Ciena To Post Q2 Earnings: Here's What To Expect

Ciena Corporation (CIEN) is scheduled to report second-quarter fiscal 2023 results on Jun 6.

In April, Ciena reaffirmed guidance for both second-quarter and full-year fiscal 2023 that it provided with its last earnings release. For second-quarter fiscal 2023, the company continues to expect revenues in the range of $1,035-$1,115 million. Adjusted gross margin is estimated to be low 40%. Adjusted operating expenses are projected to be $335 million.

The Zacks Consensus Estimate for earnings is pegged at 60 cents per share, suggesting a 20% increase from the year-ago quarter’s levels. The consensus estimate for revenues is pegged at $1.09 billion, indicating a gain of 14.4% from the year-ago quarter’s levels.

Ciena Corporation Price and EPS Surprise

(Click on image to enlarge)

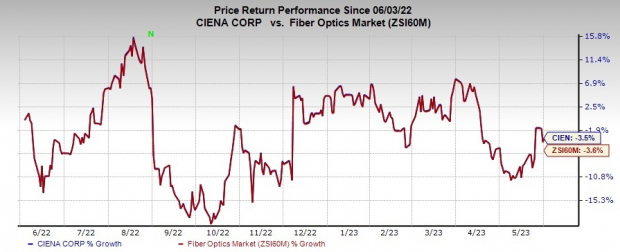

CIEN has a trailing four-quarter earnings surprise of 182%, on average. Shares of Ciena have lost 3.5% in the past year compared with the sub-industry's decline of 3.6%.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Factors to Note

CIEN is one of the leading providers of optical networking equipment, software and services. The company’s performance is likely to have been driven by increased network traffic, demand for bandwidth and the adoption of cloud architectures.

In addition to increasing demand for its solutions in the 5G, cloud, AI and automation space, CIEN is investing extensively to grab opportunities in fast growing markets in the next-gen metro and edge solutions.

CIEN’s routing and switching solutions are likely to have witnessed strong uptake. Contribution from the Vyatta platform, which Ciena acquired from AT&T, is likely to have favored the segment.

Ciena is witnessing strong momentum for its WaveLogic 5 Extreme solution. In the last reported quarter, the company added 13 new customers for its WaveLogic 5 Extreme solution.

Incremental gains from healthy performance of its software automation business, especially Blue Planet Software, are likely to have aided the top line.

However, global supply-chain dynamics, elongated lead times, component shortages and related higher logistics costs remain concerns. Inflation and higher expenses on product development amid stiff competition in the networking space might further have limited margin expansion in the to-be-reported quarter.

What Our Model Says

Our proven model does not conclusively predict an earning beat for Ciena this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Ciena has an Earnings ESP of 0.00% and a Zacks Rank #2.

More By This Author:

Lululemon Q1 Earnings And Revenues Surpass Estimates

Bilibili Reports Q1 Loss, Lags Revenue Estimates

Macy's Q1 Earnings And Revenues Beat Estimates

You can uncover the best stocks to buy or sell before they’re reported with our more