Clustering Of Volatility Spikes

Last week, my Putting Low Stock Volatility to Good Use (Guest Columnist at Barron’s) triggered a bunch of emails related to the clustering of low volatility. Most readers expressed an interest in the phenomenon of volatility clusters occurring in both high and low volatility environments and were curious about the differences between high and low volatility clusters.

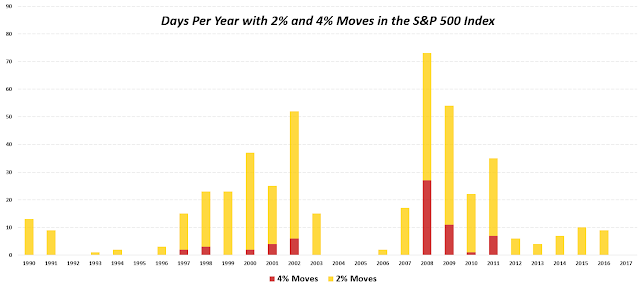

When it comes to measuring volatility clusters I am of the opinion that realized or historical volatility is a more important measurement than implied volatility measurements, such as is provided by the VIX. When I think in terms of VIX spikes, I generally focus on two single-day realized volatility thresholds:a 2% decline in the S&P 500 Index and a 4% decline.

The graphic below is in many respects the inverse of the graphic in Putting Low Stock Volatility to Good Use (Guest Columnist at Barron’s) – and this should come as no surprise. Simply stated: while high volatility clusters and low volatility clusters, volatility regimes tend to persist for several years, so it is very rare to see a clustering of high and low volatility in the same years. This is exactly the principle I laid out more than ten years ago regarding echo volatility in What My Dog Can Tell Us About Volatility.

[source(s):CBOE, Yahoo, VIX and More]

Note also that in spite of all the talk in the past few years of the potential implosion of the euro zone, a hard landing in China, central banks across the globe creating the seeds of our destruction, increasingly bipartisan politics creating deep divides across the nation, etc., etc. – volatility has been relatively mild during the past 5-6 years.

The interesting thing about volatility regimes is that they eventually transition from low volatility environments to high volatility environments and vice versa and create what I call VIX macro cycles in the process. The volatility transition phases are some of the most interesting times in the market and can certainly be some of the most profitable. These inflection points are sure to be a target of some of my future writing on volatility.

So, as VIX and More sails off into its second decade of publication, I vow to flesh out some of my evolving thinking on subjects I have touched upon above (some of which have lain dormant in this space for several years) at the same time I charge off into new areas. While I will continue to have a laser focus on volatility (particularly its global, multi-asset class aspects), it is time to pay more attention to the “and More” portion of this title of this blog and make a push into new frontiers. Said another way: my thinking likes to cluster, but it likes to spike as well.

Finally, most posts tend to touch on one or two key ideas, so I typically put a half dozen or so links below that I refer to as “Related posts.” Today, it seems as if I have touched briefly on so many subjects that more links (I’m sure today’s is a new record) seem appropriate and instead of referring to these as related posts, they are now officially 'Further Reading' going forward.

Further Reading:

- Putting Low Stock Volatility to Good Use (Guest Columnist at Barron’s)

- What My Dog Can Tell Us About Volatility

- My Low Volatility Prediction for 2016: Both Idiocy and Genius

- What Is Historical Volatility?

- Calculating Centered and Non-centered Historical Volatility

- Rule of 16 and VIX of 40

- Shrinking VIX Macro Cycles

- Chart of the Week: VIX Macro Cycles and a New Floor in the VIX

- The New VIX Macro Cycle Picture

- Recent Volatility and VIX Macro Cycles

- VIX Macro Cycle Update

- Was 2007 the Beginning of a New Era in Volatility?

- VIX Macro Cycles

- Last Two Days Are #5 and #6 One-Day VIX Spikes in History

- 2014 Had Third Highest Number of 20% VIX Spikes

- Today’s 34% VIX Spike and What to Expect Going Forward

- All-Time VIX Spike #11 (and a treasure trove of VIX spike data)

- The Biggest VIX Spike Ever: A Retrospective

- VIX Sets Some New Records, Suggesting Volatility Near Peak

- Highest Intraday VIX Readings

- Short-Term and Long-Term Implications of the 30% VIX Spike

- VIX Spike of 35% in Four Days Is Short-Term Buy Signal

- VXO Chart from 1987-1988 and Explanation of VIX vs. VXO

- Volatility History Lesson: 1987

- Volatility During Crises

- Chart of the Week: VXV and Systemic Failure

- Euro Volatility and Risk

- The Evolution of European Equity Risk

- Forces Acting on the VIX

- A Conceptual Framework for Volatility Events

Disclosure(s): the CBOE is an advertiser on VIX and More

Disclaimer: "VIX®" is a trademark of Chicago ...

more

Thanks for sharing