Cloud Stocks: Symbotic Needs To Expand To New Customers

Photo Credit: Michal Jarmoluk from Pixabay

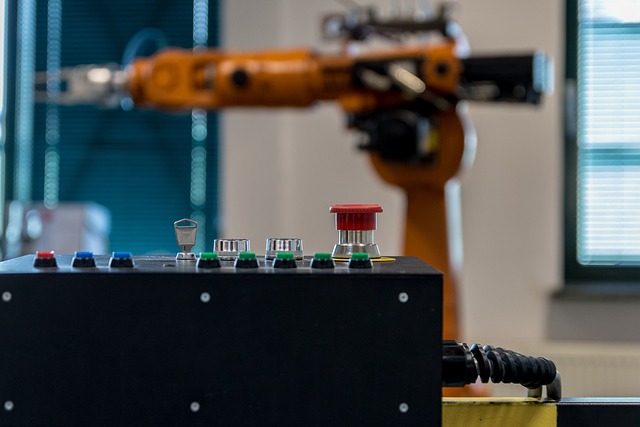

According to a market report, the warehouse automation market is expected to grow 16% annually to $115.8 billion by 2034. The market was pegged at $26.5 billion last year. The growth in the industry is driven by increasing adoption of robotics and AI to drive operational efficiency, cost savings, and speed of order fulfillment at warehouses. Symbotic (Nasdaq: SYM) recently announced a new product that is expected to meet those requirements.

Symbotic’s Financials

For the third quarter, revenues grew 26% to $592.2 million, ahead of the market’s estimates by 10%. It ended the quarter with a loss of $0.05 per share compared with the market’s forecast of a loss of $0.04 per share.

By segment, systems revenues were $559.1 million compared with $450.6 million a year ago. Software and maintenance revenues improved from $3.5 million to $8.1 million. Operation services revenues grew from $16.2 million a year ago to $24.9 million.

For the fourth quarter, Symbotic expects revenues of $590-$610 million and an EBITDA of $45-$49 million. The market was looking for revenues of $649.89 million and an EPS of $0.07 for the quarter. Analysts expect revenues of $2.22 billion and an EPS of $0.23 for the year. The market was not too pleased with the quarter’s outlook. But Symbotic attributed the lower revenue to the delays in recognized revenue surrounding the launch of its new storage system.

Symbotic’s Updated Storage Solution

Symbotic recently announced the general availability of its next-generation storage that has been designed to significantly enhance the performance of its warehouse automation system. The updated storage system has been engineered to deliver increased storage capacity for products, faster deployment, along with enhanced fire suppression, and improved seismic adaptability.

Symbotic claims that the next-generation system will help its customers reduce their storage footprint by up to 40% of its original size. The solution will help improve storage density that translates to faster, and shorter bot trips needed for case delivery. The structure includes pre-assembled, precision-manufactured sub-components that will reduce the number of on-site assembly parts to lower system implementation time at customer sites.

The Modular shelf configurations will be able to accommodate a broader range of products, and a unique leveling system will reduce the site readiness costs by minimizing floor preparation requirements. The new storage and buffering structure can be implemented as a retrofit to existing facilities or in new buildings, as part of the end-to-end Symbotic System.

Symbotic believes that these improvements will accelerate deployment and enhance scalability. Additionally, it plans to apply this structure across the supply chain ranging from distribution centers to perishable goods environments to e-commerce and micro fulfillment hubs. Initial customer response has been favorable, and Symbotic was already signing projects for the new storage structure in the last quarter.

Symbotic remains an interesting use case for the real-world application of AI technology. The current quarter weak outlook is a short-term issue. Its bigger issue remains that of expanding to a meaningful customer base outside of Walmart. Symbotic does not report Walmart’s contribution to revenue separately, but its latest 10-Q filing reveals that its biggest customer accounts for 85% of its revenue till date compared with 86% a year ago. Symbotic is looking for the new solution to help it expand into other customers.

Its stock is trading at $51.39 with a market capitalization of $30.3 billion. It touched a 52-week high of $64.16 in August and has recovered from the 52-week low of $16.32 that it was trading at in April this year.

More By This Author:

Cloud Stocks: Adobe Doubles Down On Agentic AI Strategy

Cloud Stocks: Cloudflare Is Experimenting With Managing AI Access To Content

Cloud Stocks: Broadcom Chipping Away At Nvidia’s Market

Disclosure: All investors should make their own assessments based on their own research, informed interpretations, and risk appetite. This article expresses my own opinions based on my own ...

more