Chart Of The Day: Symbotic - Very Mixed Opinions

Image Source: Unsplash

- 100% technical buy signals

- 10 new highs and up 41.34% in the last month

- 193.30+ Weighted Alpha

The Chart of the Day belongs to the robots for retailers manufacturer Symbotic (SYM). I found the stock by using Barchart's powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum and having a Trend Seeker buy signal then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 5/18 the stock gained 19.78%.

(Click on image to enlarge)

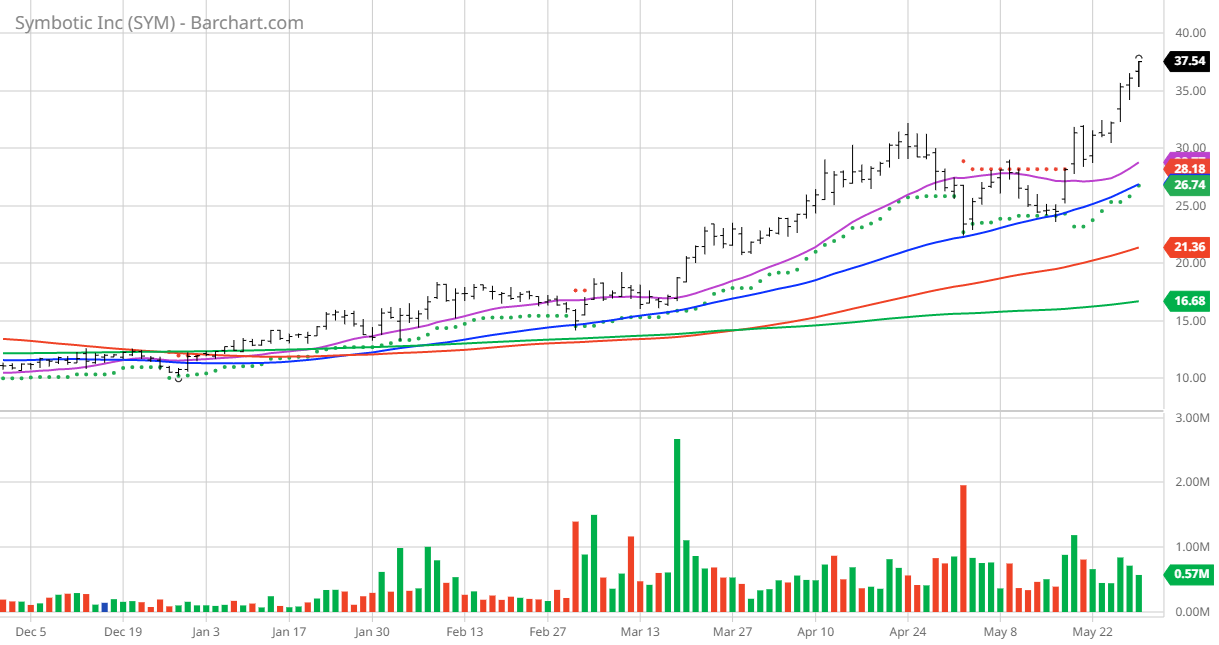

SYM Price vs Daily Moving Averages

Symbotic Inc., an automation technology company, provides robotics and technology to improve efficiency for retailers and wholesalers in the United States. The company offers Symbotic system, an end-to-end warehouse automation system for product distribution. It also designs, assemblies, and installs modular inventory management systems and performs configuration of embedded software. Symbotic Inc. is headquartered in Wilmington, Massachusetts.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 193.60+Weighted Alpha

- 276.15% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50 and 100 day moving averages

- 10 new highs and up 41.34% in the last month

- Relative Strength Index 73.47%

- Technical support level at $34.69

- Recently traded at $37.54 with 50 day moving average of $26.87

Fundamental Factors:

- Market Cap $20.05 billion

- Revenue projected to grow 310.20% this year and another 58.10% next year

- Earnings estimated to increase 147.10% next year

Analysts and Investor Sentiment -- I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts gave 10 strong buy, 2 buy and 1 hold opinion on the stock

- Analysts price targets are between $30 and $36

- CFRAs MarketScope gives it a sell rating

- MarketBeat comments: The company is in a hyper-growth phase, although growth is slowing. The most recent report had revenue up more than 200%, and the guidance expects the coming quarter to produce roughly 50% of growth or about $260 million. Walmart (NYSE: WMT), BTW, has a large stake in the company.

- 2,070 investors monitor the stock on Seeking Alpha

More By This Author:

Chart Of The Day: Vontier - Great Instruments

Chart Of The Day: PTC Therapeutics

Chart Of The Day: Cardinal Health - The Right Prescription

Disclosure: I/we have no stock, option, or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the ...

more