CNP: A Utility Profiting From Surging Power Demand

Image Source: Pixabay

To assess companies’ quality, we focus on five basic criteria:

- Long-term sustainability of dividend policy

- Revenue reliability

- Regulatory relations

- Balance sheet

- Operating efficiency

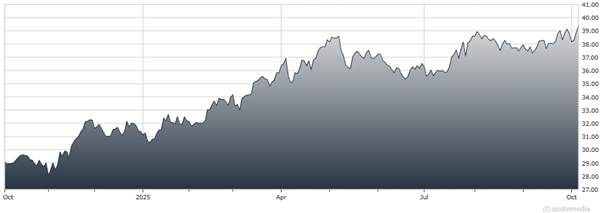

CenterPoint Energy Inc. (CNP)

Together, they answer the basic question of whether a company’s business is getting stronger and therefore more valuable. If the answer is yes, its securities are worth owning, especially the common stock that represents ownership and participation in growth. If the answer is no, the best course is to move on.

At CNP, this was the second consecutive quarter management boosted its outlook. And the primary spur is simply accelerating demand for electricity, which will require record levels of investment to meet.

It’s the same formula that’s fueling growth at other electric utilities. And the primary sources of demand growth — Artificial Intelligence (AI) enabled data centers, re-shoring of supply chains to the US, electrification of industry, and transportation and population growth — is spurring investment in natural gas distribution and transportation, communications networks, and even water utilities.

Recommended Action: Buy CNP.

More By This Author:

XAR: A Fund For Capitalizing On The Defense Drone RevolutionUSD/JPY: Broken Down Amid Broad Dollar Pressure

CTBI: A Regional Bank With Solid Dividend Growth