Cloud SaaS Computing Stock, MongoDB, Jumped 9% Last Week

Image Source: Unsplash

Introduction

The cloud computing SaaS market is expected to grow by a CAGR of 11.7% between now and 2030 and that growth will greatly benefit the data center industry.

What is Cloud Computing?

Cloud computing is the technique of processing, storing, and managing data on a network of remote computers hosted on the internet by cloud service providers rather than on a personal computer or local server using only as much compute power and storage as needed to meet demand. This theoretically allows for cheaper and faster computing because it eliminates the need to purchase, install, and maintain servers.

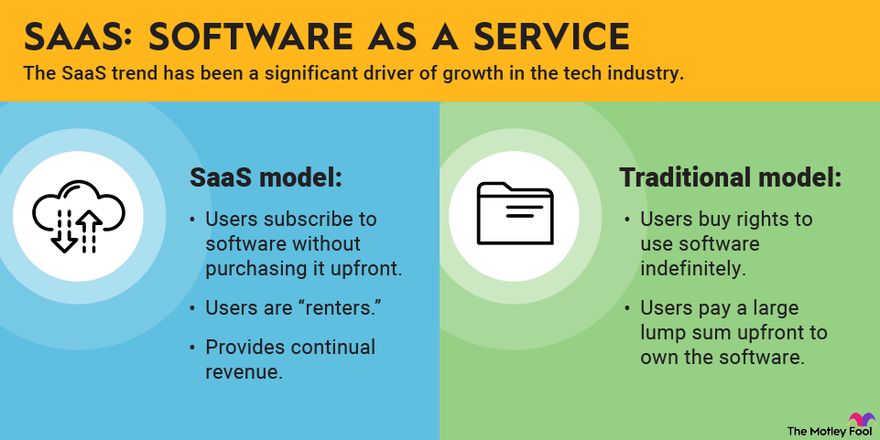

What is SaaS?

SaaS, also known as cloud application services, makes software available to users over the internet, usually for a monthly subscription fee. They are typically ready-to-use and are run from a users’ web browser which allow businesses to skip any additional downloads or application installations. (Source)

Image source: The Motley Fool

For more insightful information you are encouraged to read Cloud Computing 101.

There Are 3 Types of Cloud Computing Service Models

- IaaS (Infrastructure as a Service)

- IaaS, also known as cloud infrastructure services, provides end users with cloud-based alternatives to on-premise, physical infrastructure, allowing businesses to purchase resources on-demand instead of the more costly venture of having to buy and manage hardware. IaaS accounts for 32.5% of cloud computing revenue.

- PaaS (Platform as a Service)

- PaaS, also known as cloud platform services, provides developers with a framework, software and tools needed to build apps and software — all accessible through the internet. PaaS accounts for 29.0% of cloud computing revenue.

- SaaS (Software as a Service)

- SaaS, also known as cloud application services, is the most commonly used service within the cloud market. SaaS platforms make software available to users over the internet, usually for a monthly subscription fee. They are typically ready-to-use and run from a users’ web browser, which allows businesses to skip any additional downloads or application installations. In a nutshell, SaaS offers ready-to-use, out-of-the-box solutions that meet a particular business need (such as a website or email). Most modern SaaS platforms are built on IaaS or PaaS platforms. SaaS accounts for 38.5% of cloud computing revenue. (Source)

What Constitute "Pure Play" SaaS Cloud Computing Companies?

- Generate most or all revenue from SaaS products

- Are not diversified into hardware, advertising, or retail

- Offer subscription-based cloud software as their core business

Our Pure-Play Cloud SaaS Computing Stocks Portfolio

The constituents in the Portfolio (see below) have been updated with the elimination of Cloudflare (no longer a pure play) and the addition of Salesforce and Snowflake. It now consists of the 8 largest such companies with a minimum market capitalization of $18B They are listed below as to their performances week ending July 18th, in descending order, and MTD, along with their focus and market capitalization and the reasons for the significant increases in the price of MongoDB and Datadog.

- MongoDB (MDB): UP 9.2% w/e July 18th; UP 5.4% MTD

- Focus: provides general-purpose database platforms worldwide and offers consulting and training services

- Market Cap: $18B

- Reason for increase:

- Technical Rebound: After dipping below $200 earlier in July, MDB bounced back sharply, closing at $221.21 on July 18

- Institutional & Insider Buying: Insider transactions and institutional inflows picked up

- Datadog (DDOG): UP 5.6% w/e July 18th; UP 9.8% MTD

- Focus: operates an observability and security platform for cloud applications

- Market Cap: $50B

- Reason for Increase:

- S&P 500 Inclusion: Datadog officially joined the S&P 500 on July 9th, replacing Juniper Networks. This triggered Index fund buying

- Institutional Accumulation: Trading volume spiked midweek suggesting strong institutional interest

- Workday (WDAY): UP 4.3% w/e July 18th; DOWN 1.8% MTD

- Focus: provides enterprise cloud applications to help its customers manage their business and operations

- Market Cap: $62B

- Atlassian (TEAM): UP 4.2% w/e July 18th; DOWN 3.7% MTD

- Focus: designs, develops, licenses, and maintains various software products

- Market Cap: $51B

- HubSpot (HUBS): UP 3.5% w/e July 18th; DOWN 1.5% MTD

- Focus: provides a cloud-based customer relationship management (CRM) platform for businesses

- Market Cap: $29B

- Snowflake (SNOW): UP 2.9% w/e July 18th; DOWN 2.6% MTD

- Focus: its AI data cloud enables customers to consolidate data into a single source

- Market Cap: $72B

- ServiceNow (NOW): UP 2.6% w/e July 18th; DOWN 5.8% MTD

- Focus: provides end to-end intelligent workflow automation platform solutions for digital businesses

- Market Cap: $199B

- Salesforce (CRM): UP 1.7% w/e July 18th; DOWN 4.0% MTD

- Focus: provides customer relationship management (CRM) technology that connects companies and customers together

- Market Cap: $251B

On average the above 8 stocks went UP 3.6% w/e July 18th but are DOWN 2.5% MTD.

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed.