Cloud Stocks: RingCentral Maintains Market Share Leadership In UCaaS Through Partnerships

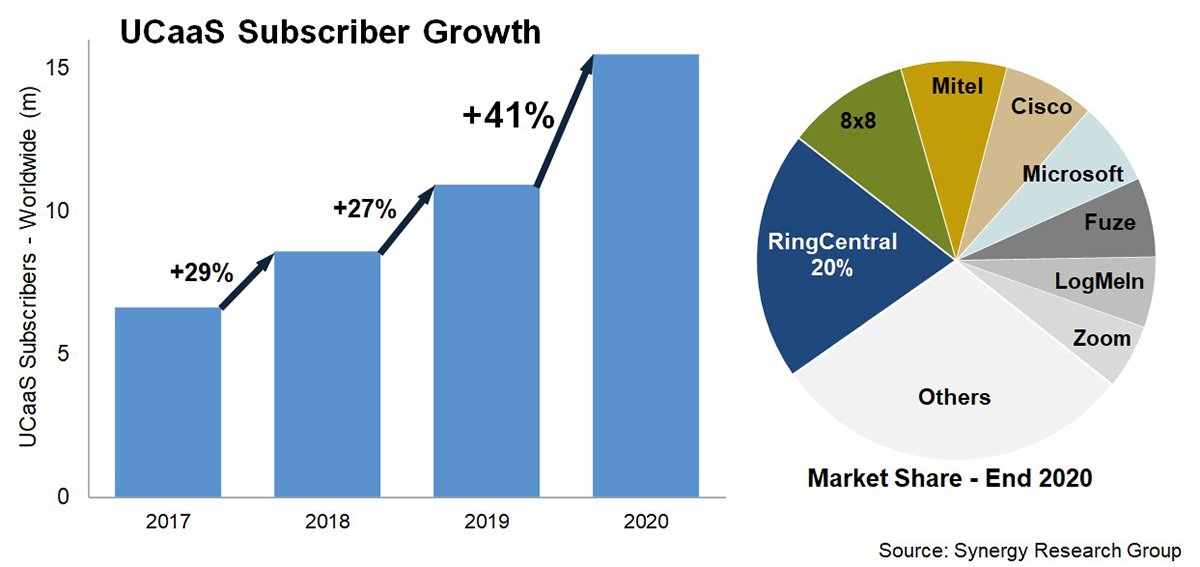

The global pandemic accelerated the growth of the Unified Communication-as-a-Service (UCaaS) market, with vendors like Microsoft (MSFT) and Zoom (ZM) seeing improvement in their market share. In 2020, the UCaaS subscriber base of both Microsoft and Zoom grew to over 1 million users each. But RingCentral (RNG) remained the market leader with a 20% market share.

RingCentral’s Financials

RingCentral’s recently released fourth-quarter revenues grew 34% to $448 million, significantly ahead of the market’s forecast of $434.53 million. Non-GAAP net income per diluted share was $0.39, ahead of the Street’s estimates of $0.37. By segment, software subscriptions revenue increased 37% to $420 million. Other revenues grew 0.9% to $28.3 million.

Among key metrics, Annualized Exit Monthly Recurring Subscriptions (ARR) grew 39% to $1.8 billion. RingCentral Office ARR increased 41% to $1.7 billion. Mid-market and Enterprise ARR, defined as $25,000 or more in ARR, increased 52% to $1.1 billion.

It ended the year with revenues growing 35% to $1.6 billion. Adjusted net income per diluted share was $1.34, compared to $0.98 in 2020.

For the first quarter, RingCentral expects revenues of $455-$459 million, representing an annual growth of 29% to 30%. It expects subscription revenues of $426-$429 million, representing annual growth of 31% to 32%.

Non-GAAP EPS is expected to be $0.34. For the full year, it expects revenues of $1.990-$2.015 billion, representing an annual growth of 25 to 26%. Non-GAAP EPS is expected to be $1.69 to $1.72.

RingCentral’s Partner Expansion

Recently, RingCentral and Vodafone Business (VOD) announced Vodafone Business UC with RingCentral, its new communications platform. It brings together RingCentral Message Video Phone with Vodafone’s mobility and 5G capabilities to provide customers with more choice, flexibility, and simplicity in workforce collaboration and remote working.

The service combines Vodafone Business’ mobile-first approach, global brand, reach, and scale with RingCentral’s deep UCaaS and CCaaS expertise to combine all preferred modes of communication into a single intuitive app that is accessible on any device.

It also announced the expansion of its partnership with Deutsche Telekom (DTEGF) to create RingCentral X. The service is powered by Telekom and includes RingCentral Message Video Phone. It combines RingCentral’s team messaging, video meetings, and cloud phone system onto a single platform, allowing customers of all sizes to work from everywhere.

Analysts believe that RingCentral still has a long way to gain from its partner network. Its direct and partner ARR increased 38% over the year to $1.03 billion, accounting for nearly two-thirds of its total ARR.

It has established partnerships with Avaya (AVYA), Alcatel-Lucent (ALU), Atos (AEXAF), and Mitel. But its relationships with BT (BT), T-Mobile (TMUS), Telus (TU), Verizon (VZ), and Vodafone are still in the early days. RingCentral will continue to see growth driven by its penetration into these partners.

Its stock has recently been trading at around $120.86 with a market capitalization of around $11.3 billion. It touched a 52-week high of $388.35 in March last year and a 52-week low of $117.49 in February.

Disclosure: I am an investor in this company.

All investors should make their own assessments based on their own research, informed interpretations and risk appetite. This article expresses ...

more