China Mobile: The Value Stock Paying 6% Dividends No One Wants To Buy

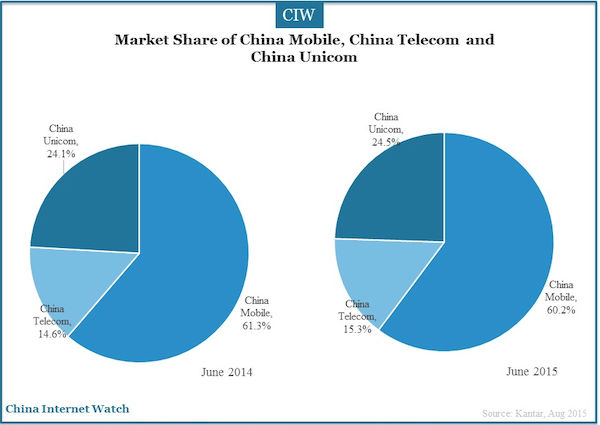

What is China Mobile? China Mobile is the largest phone carrier in China. It is state-backed, like the other major Chinese telcos, China Unicom and China Telecom. As a result, China Mobile is intimately intertwined with the other two Telcos, as the Chinese government will often shift resources and management among the three of them to prevent any of them from developing too big of a market share.

Why is it a growth stock?

Although China Mobile most likely will not expand in terms of market share due to Chinese government intervention, they are positioned in one of the fastest growing markets in the world with ample room for growth. In 2013, 71.1% of Chinese people had cell phones, and that number has grown to 78% by 2017. In comparison, 90% of Americans have cell phones. Further, those that do have phones in China will use their phones more and more as their GDP per capita goes up; China Mobile is thus in many ways a great method for betting on China as a whole.

Why is it a value stock?

The sheer numbers behind China Mobile is enough to make a lot of investors scratch their heads. Their P/E ratio is only 10.79, implying that they are undervalued; in comparison the NASDAQ has a P/E ratio of 25.85. A quick look at their balance sheet also shows that they are liquid: they are sitting on 60 billion dollars in net cash. On top of this, last period they gave a 6% dividend. Despite this, the stock has been going down. In fact, in the last three years China Mobile has lost 28% of its market value, despite consistent revenue growth.

Why has its stock has plummeted?

So China Mobile is a large company with potential for growth and excellent financials; why is its stock going down?

To many investors, the fact that China Mobile has so much cash on hand is frightening. After all, why wouldn’t they just reinvest their cash into new projects? They are the biggest phone provider in one of the fastest developing countries in the world, surely there must be positive NPV projects that they can invest in. In fact, since there hasn’t been so much as a peep about China Mobile planning to use this cash, many institutional investors simply exclude it when valuing them.

Many speculate that it is the Chinese government pushing them to keep so much cash just in case there is an economic downturn and they need to bail out Chinese banks. In fact, China Mobile already invested in a regional bank in 2010, and this by itself exacerbated many worries, though this investment played out well for them.

The other possibility is that the Chinese government is having them keep this money on hand so that they can invest in an industry that they wish to expand. This has also worried some, but investors should keep in mind that since the death of Mao, the Chinese government has been very successful in growing industries that it wants to grow; thus, this scenario could very well be good for China Mobile.

Should I invest in China Mobile?

My answer is yes; China Mobile a large company positioned in a market with long term potential that has excellent financials, is clearly undervalued and pays dividends regularly.

Many worry about China Mobile because it involves a type of risk that doesn’t really exist anywhere else on the same scale: the whim of government officials. Xi Jinping can decide to cripple China Mobile tomorrow morning, and by lunch time it will already have happened. It’s also almost impossible to predict the likelihood of something like that happening since there’s simply not enough historical data. Ben Graham, the father of modern value investing, wouldn’t make any conclusions based off of historical data unless there was 50 years’ worth of accurate data. The pseudo-communist economic system in modern China, in contrast, has really only existed for 30 years, and Xi Jinping has only be in power for 5 of those years, so trying to predict what he will do is difficult to say the least.

However, Chinese government policy isn’t random, it’s very calculated. Though really only being in existence for 30 years, the modern Chinese government has always gotten its way; if they want an industry to grow, they will shift all the resources in the Chinese economy until it does. Thus, if they do decide to use China Mobile’s cash to invest said industry, it’s more than likely China Mobile will see a good return. This will likely be true even in a recession (though a potential investor should note that we’ve never really seen a modern Chinese recession before).

China Mobile’s novel risk also comes with a novel security: they will almost certainly not go bankrupt as long as the Chinese government doesn’t collapse. Just as China can manipulate the economy to make a company grow, it can also manipulate the economy to protect companies it favors, and it has all the reason to favor China Mobile. It’s their flagship telco company, and they have almost total control over it.

China Mobile is clearly a value stock, and one that’s undervalued because it’s currently in a situation that investors have never seen before. That’s frightening to many, and for good reason too. However, if you can stomach that fear and invest in it, there is more than likely a lot of money to be made.

Good read.