Check Out Our New Long-Term Warrants Portfolio

Image Source: Pexels

Introduction

As I mentioned in my article yesterday entitled "Intro To Stock Warrants", investors are missing out on an excellent way to leverage the return of investments in stocks that provide stock warrants so this article is my attempt to change that with the introduction of our new Long-Term Stock Warrants Portfolio.

What are Warrants?

A warrant is a security giving the holder the right, but not the obligation, to acquire the underlying security at a predetermined (i.e. exercise) price and for a specified period of time (i.e. term/duration/expiration date). The idea is that you purchase a warrant when you anticipate the value of a stock to rise above the set price within the time the warrant can be used. If that happens, you buy shares of stock — known as exercising a warrant — below market price and collect the extra value as a gain. If that doesn’t happen, then you lose the money you invested in buying the warrant. Keep in mind that when an investor purchases a warrant, they don’t own anything other than the right to buy or sell stock at some point in the future. The investor doesn’t hold any shares, collect any dividends, or have any voting rights a shareholder would have.

Steps for Successful Warrant Investing

- Identify companies that offer long-term warrant of at least a 36 months expiration date and preferably of 48 or 60 months duration (see list below) because the longer the remaining life of a warrant the more time there is for the company to execute on their business plan and more time in the event of a market downturn for a favorable turnaround.

- Select a company that you think has great potential because if the company does not perform and execute on its business plan the common shares will not rise and, therefore, their associated warrants will nor rise either and, if the common shares decline, their associated warrants will decline by an even greater percentage. Visit the company's web site for their latest activity and results and review the company's latest quarterly financial results to determine their financial health.

- Identify a warrant currently priced to deliver an enhanced return of at least 1.5-to-1 (i.e. a 50% greater return than the associated stock) based on your due diligence (go here for an example of how to calculate the Return on Investment (ROI) of a warrant as compared to the associated stock).

- Choose a warrant that has a high strike price as this makes the warrant more likely to expire “in the money” and have intrinsic value.

- Choose a warrant with a high conversion ratios because you want the warrant to convert into as much stock as possible.

- Buy your chosen warrant when you think the market is favorable because, while warrants out-perform their associated stock in an up market, they under-perform much more so than their associated stock in a down market.

- Don't forget to sell the warrant before it expires (applicable to both American and Canadian investors) or, for Canadian investors only, to convert the warrant into the associated stock if the exercise price has been reached prior to the expiration of the warrant.

Our New Long-Term Stock Warrants Portfolio

Given the fact that no warrant ETFs are available to buy you could buy a basket of 3 warrants as highlighted below:

- USA Rare Earths Inc. warrants (USARW)

- About: engages in mining, processing, and supplying rare earths and other critical minerals in the United States.

- Duration: 49 months

- Expiration: March 13th, 2030

- Strike Price: $11.50

- Conversion Ratio: 1 warrant converts into 1 stock

- YTD Warrant Price Performance: +2,375%

- YTD Stock Price Performance: +105%

- Current Warrant Discount to Assoc. Stock: 48.5%

- Current Warrant Leverage vs. Stock: 1.9x

- Analyst Stock Price Forecast: The 3 analysts that cover USAR have a consensus rating of "Strong Buy" yet forecast a 25.03% decrease in the stock price over the next year.

- Media Commentary:

- Trump Media & Technology Group Corp. warrants (DJTWW)

- About: engages in social media (Truth Social), streaming services (Truth+) and a fintech brand (Truth.Fi) in the United States.

- Duration: 38 months

- Expiration: March 25th, 2029

- Strike Price: $11.50

- Conversion Ratio: 1 warrant converts into 1 stock

- YTD Current Warrant Price Performance: -70.5%

- YTD Current Stock Price Performance: - 53.6%

- Current Warrant Discount to Assoc. Stock: 57%

- Current Warrant Leverage vs. Stock: 2.3x

- Analyst Stock Price Forecast: DJT currently has no formal consensus 1-year analyst price target as its retail-driven momentum and political exposure make it difficult to model using traditional valuation frameworks. Only one analyst has issued a rating, and it is a “Sell.”

- Media Commentary:

- Trump Media stock: here’s why DJT shares are falling. DJT has authorized over 36 million warrants, which could significantly dilute existing equity if exercised as it would flood the market with new shares, depressing the stock price and warrant value.

- Critical Metals Corp. warrants (CMLW):

- About: operates as a mining exploration and development company in Austria and Southern Greenland.

- Duration: 37 months

- Expiration: February 27th, 2029

- Strike Price: $11.50

- Conversion Ratio: 1 warrant converts into 1 stock

- YTD Warrant Price Performance: +3,078%

- YTD Stock Price Performance: +121%

- Current Warrant Discount to Assoc. Stock: 51%

- Current Warrant Leverage vs. Stock: 2.1x

- Analyst Stock Price Forecast: Only 1 analyst covers CRML and has a 1-year target which predicts a 20.16% decrease from the current stock price.

- Media Commentary:

- Critical Metals files to sell 18.03M ordinary shares for holders which would likely exert downward pressure on the price of the company’s warrants due to dilution concerns

On average, the current warrant prices have a 2x leverage vs. their associated stock prices

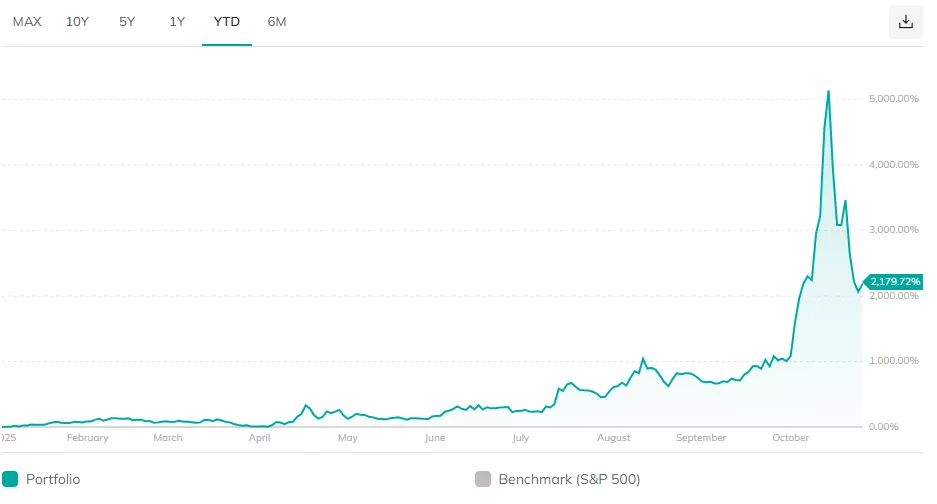

Portfolio Performance Chart

Conclusion

Warrants have been the best kept ‘secret’ of the investment world until now. After all, when was the last time you read an article on warrants or had your financial advisor broach the subject? Now that the ‘secret’ is out you can’t help but agree that warrants warrant your serious consideration.

More By This Author:

Intro To Stock Warrants

Our New Luxury Brands Portfolio Is Up 65% In Last Six Months

Gold And Silver ETFs Fell 10% Yesterday, October 21st; Here's Why

This article has been composed with the exclusive application of the human intelligence (HI) of the author. No artificial intelligence (AI) technology has been deployed.