Chevron Vs. Exxon Stock: Which Oil Giant Is The Better Investment?

Image Source: Pixabay

Falling back towards $60 a barrel, the recent surge in crude oil prices was short-lived, with it being noteworthy that these levels are below the threshold for peak profitability.

However, Chevron (CVX - Free Report) and Exxon Mobil (XOM - Free Report) are at the forefront of companies that can still capitalize, making it a worthy topic of which oil giant may be the better investment at the moment.

Although there are some caveats, both have optimized their operations to thrive even with crude prices being suppressed this year. Correlating with such, Exxon and Chevron control over 20% of the global oil and gas integrated operations market.

Being the largest U.S. oil firms, Exxon currently has a market cap of over $477 billion, followed by Chevron at $267 billion.

Image Source: Zacks Investment Research

Chevron & Exxon’s Operational Excellence

Excelling in upstream oil production (exploration & extraction) as well as oil refining, Chevron and Exxon have maintained their dominance by focusing on high-return projects while maintaining disciplined capital spending.

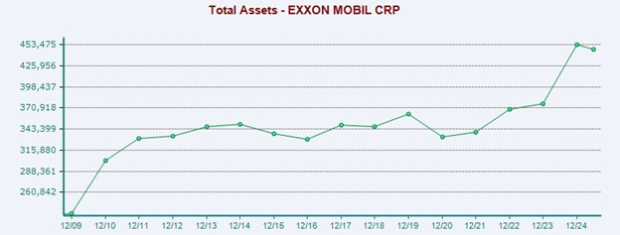

Exxon especially stands out in this regard, having more than $15 billion in cash & equivalents and $447.59 billion in total assets compared to $177.63 billion in total liabilities.

Image Source: Zacks Investment Research

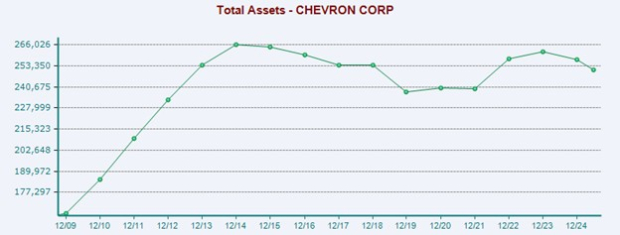

While Chevron’s cash pile of $4 billion isn’t as mesmerizing, its total assets of $250.82 billion are nicely above it total liabilities of $103.56 billion.

Image Source: Zacks Investment Research

Sector Headwinds

Despite their strong balance sheets, Chevron and Exxon haven’t been immune to headwinds that have affected the broader energy sector, including layoffs and reduced hiring due to falling oil prices and rising input costs.

Notably, Chevron has announced it will reduce its workforce by 20% through 2026, and Exxon is cutting 2,000 positions as part of a restructuring. Furthermore, Exxon’s profit most recently dipped to a four-year low during Q2 to $1.64 per share, with Chevron’s Q2 EPS falling to $1.77 compared to $2.55 in the comparative quarter.

Performance & Valuation Comparison

Year to date, Chevron stock is up a modest +6% which has edged Exxon’s +4% and their Zacks Oil and Gas-Integrated-International Market’s +5%.

From a longer-term view, Chevron and Exxon have been very viable investments although they have trailed the broader market’s YTD return of +15%.

In the last five years, Exxon stock is still sitting on industry-leading gains of +230% with Chevron shares up over +100%, trailing the Oil and Gas-Integrated-International Market’s +140% but edging the benchmark S&P 500.

Image Source: Zacks Investment Research

At 20X and 16X forward earnings, respectively, CVX and XOM do trade at premiums to the industry average of 10.6X but are the clear-cut leaders in the space and offer pleasant discounts to the S&P 500.

Although they also trade above the industry’s 0.6X price to forward sales multiple, CVX and XOM are still under the preferred level of less than 2X, and the S&P 500’s 5.6X.

Image Source: Zacks Investment Research

CVX & XOM Dividend Comparison

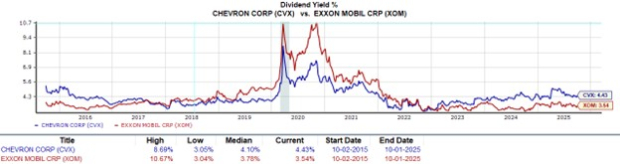

Known for their enticing dividends, Chevron’s 4.43% annual yield is roughly on par with the industry average and tops Exxon’s 3.54%. These yields impressively edge the S&P 500’s 1.09% average.

Image Source: Zacks Investment Research

Bottom Line

For now, Chevron and Exxon stock both land a Zacks Rank #3 (Hold). Given what has been a prolonged suppression in crude prices, there could be better entry points to invest in these oil conglomerates.

Optimistically, this may present appealing opportunities for long-term investors who may prefer Exxon stock, given its industry-leading returns in the last five years, although those seeking higher income in the portfolio may favor Chevron.

More By This Author:

Buy Nike Stock After Crushing Its Q1 Expectations?

Is GM The Best Automaker To Invest In Now?

Still Time To Buy The Top Aerospace & Defense Stocks?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more