Colgate-Palmolive Co: Is It A Buy?

Image Source: Pixabay

As part of an ongoing series, we will take a closer look at one of the stocks from our stock screeners and review why it’s a ‘buy’ based on key fundamentals.

One of the cheapest stocks in our screens is:

Colgate-Palmolive Co (CL)

Since its founding in 1806, Colgate-Palmolive has grown to become a leading player in the household and personal care arena. In addition to its namesake oral care line (which accounts for more than 40% of its total sales), the firm manufactures shampoos, shower gels, deodorants, and homecare products that are sold in over 200 countries.

International sales account for about 70% of its total business, including approximately 45% from emerging regions. It also owns specialty pet food maker Hill’s (around one fifth of sales), which primarily sells its products through veterinarians and specialty pet retailers.

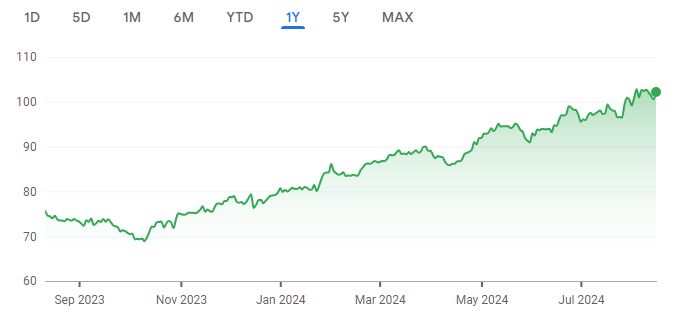

A quick look at the share price history (provided below) over the past twelve months shows that the price has moved up approximately 34.94%. Here is a brief look at why the company is potentially undervalued.

Source: Google Finance

Key Stats

- Market cap: $85.14 billion

- Enterprise value: $91.19 billion

Operating Earnings

- Operating earnings: $4.52 million

Acquirer’s Multiple

- Acquirer’s multiple: 20.20

Free Cash Flow (TTM)

- Free cash flow: $3.36 billion

FCF/MC Yield Percentage

- FCF/MC yield: 4.02

Shareholder Yield Percentage

- Shareholder yield: 3.10

Other Indicators

- Piotroski F score: 8.00

- Altman Z-score: 7.10

- ROA (five-year average percentage): 27

More By This Author:

Tesla Inc (TSLA) DCF Valuation: Is The Stock Undervalued?Large-Cap Stocks In Trouble: Here Are The 10 Worst Performers

AT&T Inc: Is It A Buy?

Disclosure: None.