CHTR: The One Stock That Superinvestors Are Dumping: Is It Time To Sell?

Image Source: Pixabay

As part of the weekly research here at The Acquirer’s Multiple we’re always interested in superinvestors who hold the same stocks that appear in our Acquirer’s Multiple Stock Screeners, based on their latest 13F’s. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks.

While doing this research we’ve also uncovered a number of stocks that superinvestors have sold, or reduced in their portfolios, according to their latest 13f’s. So we’re now providing a new weekly feature article called ‘One Stock Superinvestors Are Selling‘. This week we’ll take a look at:

Charter Communications Inc. (CHTR)

Charter is the product of the 2016 merger of three cable companies, each with a decades-long history in the business: Legacy Charter, Time Warner Cable, and Bright House Networks. The firm now holds networks capable of providing television, internet access, and phone services to roughly 58 million US homes and businesses, around 35% of the country. Across this footprint, Charter serves 29 million residential and 2 million commercial customer accounts under the Spectrum brand, making it the second-largest US cable company behind Comcast. The firm also owns, in whole or in part, sports and news networks, including Spectrum SportsNet (long-term local rights to Los Angeles Lakers games), SportsNet LA (Los Angeles Dodgers), SportsNet New York (New York Mets), and Spectrum News NY1.

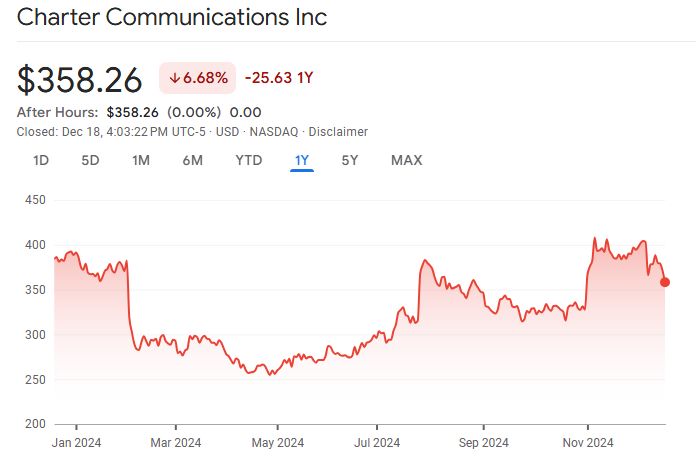

A quick look at the price chart below for the company shows us that the stock is down 6.68% in the past twelve months.

Source: Google Finance

Superinvestors who reduced, or sold out of the company’s stock, according to their latest 13Fs, include:

(Remaining shares)

Rich Pzena – 3,013,220

Warren Buffett – 2,821,879

Steve Romick – 610,632

Wally Weitz – 135,450

Ray Dalio – 11,488

Mario Gabelli – 3,328

More By This Author:

The Risks Of Shorting MSTR And Long Bitcoin

V: The Undervalued Stock That Superinvestors Are Loading Up On

Large-Cap Stocks In Trouble - Saturday, Dec. 21