy and the likelihood of a potential recession. Cintas may also provide valuable insight in this regard and for now, recessionary fears may be overblown as these HCM stocks have outperformed the broader market although certain businesses and areas of the economy will struggle with high tariffs.

More By This Author:

M&A Watch: Buy Alphabet Stock Amid Plans To Acquire Cybersecurity Startup WIZ?3 Dividend Stocks To Consider For A Market Rebound

Oneok Inc. Stock Falls Amid Market Uptick: What Investors Need to Know

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more