CloudMD, Cheap Valuation For One Of The Fastest Growing Telemedicine Companies In Canada

TM editors' note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Please note, news came out this morning on CloudMD, the subject of this article. The news is not addressed in this article, but is considered to be good news and will be discussed in a future write-up.

Gold is at a nine-year high. Dozens of gold juniors have seen their share prices soar this year. Investors see the writing on the wall; gold fundamentals are incredibly strong due to COVID-19 induced gov’t debt issuance, money printing & deficit spending, with no end in sight…

Once people realize a paradigm shift is at hand, they’re not afraid to buy smaller, riskier companies, seeking large gains. COVID-19 is ushering in a number of paradigm shifts, but few as clear-cut as gold. Readers beware, some trends have already been exploited. Online shopping? Amazon is up 92% since March. Teleconferencing? Zoom up 140%. Online education? K-12 Inc., +175%. Movie streaming? Netflix+110%.

Telemedicine is hot & will remain strong for years, not months or weeks….

Like gold, I think telemedicine’s time has come. COVID-19 has vaulted this niche industry into the Big leagues in a matter of months rather than years. Regulators were forced to rapidly understand and get behind tele-sessions. Insurance companies have had to do the same. Truly a win-win-win for patients, doctors / nurses & medical practices.

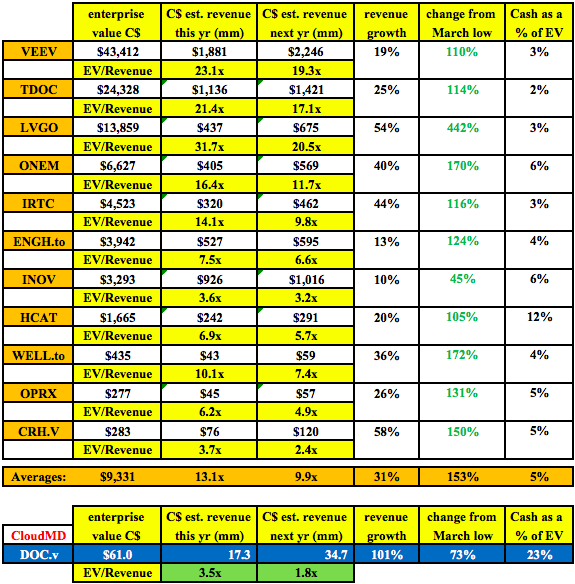

If one agrees that telemedicine is a bona fide paradigm shift in health care services, then one should consider investing in smaller companies with potentially more upside (albeit with commensurately more risk) than firms like $50B Veeva Systems, which is +104% since March, $24B Teladoc +114%, or $14BLivongo Health +430%!

Much of telemedicine is new, everyone is learning as they go. Successes will be handsomely rewarded. Well funded, small, smart, fast, nimble companies probably have a 2 or 3-year window to get it right. The top comanies will get taken out at attractive valuations.

CloudMD well-positioned to thrive in telemedicine, then get acquired

A company that’s ideally positioned to rapidly expand in telemedicine and potentially be acquired is CloudMD Software & Services (TSX-V: DOC) / (OTCQB: DOCRF). It has a market cap of $72.7M and an Enterprise Value (“EV“) {market cap + debt – cash} of ~$61M. Revenue is growing very rapidly, potentially increasing by > 400% from $6.8M in 2019 to the consensus estimate of $34.7M in 2021.

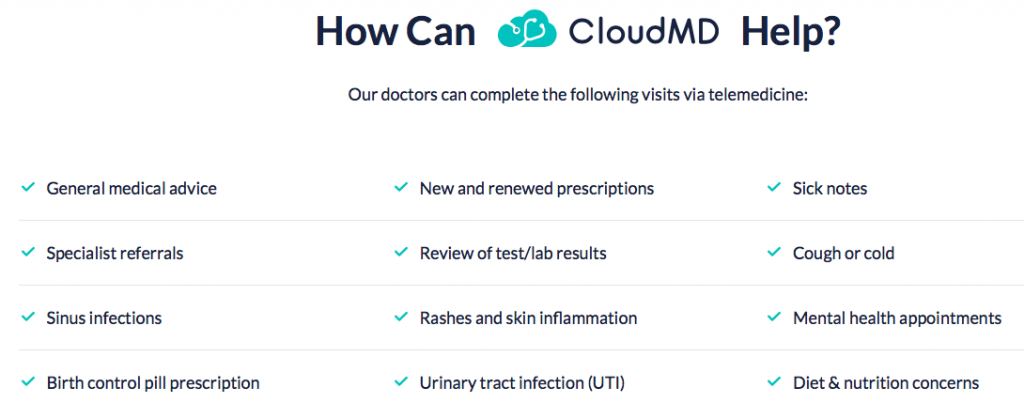

CloudMD is revolutionizing the delivery of healthcare by providing patients easy, fast access to all aspects of their care, via phone, tablet, laptop or desktop computer. The Company offers SAAS-based solutions to medical clinics across Canada. That’s on top of owning, operating brick & mortar clinics and acquiring new facilities.

Management has developed or acquired proprietary technology that delivers high-quality care through connected primary care clinics, telemedicine & artificial intelligence. CloudMD currently provides service to an ecosystem of 376 clinics in eight provinces, over 3,000 licensed practitioners, with access to nearly 3 million patient charts.

Hybrid business model; clinics + telemedicine + SAAS-like margin potential

Following the SAAS business model, CloudMD has the potential to be a high-margin, stable (low churn), rapidly growing company, with long-lasting (recurring) revenue. In the chart below, CloudMD has the fastest [expected] revenue growth (2021 over 2020) at 101% vs. an average of 31%. Part of the reason is that revenue is launching off of a small base, but the Company also compares favorably on its EV / Rev. multiple (3.5x / 1.8x) vs. averages of (13.1x / 9.9x). So, fastest growing, cheapest valuation.

Management is prudenly pursing a hybrid approach to healthcare delivery in Canada. In addition to telemedicine the team continues to acquire, own & optimize conventional clinics. I believe this approach captures the most efficient & cost-effective way to gain market share. There’s a finite number of doctors, nurses & family offices. Rolling them up into CloudMD, before they join other companies, is a winning strategy.

Medium-sized companies can only grow so fast organically. They need to acquire growth in order to make themselves attractive to larger players. There are a lot of small cap telemedicine ventures, but only a few are high-quality, with visionary management teams, strong balance sheets & rapid revenue growth. Fewer still offer compelling valuation.

After raising $15M last month, management has amassed a sizable war chest with which to make accretive acquisitions. CloudMD is making acquisitions of businesses at under 1x revenue, integrating & streamlining them, making the revenue worth more.

Larger players pay higher revenue multiples, M&A critically important

Larger entities can afford to pay well above 1x revenue because they unleash even greater synergies & economies of scale, and gain the opportunity to cross-sell new services. It appears that management has the financial wherewithal to acquire about $30M in annual revenue. That’s 86.5% of the consensus estimate for 2021 of $34.7M.

Once companies like CloudMD gain reasonable scale, they become prime takeover targets themselves. To be clear, this whole chain of events only works while the underlying sector is strong. Telemedicine is STRONG!

CloudMD’s shares have languished, some fear an upcoming selloff as two blocks totaling ~6M shares (private placements @ $0.48, current share price, $0.64) become free-trading on July 20th & 30th. Some of the feared selling has probably already taken place. Over the past three months avg. daily trading volume was 1.3M shares. (stockwatch)

As the telemedicine sector soared from late March on, CloudMD shares initially participated, rising from $0.37 to $0.95. However, the stock has settled back to $0.64. Early last month, the Company issued $15M worth of shares at $0.70 with a half warrant at $1.00, giving them the largest cash holdings relative to EV (23%) of any peer I could find.

CloudMD & its CEO are not new to telemedicine, this is a people business

CloudMD has been actively involved in the healthcare space for years. In May 2018, it acquired HealthVue Ventures, a family practice with three clinics performing telemedicine, and other more routine services. It’s been over two years that management has seen virtual meetings as the wave of the future. CEO Dr. Hamza has been practicing telemedicine for seven years, making him a leading expert in this nascent field.

Patients can avoid missing work or school by using virtual meetings, negating the need for child care; or worse, having to drag children to the doctor’s office. For some, getting to an appointment on time, and also planning the rest of the day’s activities, can be difficult & stressful.

Evidence from four months of pandemic in N. America, as telemedicine has been thrust upon us, suggests most patients find it to be as good, or better, than in-person visits. Going to the doctor takes time & logistical preparation and carries added expenses. By car or public transport, finding / paying for parking, paying & waiting for Uber rides, or getting rides from friends & family. A half-hour appointment can turn into a much longer, unpredictable, stress-provoking ordeal.

In addition to being much more convenient, patients are reporting more time with doctors and feeling that they have a doctor’s full attention. Incremental, high-quality time spent with doctors & nurses means more questions asked & answered. In-person visits will still be needed, but the mix is shifting in favor of virtual consultations.

Patients like telemedicine, everyone benefits from less exposure to germs

As patients get used to the ease of telemedicine, pundits believe they will initiate more sessions with doctors than they otherwise would have. Also, patients who rarely, if ever, seek medical advice or treatment — due to a fear doctors, hospitals, germs or social anxiety — might find telemedicine appealing.

From the doctor’s point of view, they can expect to “see” more patients per week, or the same # in fewer days (5 days worth of patients in 4 days = Fridays off). Patients are less likely to cancel or not show up to appointments. If a doctor is away on business, at a conference — she/he could still meet remotely.

Earlier this week, the CDC Director predicted that this fall & winter will be, “one of the most difficult times we’ve experienced in American public health.” No one wants to hear that, I sincerely hope he’s wrong, but it means that investors will be thinking about & experiencing telemedicine for quite some time.

Doctors like telemedicine, everyone benefits from less exposure to germs

Healthcare is one of the toughest businesses to operate and especially hard to enter. It takes years of experience and, importantly, trusted relationships & teamwork. New companies can’t obtain credibility overnight. Yet credibility is critical to attracting new patients, doctors, nurses & family offices to join small companies like CloudMD.

Joining a smaller group of highly talented professionals has advantages over being a tiny fish in a giant pond. New executives & business partners can make a meaningful difference in how CloudMD evolves. In the end, telemedicine is only be as good as the people / groups behind it. That’s where the CloudMD story gets really exciting and where the Company can deliver tremendous shareholder value.

Attracting healthcare rock stars, in part by offering sign-on bonuses, equity stakes, autonomy, a chance to help build a fantastic company, flexible hours / places to work (home, travel, holiday or in a medical office)— getting this right will make an investment in CloudMD really pay off! Great people attract great people. Great people have large networks, give them C$15M to deploy? Great things should follow.

Disclosure: At the time this article was posted, CloudMD was an advertiser on [ER]. Peter Epstein owned no shares, options or warrants in the Company.

The content of this article is for ...

more

I compare tele-medicine to having a good friend tell you all about the wonderful concert you missed, instead of you being there at the concert in person.

Yes, certainly it has advantages and certainly it is more convenient, and the additional profit for the doctor's business is not to be ignored. And undoubtedly with some doctors it will be no different. But it is an addittion, not a substitute. THAT must be understood.