Competitive Analysis In The ATTR-CM Field

Background

Transthyretin amyloid cardiomyopathy (ATTR-CM) is a life-threatening disease caused by progressive accumulation of misfolded, cleaved and aggregated transthyretin protein (TTR) in the heart[1]. The misfolded TTR can also be deposited in other tissues such as peripheral nerves, which cause the ATTR-PN disease. There are two types of ATTR-CM, variant and wild-type form. Variant ATTR-CM (ATTRv-CM) occurs due to a mutation in the transthyretin gene. There are more than 120 pathogenic mutations in TTR that result in a variable phenotypic presentation[1]. It can occur in people as early as their 50s and 60s. Wild-type ATTR-CM (ATTRwt-CM) occurs due to the deposition of wild-type transthyretin protein associated with aging. It occurs generally after the age of 60. It is the most common form of ATTR-CM.

ATTR-CM disease awareness has increased over the past 10+ years, and a noninvasive diagnostic algorithm is currently available to make early diagnosis and treatment possible following the onset of symptoms for patients. Studies reported that the prevalence of ATTR-CM was 6% to 30% among patients with heart failure with a preserved ejection fraction, with increased prevalence in those over 75 years of age[1].

Due to the noninvasive diagnosis and approved disease modifying therapies, ATTR-CM has become a multi-billion-dollar marketplace for continued growth. From the report of Global Market Insights, ATTR-CM treatment market size was valued at USD 4.7 billion in 2023 and is expected to reach USD 10 billion by 2032.

The current and emerging therapies of ATTR-CM include TTR tetramer stabilizers, TTR silencers, and TTR amyloid depleters, as shown in Table 1.

TTR stabilizers binds and stabilizes TTR tetramers, preventing tetramer dissociation into monomers which aggregate into the amyloid fibrils[1]. Tafamidis and acoramidis are two TTR stabilizers approved by FDA for ATTR-CM, respectively in 2019 and 2024. Tafamidis made 1.5 billion in sales in fourth quarter of 2024 for Pfizer, which represents a 61% increase from same period 2023.

TTR silencers inhibit or knock down the production of TTR. By blocking the production of the mutant or wild-type TTR, unstable TTR tetramers are reduced, which reduce the toxic amyloid deposition[3].

| Drug | Company | Mechanism | Development Stage | Dosing and administration |

| Tafamidis | Pfizer (PFE) | TTR stabilizer | FDA arppved on May 2019 | Vyndamax 61 mg oral QD. Vyndaqel 80 mg (four 20-mg capsules) oral QD |

| Acoramidis | BridgeBio Pharma (BBIO) | TTR stabilizer | FDA arppved on Nov 2024 | 800 mg oral BID |

| Vutrisiran | Alnylam Pharmaceuticals (ALNY) | TTR siRNA | FDA arppved on Mar 2025 | 25 mg SC Injection, Q3mo |

| Nucresiran | Alnylam Pharmaceuticals (ALNY) | TTR siRNA | Phase 3 initiation in late 2025 | 300mg SC Injection, Q6mo |

| Eplontersen | Ionis Pharmaceuticals (IONS) AstraZeneca (AZN) |

TTR ASO | Phase 3 result in H2 2026 | 45mg SC Injection, Q4wk |

| NTLA-2001(nex-z) | Intellia Therapeutics (NTLA) | TTR gene editing | Phase 3 initiated in Dec 2023 | Single 55mg IV Injection |

| ALXN2220 | Neurimmune AstraZeneca (AZN) |

TTR amyloid depleter | Phase 3 initiated in Jan 2024 | IV Injection,Q4wk |

| Coramitug | Novo Nordisk (NVO) | TTR amyloid depleter | Phase 2 result in 2025 | IV Injection |

| AT-02 | Attralus | TTR amyloid depleter | Phase 2 result in 2026 | IV Injection |

Table 1. Current and emerging therapies of ATTR-CM.

Vutrisiran is a small interfering RNA (siRNA) therapeutic agent that inhibits hepatic synthesis of TTR messenger RNA, resulting in over 80% knockdown of the TTR[3]. Vutrisiran has reported positive topline results from the HELIOS-B phase 3 study in 2024, and was approved for the ATTR-CM indication on March 20, 2025. Nucresiran is a next-generation siRNA agent in the phase 1 stage, which reduces the serum TTR by over 90%.

Eplontersen is a ligand conjugated antisense oligonucleotide to reduce the production of TTR[14]. It is in a phase 3 clinical trial of ATTR-CM, with the completion date expected in 2026.

NTLA-2001 is a CRISPR-Cas9 in vivo gene editing therapy that edits TTR gene in hepatocytes[14]. It delivers Cas9 mRNAs and TTR single guide RNAs into the liver, which is translated to the CRISPR-Cas9 complex. The complex brings insertions or deletions of bases (indels) into TTR gene, and leads to frameshift mutations that prevent production of functional TTR protein. NTLA-2001 is in the phase 3 stage that expected completion in 2028.

TTR amyloid depleters ALXN2220, Coramitug and AT-02 are monoclonal antibodies designed to deplete TTR amyloid deposits and to prevent new amyloid formation[14]. They are still in the phase 2 trial stage of concept confirmation.

Analysis of Efficacy Data

We will focus on the analysis of tafamidis, acoramidis and vutrisiran, mainly based on the published phase 3 clinical trial data[1][2][3]. The three phase 3 clinical trials ATTR-ACT, ATTRibute-CM and HELIOS-B were initiated respectively in Dec 2013, Mar 2019 and Nov 2019. The demographic and clinical characteristics of the patients are summarized in Table 2. From ATTR-ACT, ATTRibute-CM to HELIOS-B, the patients were less severe, mainly reflected by the percentage of ATTRwt-CM and NYHA Class III patients, and NT-proBNP level. This is due to the patient early diagnosis in recent years, and some difference in the trial designs.

| Characteristic | ATTR-ACT | ATTRibute-CM | HELIOS-B | HELIOS-B Monotherapy | ||||

| Tafamidis (N=264) |

Placebo (N=177) |

Acoramidis (N=421) |

Placebo (N=211) |

Vutrisiran (N=326) |

Placebo (N=328) |

Vutrisiran (N=196) |

Placebo (N=199) |

|

| Age(yr) | 75 | 74 | 77.4 | 77.1 | 77 | 76 | 77.5 | 76 |

| ATTRwt-CM (%) | 76.1 | 75.7 | 90.3 | 90.5 | 89 | 88 | 88 | 87 |

| NYHA Class III(%) | 29.5 | 35.6 | 18.3 | 15.2 | 8 | 11 | 5 | 9 |

| NT-proBNP level (median,pg/ml) |

2995.9 | 3161 | 2326 | 2306 | 2021 | 1801 | 2402 | 1865 |

| Serum TTR(mg/dl) | 22 | 21.2 | 23.2 | 23.6 | 28.1 | 27.9 | 24.3 | 24.8 |

| Mean 6WMT(m) | 350.6 | 353.3 | 361.2 | 348.4 | 372 | 377.1 | 362.7 | 372.8 |

| Mean KCCQ-OS | 67.3 | 65.9 | 71.5 | 70.3 | 73 | 72.3 | 70.3 | 69.9 |

| Mean eGFR mL/min/1.73 m2 |

61 | 61 | 60.9 | 61 | 64 | 65 | 64 | 65 |

Table 2. Demographic and Clinical Characteristics of the Patients at Baseline.

1) Overall Analysis

The three clinical trials were all designed to compare drug with placebo. It is very difficult to give a definite answer which is the best-in-class drug, given that no head-to-head phase 3 confirmatory clinical trial was ever done between them. Below we will give some comparison of the efficacy data from various viewpoints including the critical endpoints and biomarkers.

Table 3 shows the primary and secondary end points of the three clinical trials. The win ratio or hazard ratio of the composite of all-cause mortality (ACM) and the rate of cardiovascular-related hospitalizations (CVH) is the primary endpoint. The three drugs all statistically significantly meet the primary endpoint. The three drugs also statistically significantly improve the function outcomes 6WMT and KCCQ-OS.

In the sub-term CVH, the three drugs all statistically significantly reduce the frequency of CVH. For the ACM endpoint, acoramidis misses the reduction of ACM versus placebo at 30 months. Vutrisiran misses the ACM endpoint in the monotherapy group at 33-36 months, but it meets the ACM endpoint in the overall group. The hazard ratio of ACM of Vutrisiran in the overall group is 0.69, which is somewhat contradictory to the ACM rate data (Vutrisiran 16% vs placebo 21%). This is related to the Cox proportional hazards statistical model used for the ACM model (appendix in [3]). The model assumptions maybe be suspicous, as we can see the separation of the death curves at 24 months in the Figure 2.B in [3], actually with no difference or even worse of ACM rate data (Vutrisiran 13.8% vs placebo 13.6%).

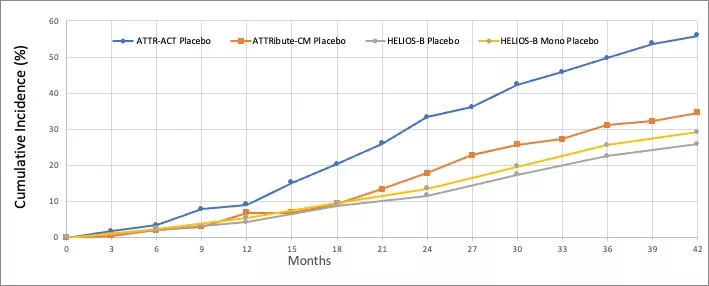

A delayed effect on mortality is anticipated from the less severe population in ATTRibute-CM and HELIOS-B clinical trials. From the ACM data of the placebo groups in Figure 1, the ACM rate of ATTR-ACT population at 24 months is similar to that of ATTRibute-CM population at 42 months. It is an 18-month delay effect for the two clinical trials. There is about a 6-month difference between the population of ATTRibute-CM and HELIOS-B Monotherapy. From the ACM data through 42 months shown in Table 4, the relative risk reduction of the three drugs is increasing with time, and all statistically significantly meet the ACM reduction at 42 months.

The above data provide solid and confirmatory evidences of the mechanism of action and efficacy of the three disease-modifying therapies.

| Characteristic | ATTR-ACT at 30 months | ATTRibute-CM at 30 months | HELIOS-B at 33-36 months |

HELIOS-B Monotherapy at 33-36 months |

||||

| Tafamidis (N=264) |

Placebo (N=177) |

Acoramidis (N=409) |

Placebo (N=202) |

Vutrisiran (N=326) |

Placebo (N=328) |

Vutrisiran (N=196) |

Placebo (N=199) |

|

| ACM, n (%) | 78(29.5%) | 76(42.9%) | 79(19.3%) | 52(25.7%) | 51(16%) | 69(21%) | 36(18%) | 46(23%) |

| Hazard ratio of ACM | 0.70 (0.51–0.96) | 0.772 (0.542-1.102) | 0.69 (0.49-0.98) | 0.71 (0.47-1.06) | ||||

| Patients with CVH, n (%) | 138 (52.3%) | 107 (60.5%) | 110(27%) | 87(43%) | 112 (34%) | 133 (41%) | 66 (34%) | 87 (44%) |

| CVH events per year | 0.48 | 0.7 | 0.3 | 0.6 | NA | NA | NA | NA |

| Relative risk ratio of CVH | 0.68 (0.56–0.81) | 0.496 (0.355-0.695) | 0.73 (0.61-0.88) | 0.68 (0.53-0.86) | ||||

| Hazard ratio of ACM&CVH | NA | 0.645 (0.500-0.832) | 0.72 (0.56-0.93) | 0.67 (0.49-0.93 | ||||

| Win ratio of ACM&CVH | 1.70 (1.26–2.29) | 1.5 (1.1-2.0) | 1.39 (1.09-1.78) | 1.51 (1.11-2.05) | ||||

| Mean difference of 6WMT(m) at Month 30 | 75.68 (66.44-84.92) | 39.6 (21.1-58.2) | 26.5 (13.4-39.6) | 32.1 (14.0-50.2) | ||||

| Mean difference of KCCQ-OS at Month 30 | 13.65 (11.52-15.78) | 9.94 (5.97-13.91) | 5.8 (2.4-9.2) | 8.7 (4.0-13.4) | ||||

Table 3. Primary and Secondary End Points. Note: 1). HELIOS-B uses CVH recurrent events; 2). ATTR-ACT and ATTRibute-CM use the Finkelstein–Schoenfeld method in the statistical analysis of ACM and CVH, while HELIOS-B uses the modified Andersen–Gill model.

Figure 1. All-cause mortality data through 42 months of the placebo groups[3][5][6]. Note: 1).Patients in the ATTR-ACT and ATTRibute-CM placebo group switch to the drug after 30 months, while patients in the HELIOS-B placebo group switch after variable 33-36 months; 2). 22.8% Patients in the ATTRibute-CM placebo group received tafamidis after 12 months. 40% Patients in the HELIOS-B placebo group received tafamidis from baseline. 21% Patients in the HELIOS-B monotherapy placebo group received tafamidis from baseline.

| Characteristic | ATTR-ACT | ATTRibute-CM | HELIOS-B | HELIOS-B Monotherapy | ||||

| Tafamidis 80mg(N=176) |

Placebo (N=177) |

Acoramidis (N=409) |

Placebo (N=202) |

Vutrisiran (N=326) |

Placebo (N=328) |

Vutrisiran (N=196) |

Placebo (N=199) |

|

| ACM at 24 months, n (%) | 44(25%) | 59(33.3%) | 65(15.9%) | 36(17.8%) | 37(11.3%) | 38(11.6%) | 27(13.8%) | 27(13.6%) |

| RRR of ACM at 24 months | 0.25 | 0.11 | 0.02 | 0 | ||||

| ACM at 30 months, n (%) | 54(30.7%) | 76(42.9%) | 79(19.3%) | 52(25.7%) | 49(15%) | 57(17.4%) | 38(19.4%) | 39(19.6%) |

| RRR of ACM at 30 months | 0.29 | 0.25 | 0.14 | 0.01 | ||||

| ACM at 36 months, n (%) | 59(33.5%) | 88(49.7%) | 82(20.0%) | 63(31.2%) | 56(17.2%) | 74(22.6%) | 41(20.9%) | 51(25.6%) |

| RRR of ACM at 36months | 0.33 | 0.36 | 0.24 | 0.18 | ||||

| ACM at 42 months, n (%) | 66(37.5%) | 99(55.9%) | 93(22.7%) | 70(34.7) | 60(18.4%) | 85(25.9%) | 43(21.9%) | 58(29.1%) |

| RRR of ACM at 42 months | 0.33 | 0.34 | 0.29 | 0.25 | ||||

Table 4. All-cause mortality data and the calculated data of relative risk reduction (RRR) [3][5][6]. Note that RRR is calculated by (1-ACM rate of drug/ACM rate of Placebo).

2) Subgroup Analysis

In the long-term extension to the three trials, patients initially treated with drug had substantially better survival than those first treated with placebo (as shown in Table 4), highlighting the importance of early diagnosis and treatment in ATTR-CM.

In the subgroup analysis of ATTR-ACT trial, there was a greater reduction of ACM and CVH in patients with NYHA class I or II than NYHA class III[1]. This further supports the use of tafamidis in all patients with ATTR-CM but emphasize the importance of early treatment.

In the subgroup analysis of ATTRibute-CM trial, there was a greater reduction of ACM and CVH in patients with NYHA class I or II vs NYHA class III, age <78 vs age>78, NT-proBNP<3000 vs NT-proBNP>3000 [2]. These evidences further support the early use of acoramidis in patients with ATTR-CM.

In the subgroup analysis of HELIOS-B trial, there was a greater reduction of ACM and CVH in patients with age <75 vs age>75, NT-proBNP<2000 vs NT-proBNP>2000 [3]. But there was a little less reduction of ACM and CVH in patients with NYHA class I or II than NYHA class III. This maybe be caused by too small population of NYHA class III. Anyway, it is inconsistent for early treatment suggestion. Another inconsistent point is that in the subgroup analysis of ATTRv-CM vs ATTRwt-CM, there is almost no treat benefit of ACM and CVH for the ATTRv-CM patients.

3) Acoramidis versus Tafamidis

Tafamidis stabilizes TTR by binding to the T4-binding site. It was invented by Scripps Research professors Jeffery Kelly and Evan Powers. Tafamidis was first approved in the European Union in 2011 for the treatment of transthyretin amyloidosis with polyneuropathy (ATTR-PN).

Acoramidis (AG10), designed as a next-generation stabilizer, binds with TTR by mimicking protective T119M mutation. It was invented by Isabella Graef and Mamoun Alhamadsheh at Stanford University. In the preclinical studies[10][11], acoramidis was more potent than Tafamidis in different assays, by more potent second site binding, lower binding to albumin, and enthalpically-driven binding. The TTR stabilization rate was 50% and 95.4% respectively for tafamidis (80mg QD) 20μM and acoramidis (800 BID) 10μM[11]. But the inventors of Tafamidis Jeffery Kelly and Evan Powers had different opinions about the potency comparison and designed a preclinical study to measure the potency by subunit exchange in human plasma assay[12]. The TTR stabilization rate is 94.4-95.7% and 95-97.5% respectively for tafamidis (80mg QD) and acoramidis (800 BID). Pfizer also did similar analysis and concluded that tafamidis 80mg achieved great than 90% TTR stabilization[13]. Because there is no standard preclinical model and measurement method to determine the TTR stabilization rate at present, the potency dispute about tafamidis and acoramidis will still exist. We only get from the information that acoramidis is at least somewhat more potent than tafamidis.

There is no method to measure TTR stabilization directly in the clinical setting. Serum TTR levels reflect the stability of the TTR tetramer and may serve as indirect markers of disease activity. Stabilizers in clinical doses raise serum TTR, which may be a surrogate for the degree of stabilization. As shown in Table 5, there is dose-dependent increase of serum TTR from tafamidis 20mg to tafamidis 80mg at both Month 12 and Month 30. Acoramidis increases the serum TTR level 34.5% and 39.6% respectively at Month 12 and Month 30, while that is 30.8% and 37.6% for tafamidis 80mg. It is not a head-to-head comparison for tafamidis and acoramidis. In the ATTRibute-CM trial, the serum TTR of participants who received tafamidis in the placebo group increased 6.4 mg/dL[8] at Month 30. During the open-label extension period, the participants switched from placebo + tafamidis to acoramidis, and serum TTR increased further 3.0 and 3.4 mg/dL at Month 1 and 6, respectively. It maybe the direct evidence of more potency of acoramidis.

| Characteristic | ATTR-ACT | ATTRibute-CM | |||

| Tafamidis 80mg (N=176) |

Tafamidis 20mg (N=88) |

Placebo (N=177) |

Acoramidis only (N=348) |

Placebo only (N=156) |

|

| Serum TTR at baseline (mg/dl) | 21.8 | 22.2 | 21.2 | 23.0 | 24.8 |

| Mean change of TTR at Month 12 (mg/dl) | 6.7 | 4.6 | -0.6 | 7.8 | -0.7 |

| Percent change of TTR at Month 12 (%) | 30.8 | 20.7 | -2.8 | 34.5 | -2.8 |

| Mean change of TTR at Month 30 (mg/dl) | 8.2 | 5.2 | 0.6 | 9.1 | -0.4 |

| Percent change of TTR at Month 30 (%) | 37.6 | 23.7 | 2.8 | 39.6 | -1.6 |

Table 5. Serum TTR absolute and relative change from baseline to Month 30[4][7][8][9]. Note that in the ATTRibute-CM trial, tafamidis was allowed for patients after 12 months, and 61/46 in the acoramidis/placebo groups received tafamidis respectively.

| Characteristic | ATTR-ACT | ATTRibute-CM | |||

| Tafamidis 80mg (N=176) |

Tafamidis 20mg (N=88) |

Placebo (N=177) |

Acoramidis only (N=421) |

Placebo only (N=211) |

|

| NT-proBNP level at baseline (median,pg/ml) |

3122.0 | 2682.0 | 3161.0 | 2326 | 2306 |

| Patients at Month 30, n | 110 | 60 | 80 | 232 | 98 |

| Change from baseline to Month 30 (median,pg/ml) |

95.5 | 863.5 | 2561.6 | 89.5 | 1129.4 |

Table 6. NT-proBNP median change from baseline to Month 30[4][9].

NT-proBNP is an established biomarker for heart failure and cardiac dysfunctions. Table 6 shows that dose-dependent effect of tafamidis, and both Tafamidis and acoramidis realized the lesser increase of NT-proBNP comparing to placebo, which means lesser disease progression.

Did a greater stabilization of TTR improve the clinical outcomes of patients? In ATTR-ACT trial, 20 mg and 80 mg of tafamidis had identical benefits of ACM&CVH over placebo during the 30 months of the study despite lesser stabilization with the lower dose. But in ATTR-ACT combined with the LTE[4] there was a significantly greater survival benefit with tafamidis 80 vs. 20mg [0.700 (0.501–0.979), P = 0.0374] at median follow-up 51 months.

Combing the long-term ACM data in Table 4, CVH data in Table 3, and the above discussed TTR stabilization data and serum TTR data, We think acoramidis is a more potent stabilizer, although there is not a definite answer how much clinical benefit this can bring to the patients without the study of a direct comparison of stabilizers.

4) Vutrisiran versus Acoramidis and Eplontersen

Vutrisiran is a siRNA conjugated with N-acetylgalactosamine (GalNAc) to enhance delivery to hepatocytes and facilitate rapid uptake, which is the successor of revusiran and patisiran. Vutrisiran was first approved by FDA in June 2022 for the treatment of ATTR-PN, which is recognized as best-in-class in this indication.

In the HELIOS-B Phase 3 clinical trial for ATTR-CM, the primary endpoint was originally defined at 30 to 36 months after the last patient reached at 30 months. Following patisiran was refused approval in ATTR-CM indication in Oct 2023, the primary endpoint was updated to add the monotherapy group, and delay the data collection at 33 to 36 months. It reflected the lessons learned from the APOLLO-B study.

In the HELIOS-B study, a rapid and sustained reduction in serum TTR levels was observed with vutrisiran. The mean trough percent reduction was 81.0% (95% CI, 79.0 to 83.0) at 30 months in the overall population. From the NT-proBNP geometric change in Table 7, we can see that vutrisiran and acoramidis realized the same level of lesser increase of NT-proBNP comparing to placebo, which means lesser disease progression. As shown in Table 3 and Table 4, vutrisiran was proved to be effective in ATTR-CM.

| Characteristic | ATTRibute-CM | HELIOS-B | HELIOS-B Monotherapy | |||

| Acoramidis (N=409) |

Placebo (N=202) |

Vutrisiran (N=326) |

Placebo (N=328) |

Vutrisiran (N=196) |

Placebo (N=199) |

|

| NT-proBNP level at baseline (median,pg/ml) |

2326 | 2306 | 2021 | 1801 | 2402 | 1865 |

| Geometric mean fold change from baseline to Month 30 | 1.48/1.06* | 2.8/1.88* | 1.19 | 1.75 | 1.3 | 2.28 |

| Geometric fold-change ratio | 0.53/0.56* | 0.68 | 0.57 | |||

Table 7. NT-proBNP geometric change from baseline to Month 30[2][3][6].

* Data from [6] where NT-proBNP data without any imputation.

Vutrisiran and acoramidis have the different mechanism of action, so patients may have their own preference such as oral or SC injection. From the viewpoint of subgroup efficacy, vutrisiran is inconsistent in the efficacy of NYHA class I or II to NYHA class III, and has no treat benefit of ACM and CVH for the ATTRv-CM patients. The RRR value of ACM in Table 4 is still increasing with time after Month 42 and lower than the steady RRR value of stabilizers. More open-label extension time is needed for the HELIOS-B trial to show the consistent subgroup efficacy data.

This inconsistency may give a great chance to eplontersen, which is under the phase 3 CARDIO-TTRansform study. Eplontersen is the successor of inotersen, and in the NEURO-TTRansform trial for ATTR-PN Eplontersen achieved a mean reduction of 82% in serum TTR levels at 65 weeks. The CARDIO-TTRansform study enrolled 1438 patients, and half is naïve patients for tafamidis. It also had the preferred percentage of ATTRv-CM patients. The study extended the blinded dosing period to 140 weeks from 120 weeks. These measures may give more robust results in the second half of 2026.

But this is not the end-point. Nucresiran, a more potent silencer next to vutrisiran, will enter the phase 3 trial in this year.

Conclusion

The global ATTR-CM treatment market is a multibillion-dollar market opportunity. It attracts more and more players in this field. The three phase 3 clinical trials give enough data evidence that more precise and selective therapeutic approach is the future direction, which continuously push the boundaries of precise drug innovation in this field.

In the ATTRibute-CM trial with the OLE, acoramidis shows consistent clinical benefits in the contemporary population. It reduced the frequency of CVH by 50%, which greatly reduce the economic burden of patients. From the comprehensive data analysis including biomarker data, we think acoramidis is the most potent stabilizer at present.

Vutrisiran is the first TTR silencer for ATTR-CM. It will share the market with approved TTR stabilizers due to its different mechanism of action. But if it targets to reach the same leadership position in the ATTR-CM market as that in the ATTR-PN market, it needs more OLE data to support its best efficacy and consistent subgroup effects.

Reference

1.Maurer MS, Schwartz JH, Gundapaneni B, et al. Tafamidis treatment for patients with transthyretin amyloid cardiomyopathy. N Engl J Med 2018;379:1007-16.

2.Gillmore JD, Judge DP, Cappelli F, et al. Efficacy and safety of acoramidis in transthyretin amyloid cardiomyopathy. N Engl J Med 2024;390:132-42.

3.Fontana M, Berk JL, Gillmore JD, et al. Vutrisiran in patients with transthyretin amyloidosis with cardiomyopathy. N Engl J Med 2025;392:33-44.

4.Damy T, Garcia-Pavia P, Hanna M, et al. Efficacy and safety of tafamidis doses in the Tafamidis in Transthyretin Cardiomyopathy Clinical Trial (ATTR-ACT) and long-term extension study. Eur J Heart Fail 2021;23:277–285.

5.Elliott P, Drachman BM, Gottlieb SS, Hoffman JE, Hummel SL, Lenihan DJ, et al. Long-term survival with tafamidis in patients with transthyretin amyloid cardiomyopathy. Circ Heart Fail. (2022) 15(1):e008193.

6.Judge DP, Gillmore JD, Alexander KM, et al. Long-term efficacy and safety of acoramidis in ATTR-CM: initial report from the open-label extension of the ATTRibute-CM trial. Circulation. 2024; 151(9):601-611.

7.Gillmore JD, Judge DP, Cappelli F, et al. Efficacy and Safety of Acoramidis in Transthyretin Amyloid Cardiomyopathy: Results of the ATTRibute-CM Trial. ESC Congress 2023.

8.Maurer M, Cappelli F, Fontana M, et al. Increase in serum TTR levels observed with acoramidis treatment in patients with transthyretin amyloid cardiomyopathy (ATTR-CM): insights from ATTRibute-CM and its open-label extension. European Heart Journal, Volume 45, Issue Supplement_1, October 2024:ehae666.2088.

9.BridgeBio Pharma Corporate Presentation Page 8&Page9. May 15 2024.

10.Penchala SC, Connelly S, Wang Y, et al. AG10 inhibits amyloidogenesis and cellular toxicity of the familial amyloid cardiomyopathy-associated V122I transthyretin. Proc Natl Acad Sci U S A 2013;110: 9992-7.

11. Miller M, Pal A, Albusairi W, et al. Enthalpy-driven stabilization of transthyretin by AG10 mimics a naturally occurring genetic variant that protects from transthyretin amyloidosis. J Med Chem. 2018;61:7862-7876.

12.Nelson LT, Paxman RJ, Xu J, et al. Blinded potency comparison of transthyretin kinetic stabilisers by subunit exchange in human plasma. Amyloid. 2021; 28(1): 24–29. Comment: 28(2):138-139. Response: 28(2):140-141.

13.Tess, D.A.; Maurer, T.S.; Li, Z.; Bulawa, C.; Fleming, J.; Moody, A.T. Relationship of binding-site occupancy, transthyretin stabilisation and disease modification in patients with tafamidis-treated transthyretin amyloid cardiomyopathy. Amyloid 2022; 30(2):208-219.

14.Mathew S Maurer. Overview of Current and Emerging Therapies for Amyloid Transthyretin Cardiomyopathy. Am J Cardiol. 2022 Dec:185 Suppl 1:S23-S34.

We wrote this article ourself, and it expresses our own opinions. We have no business relationship with any company whose stock is mentioned in this article. Readers are advised to ...

more