CMS Energy: An Attractive Michigan Utility With A Long Dividend History

Image Source: Unsplash

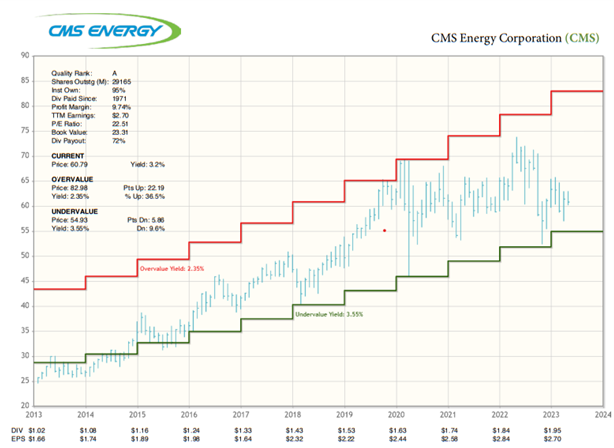

With the dividend yield of the Dow Utilities recently seen within the realm of being “Overvalued,” I find it interesting that some utility stocks have been finding their way to the “Undervalued” category. As one of the more interest rate sensitive sectors, utility stocks historically have been an indicator for the direction of interest rates. Consider buying sector name CMS Energy Corp. (CMS), advises Kelley Wright, editor of Investment Quality Trends.

CMS is the energy holding company for Consumers Energy, a regulated electric and gas utility serving Michigan’s lower peninsula, and North Star Clean Energy, which is engaged in U.S. and international energy-related businesses.

CMS operates in three business segments: Electric utility, gas utility, and North Star. CMS’s electric utility operations include the generation, purchase, distribution, and sale of electricity. The company’s gas utility purchases, transports, stores, distributes, and sells natural gas. The North Star segment, through its various subsidiaries and equity investments, is engaged primarily in domestic independent power production.

In June 2021, CMS Energy sold EnerBank, a Utah state-chartered, FDIC-insured industrial bank providing unsecured consumer installment loans to Regions Bank for $1.019 billion in proceeds. With the sale of EnerBank, CMS can focus more on its core areas of utility operations and services and improving the earnings and cash flow at its North Star segment.

The company plans to grow its rate base through capital expenditures of $14.3 billion from 2022 to 2026, with around 80% aimed at the regulated utility businesses and roughly 20% intended for clean energy generation, including wind, solar, and hydroelectric.

CMS has a goal of achieving net-zero carbon emissions by 2040. CMS Energy is headquartered in Jackson, Michigan and has paid dividends since 1971. My recommended action would be to consider buying CMS.

About the Author

Kelley Wright entered the financial services industry in 1984 as a stock broker, first with a private investment boutique in La Jolla and later with Dean Witter Reynolds. In 1990, he left the retail side of the industry for private portfolio management. In 2002, Mr. Wright succeeded Geraldine Weiss as the managing editor of the Investment Quality Trends newsletter as well as the chief investment officer and portfolio manager for IQ Trends Private Client.

His commentaries have been published in Barron's, Forbes, BusinessWeek, Dow Jones MarketWatch, The Economist, and many other business and financial periodicals. Mr. Wright is an active speaker at trade shows and investment conferences, and is a frequent guest and contributor to radio and CNBC. He is the author of Dividends Still Don't Lie, which was published in February, 2010, by John Wiley & Sons, Inc.

More By This Author:

Four Flexible Funds For A Cautious MarketNational Fuel Gas: Ready To Run

Bob Iger Sets A New Path At Disney

Disclaimer: © 2023 MoneyShow.com, LLC. All Rights Reserved.