Chevron: A Supermajor To Own For Energy's Next Powerful Phase

Image Source: Pixabay

The year 2025 has been a tough one for oil prices. North American benchmark crude began 2025 in the low $70s. Now with just a couple weeks to go in the year, it’s been struggling along in the high $50s with bearish sentiment thick. But I still like Chevron Corp. (CVX) below $160, writes Elliott Gue, editor of Energy and Income Advisor.

Meanwhile, it has been a good year for natural gas. And thanks to that, Energy and Income Advisor stocks have on the whole continued to build wealth.

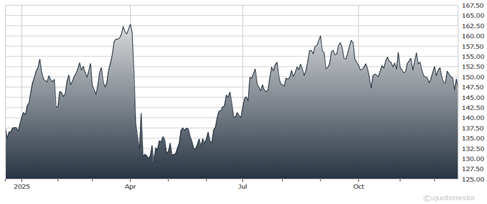

Chevron Corp. (CVX) Stock Chart

Chevron’s biggest move recently was closing the acquisition of Hess Corp. to become a 30% owner of Stabroek, the prolific oil and gas field off the coast of Guyana. That sets the company’s production profile up nicely the next few years, along with natural gas development in the eastern Mediterranean Sea and oil and gas in the Permian Basin.

Chevron’s year-to-date total return is about 8%, with the dividend raised 4.9%. We expect a similar payout boost next month but a larger total return on higher commodity prices, rising output, and relentless cost cutting.

About the Author

Elliott Gue is chief strategist at Capitalist Times, an investment research firm he co-founded ten years ago. Prior to founding Capitalist Times, he shared his expertise and stock-picking abilities with individual investors in several highly regarded research publications, including The Energy Strategist, and as chief editor of Personal Finance, one of the largest and oldest financial newsletter publications in the US.

Mr. Gue is one of the foremost experts on energy investing and has dedicated himself to learning the ins and outs of this dynamic sector, scouring trade magazines, attending industry conferences, touring facilities, and meeting with management teams.

He is also the co-author of two investment books published by the FT Press, The Silk Road to Riches: How You Can Profit by Investing in Asia's Newfound Prosperity and Rise of the State: Profitable Investing and Geopolitics in the 21st Century.

More By This Author:

APD: An Industrial Gas Giant Offering Compelling ValueSPX: Why 2026 Could Be Much Better Than Investors Think

AI Spending: No, This Is Not The Dot-Com Bubble All Over Again