Clean Energy Stock Deflation And Biden’s Infrastructure Plan

Last month saw buying opportunities in some clean energy stocks as the bubble created from the euphoria over Biden’s election vanished as if it never happened.

Clean energy stocks have simply returned to the general upward trendline from the second and third quarter of 2020. Rather than bursting in a market panic, this seems to have been more of general deflation.

Some clean energy stocks seem reasonably priced, but there are no great values like we often see during the market panics which typically follow bubbles. Without a panic, I’m not ready to buy aggressively. Stocks, in general, continue to trade at fairly high valuations, and rising interest rates or some other market disruption could still trigger a sell-off.

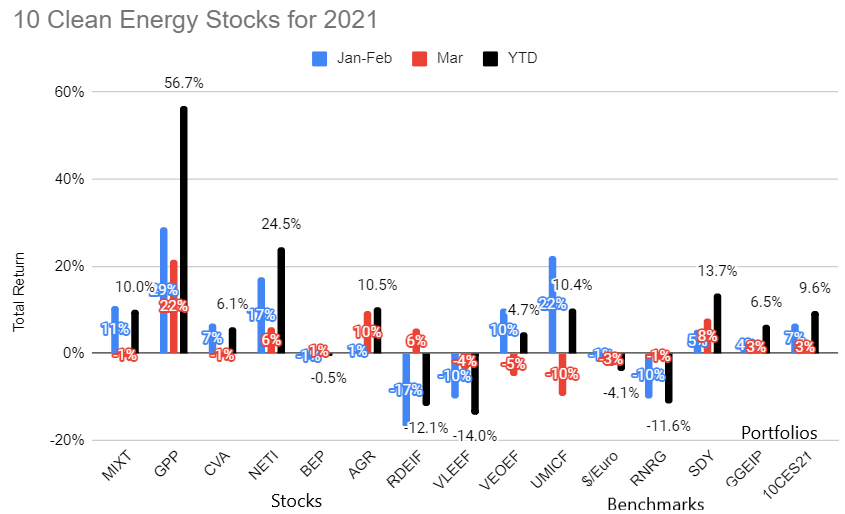

Performance of the 10 Clean Energy Stocks for 2021 model portfolio through the end of March, vs benchmarks. Note the Clean energy benchmark RNRG is down 11.6% while the broad market benchmark SDY is up 13.7%.

Biden’s Infrastructure Plan

Biden’s infrastructure plan includes significant funding for clean energy. It would make tax credits refundable and extend them and includes an offshore wind push. It also includes significant measures to improve the long-neglected electric grid and electric vehicle charging.

Solar and wind manufacturers will benefit from the tax credit extensions, but this may not be that significant for anyone company because most sell globally. The US is a large market for solar and wind, but not so large that it’s a dominant player. Renewable energy developers are more likely to see a significant impact.

In the 10 Clean Energy Stocks for 2021 list, Brookfield Renewable (BEP) and Avangrid (AGR) both have significant development arms, so robust support for renewable energy may enable them to increase their growth rates. Of the two, Avangrid is particularly well placed because it also develops offshore wind and electricity transmission and distribution networks. Avangrid’s offshore wind development, Vineyard Wind, had been suffering delays due to roadblocks put up by the Trump administration. Now it seems to be on the fast track.

The best Biden infrastructure pick in the list is Eneti (NETI). As a future owner of offshore wind turbine installation vessels, the booming offshore wind industry and the long lead time for building such vessels should put it in a very good position when its first vessel is delivered in 2023. I expect the company will exercise some of its options to buy more before then so that it will have a robust pipeline of new vessels being delivered in subsequent years.

The ethanol industry and Green Plains Partners (GPP) are also benefiting from the change of administration, with the EPA taking steps to limit Renewable Fuel Standard waivers given to oil refineries. GPP is also benefiting from an investment by an activist hedge fund, which believes the stock is undervalued, as I noted for my Patreon supporters on March 10th.

Conclusion

The changed political climate gives reason to be hopeful about clean energy stocks, especially now that much of the air has been let out of the bubble that began with Biden’s election. However, overall stock market valuations are still high, and rising interest rates are a drag on the income stocks I focus on.

Cautious buying of better clean energy stock values seems warranted, but the emphasis should be on “cautious” not “buying.” Make sure to keep significant cash in reserve.

Disclosure: Long positions all the 10 Clean Energy Stocks for the 2021 model portfolio.

Disclaimer: Past performance is not a guarantee or a reliable indicator of ...

more