Charles Schwab Stock Price Is At Risk As Death Cross Nears

The Charles Schwab Corporation (SCHW) stock price has been a big laggard this year as concerns about the company’s business model continued. It has dropped by 6.15% this year while the S&P 500 has jumped by 16.80%.

Similarly, the KBW Banking ETF (KBWB) has soared by 16% while Robinhood Markets (HOOD) has risen by over 50%. Schwab has risen by just 14% in the past 12 months.

Business model concerns

Charles Schwab is a large financial services company that uses a diversified business model. It is a unique kind of bank that also offers additional services like wealth management and brokerage solutions.

Schwab’s business model is simple. It takes customer deposits and then invests them in government bonds with various maturities. This is unlike other banks that take deposits and then invest them in corporate and consumer loans.

By investing in these bonds, Schwab has been able to remove the commissions it used to charge customers when they bought shares using its brokerage account.

The company also makes other fees from its ETFs like the popular Schwab US Dividend Equity Fund (SCHD).

Schwab’s unique business model has come under pressure in the past few years as the Federal Reserve has pushed interest rates to the highest point in over a decade.

By doing that, the longer-dated government bonds that Schwab holds have lost substantial value and led to large unrealized losses. These unrealized losses have been credited for playing a role in the failure of companies like First Republic and Silicon Valley Bank. At some point last year, it had almost $20 billion in unrealized losses in its ‘held-to-maturity’ portfolio.

Schwab has survived the post-First Republic and SVB collapse in 2023 and is now working to change its business model. To do that, it has started to invest most of its cash in short-term government bonds, which, in these times of an inverted yield curve, are generating better returns.

The company is also intensifying its investments in other areas like wealth management that offer stable fees over time.

The earnings report also showed that the company was considering optimizing its balance sheet by shrinking its assets deposited in other banks.

This is notable since Schwab has a loan-to-deposit ratio of 17%, lower than the industry average of between 35% and 40%. This means that it has a lot of excess deposits, meaning that its balance sheet has not been optimised, making the new initiative more positive.

Additionally, the bank has reduced the payments it has historically allocated to share repurchases and is using these funds to reduce its supplemental borrowing. That means that its EPS growth will likely be slow going forward.

Charles Schwab Q2 earnings

The most recent financial results showed that Schwab’s interest revenue dropped to $3.8 billion in Q2, down from $4.1 billion in the same quarter in 2023. Its net interest revenue fell to $2.15 billion. For the first half, net interest revenue dropped from $5 billion to $4.39 billion.

On the positive side, its asset management and administration fees rose to $1.38 billion last quarter from $1.17 billion last year. It makes this money by charging a fee for the assets it holds.

It has trillions of assets under management and is the 5th issuer of ETFs in the world after Blackrock, Vanguard, State Street, and Invesco. Its total ETF assets under management are over $3.6 trillion.

Despite strong competition, Schwab also had some bright spots in the number of clients it added during the quarter. It had over 2 million brokerage account openings in the first half of the year. These clients brought in over $61.2 billion in assets and the company anticipates more gains going forward.

Analysts have mixed feelings about Charles Schwab. The most bearish are Piper Sandler whose analysts downgraded it from overweight to sell. 14 of the analysts following the company have a buy rating while five have a hold rating.

I am a bit pessimistic about Charles Schwab stock because most of its revenues are still linked to interest. Its asset management, trading revenue, and bank deposit fees totaled $2.5 billion while its interest revenue was $3.8 billion.

Charles Schwab stock price analysis

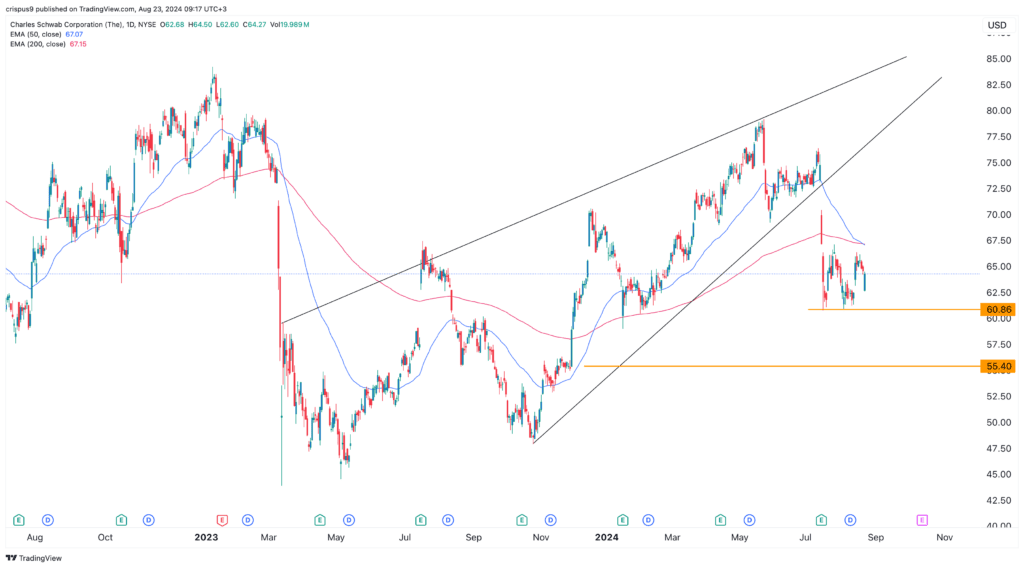

(Click on image to enlarge)

The daily chart shows that the SCHW stock price crashed hard after its recent earnings. This sell-off happened after it formed a rising wedge chart pattern, which is often a bearish sign.

More By This Author:

Price Of Raw Sugar Falls To Lowest Level In Two YearsUS Job Growth Cut By 30% In Revised Data - IT, Retail, And Manufacturing Sectors Hit Hardest

Fed Minutes Reveal Likely Rate Cut In September Amid Easing Inflation And Labor Market Concerns

Disclosure: Invezz is a place where people can find reliable, unbiased information about finance, trading, and investing – but we do not offer financial advice and users should always ...

more