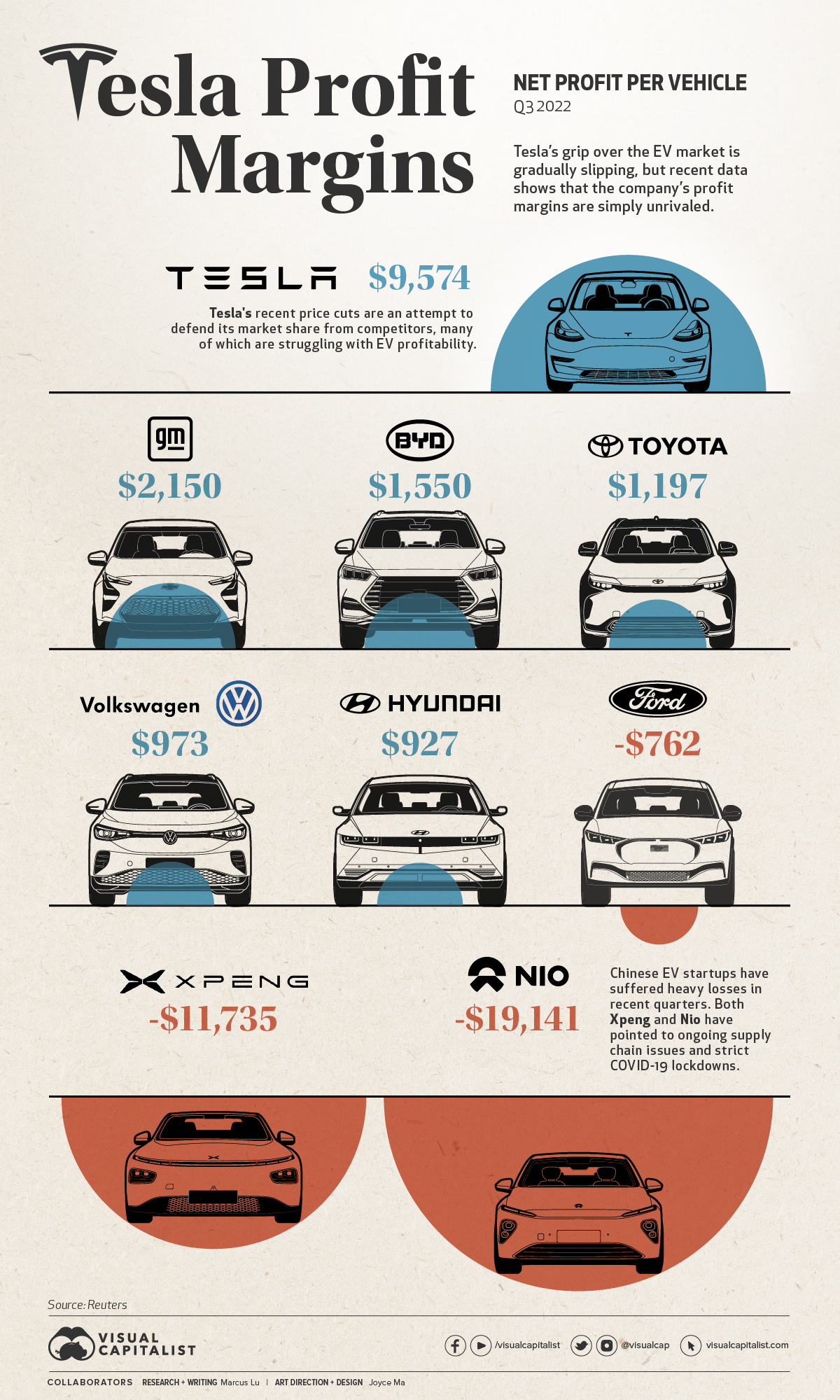

Charted: Tesla’s Unrivaled Profit Margins

(Click on image to enlarge)

In January this year, Tesla made the surprising announcement that it would be cutting prices on its vehicles by as much as 20%.

While price cuts are not new in the automotive world, they are for Tesla. The company, which historically has been unable to keep up with demand, has seen its order backlog shrink from 476,000 units in July 2022, to 74,000 in December 2022.

This has been attributed to Tesla’s robust production growth, which saw 2022 production increase 41% over 2021 (from 930,422 to 1,313,851 units).

With the days of “endless” demand seemingly over, Tesla is going on the offensive by reducing its prices—a move that puts pressure on competitors, but has also angered existing owners.

Cranking up the Heat

Tesla’s price cuts are an attempt to protect its market share, but they’re not exactly the desperation move some media outlets have claimed them to be.

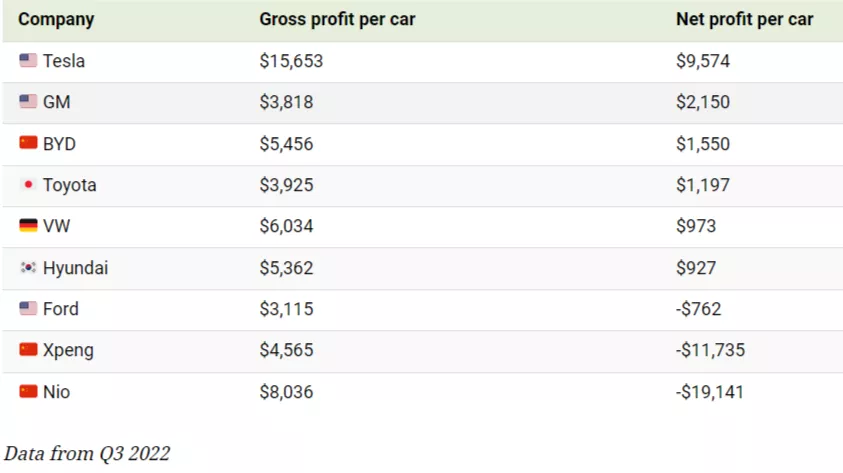

Recent data compiled by Reuters shows that Tesla’s margins are significantly higher than those of its rivals, both in terms of gross and net profit. Our graphic only illustrates the net figures, but gross profits are also included in the table below.

(Click on image to enlarge)

Price cutting has its drawbacks, but one could argue that the benefits for Tesla are worth it based on this data—especially in a critical market like China.

Tesla has taken the nuclear option to bully the weaker, thin margin players off the table.

– BILL RUSSO, AUTOMOBILITY

In the case of Chinese EV startups Xpeng and Nio, net profits are non-existent, meaning it’s unlikely they’ll be able to match Tesla’s reductions in price. Both firms have reported year-on-year sales declines in January.

As for Tesla, Chinese media outlets have claimed that the firm received 30,000 orders within three days of its price cut announcement. Note that this hasn’t been officially confirmed by anyone within the company.

Tit for Tat

Ford made headlines recently for announcing its own price cuts on the Mustang Mach-E electric SUV. The model is a direct competitor to Tesla’s best-selling Model Y.

Chevrolet and Hyundai have also adjusted some of their EV prices in recent months, as listed in the following table.

(Click on image to enlarge)

Source: Observer (Feb 2023)

Volkswagen is a noteworthy player missing from this table. The company has been gaining ground on Tesla, especially in the European market.

We have a clear pricing strategy and are focusing on reliability. We trust in the strength of our products and brands.

– OLIVER BLUME, CEO, VW GROUP

This decision could hamper Volkswagen’s goal of becoming a dominant player in EVs, especially if more automakers join Tesla in cutting prices. For now, Tesla still holds a strong grip on the US market.

More By This Author:

Mapped: GDP Growth Forecasts By Country, In 2023

Visualizing The Scale Of Global Fossil Fuel Production

Infographic: 11 Tech Trends To Watch In 2023

Disclosure: None.