Chevron Stock Price Benefits From The Rise In Energy Prices

Chevron's (NYSE:CVX) stock price is one of the main beneficiaries of the rise in energy prices. The U.S. oil giant, with both upstream and downstream operations, releases its quarterly earnings today.

Image Source: Pexels

Chevron, the U.S. oil giant, releases its quarterly earnings today at 11:00 AM EDT. The EPS estimates for Q3 2021 are $2.19, but Chevron may easily beat them as the price of oil rose during the quarter.

Chevron is an integrated oil and gas company headquartered in California and employing over 45,000 people worldwide. It is one of the leading corporations in the energy sector and thus benefits from the rise in energy prices in 2021.

This is a dividend-paying company as pretty much any other oil company. Oil was out of fashion before the CVODI-19 pandemic due to climate change worries – and still is. However, governments worry more about the effects of an economic recession, and oil is forecast to keep the largest share in the energy mix in the years to come.

The rally in the oil prices, from close to negative $40 to the current +$80 meant a lot for oil-producing and oil-refining companies such as Chevron. The company operates both in upstream (i.e., oil exploration) and downstream (i.e., oil refining) and thus, its profitability correlates directly to the price of crude oil. As such, the higher the price of oil goes, the more profits for Chevron and its peers.

Chevron's stock price this year fully reflects the developments in the oil markets – it is up close to +35% and it currently hovers near yearly highs. The company pays a quarterly dividend and has a payout ratio of 74.61% while growing the dividend for the past five years.

(Click on image to enlarge)

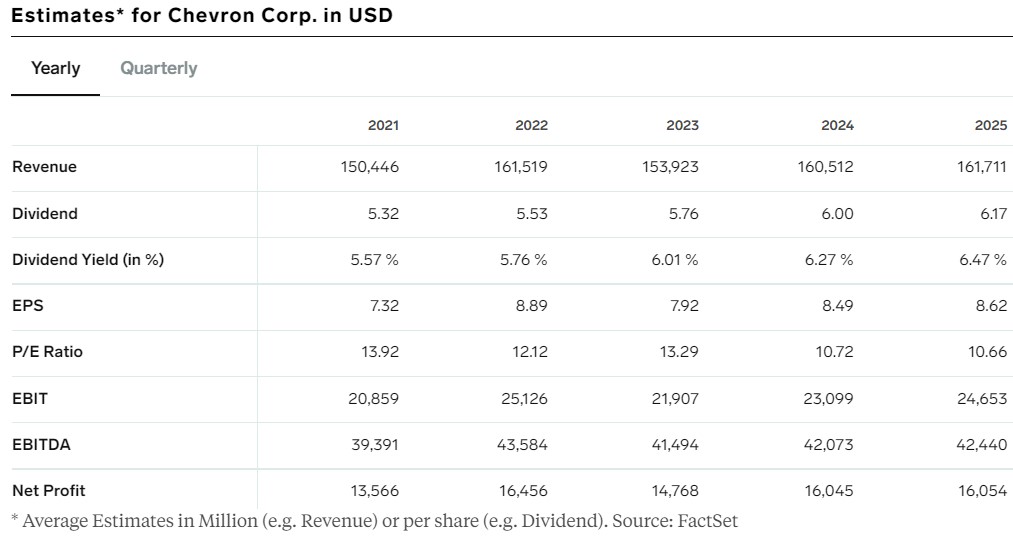

Chevron Stock Price Trades at an Attractive P/E Ratio

While the oil companies are not in fashion due to the world shifting to green and renewable energy, there might be scope for short- to medium-term investing in the industry. Once again, oil is forecast to hold the main share in the energy mix in the decades ahead, so the oil companies’ valuation seems attractive here.

Chevron's stock price trades at a P/E ratio of 13.92 for this year, much more attractive than other companies in other sectors (e.g., the tech sector). In addition, the higher oil prices led to free cash flow piling, meaning that Chevron has cash at hand to invest in turning around the company or better complying with and adapting to the newest ESG requirements.

Disclaimer: None of the content in this article should be viewed as investment advice or a recommendation to buy or sell. Past performance/statistics may not necessarily reflect future ...

more