Changes To Our Healthcare System Could Spell Problems For Healthcare Equities And Debt

In a way, we have been brainwashed, fed propaganda by the business of healthcare and our elected officials for decades.

The message we have been given from all forms of media, third party insurers and government officials is ‘Increasing healthcare cost is a difficult and complex problem to manage. There is no simple solution.’

I am not alone in believing there a relatively simple solution to what turns out to not be a complex problem.

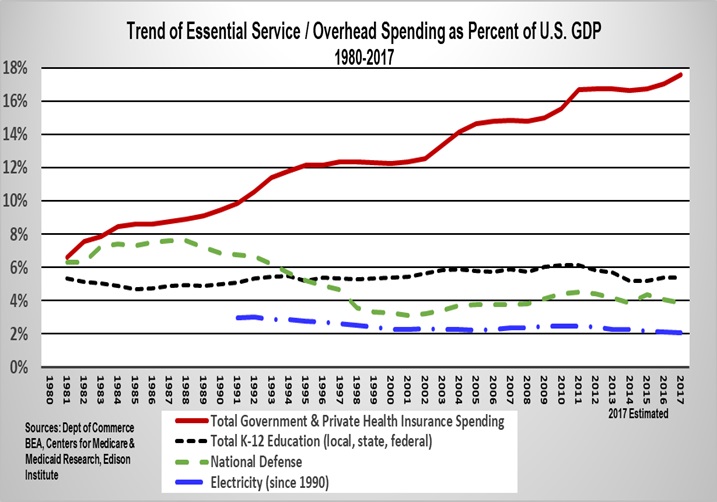

Chart: Essential Service Spending as Percent of U.S. Economy (GDP)

The Healthcare Oligopoly

The oligopoly consists primarily of hospitals, physicians, and prescription drug companies. Each have high barriers to entry and each is financially dependent on health insurance. (Here, they are referred to healthcare providers or, or simply the providers.

The fact is insurance, (i.e. risk sharing enterprises, commercial, governmental, or not-for-profit) is essential for the delivery of modern healthcare. The question is, whether high-quality healthcare is delivered at the highest possible or the lowest possible price. Imagine a private health insurer who decides to lower premium rates to attract more business. Lower premium rates mean reimbursement rates (dollars paid to providers for medical services) will be lower. The first thing that would happen is that healthcare providers would stop accepting that insurance.

Breaking up an oligopoly to foster competition would not work in the case of healthcare because it is necessary by circumstance. It is the private health insurance companies who control health insurance prices for the benefit of their customers – the healthcare systems individual providers, not those covered by insurance

If you can imagine healthcare without any insurance, then you can imagine price competition between providers. But because private insurance is not going away, price competition among providers cannot exist in any meaningful form.

The private health insurers have long managed the competing interests of health providers, largely by acceding to higher reimbursement rates and the premium rate increases that go with them. Across America, there are slight differences in the premium rates charged by private insurers for a given level of coverage.

The solid line on the chart is essentially proof of the existence of a healthcare provider oligopoly. Made possible by private third-party insurers’ power to increase premium rates with no external oversight or price regulation.

Federal and State Government Roles

The federal government and the states, who now pay more than 50% of the insured healthcare bill, are obliged to match private insurer reimbursement rates. If they do not, Medicare would quickly become second-class insurance, not widely accepted, and causing a break in the 1965 Great Society promise of quality health insurance for all retired Americans.

For reasons cited, the federal government has been along for the ride, seemingly powerless to control its own spending on healthcare insurance and spending by private insurers. The truth is that Congress has failed to act in the public’s best interest and its own by failing to adopt a regulated reimbursement regime.

Our representatives are unwilling to take on the Healthcare Lobby, even though it is the main cause of the federal government’s structural budget deficit and by far the most severe systemic problem facing the United States, its citizens, States, and businesses.

The point is that prices must decline, not just stop increasing to bring healthcare spending down to no more than 12% GDP over a period of, say, ten years. Healthcare spending with the cost of federal tax subsidies is 19% of GDP, closing in on 20%.

The difference between 12% of U.S. GDP and 20% (by 2018) equals $1.5 trillion, or 8% of current GDP over say ten years. That is a giant amount of excess overhead carried by the economy and its citizens.

Many former nations have been bankrupted by spending more than they could afford on defense, also an essential overhead expense - like the former Soviet Union.

The United States is spending a great deal more on healthcare than it can afford. Congress has not even considered regulating prices charged by the private sector for healthcare (i.e., health insurance). Even though throughout western Europe, government ministries and commissions regulate health insurance premiums, and the price of medications. The fact that 70% of Americans get their health insurance from their employers helps obscure the structure and problem.

Size and Scope

This year we reached a milestone with public and private healthcare spending together reaching $10,000 per person. That is $3.3 trillion dollars per year or 18% of the U.S. current economic output.

That number does not include the value of corporate tax write-offs for employee health insurance. These are subsidies, allowing private healthcare insurers to more easily increase rates and provider reimbursements.

Nor does it include the value of tax write-offs, also worth billions of dollars, allowed to hospitals and doctors for the difference in what their reasonable and customary charge is and what the health insurer reimburses.

In 2016, the New York Times published a table and wrote an accompanying article on what professions are represented in the top 1% of Americas’ highest income families. The percent of American households having one or two M.D.’s accounted for 51% of the top 1% of America’s highest income families

How did this happen and how much does high-quality healthcare at the lowest price for all citizens cost? If we are spending too much, how much are we wasting?

Healthcare spending in Germany, France, Japan, and most of Western Europe consumes between 11% to 12% of their national wealth, or GDP. The United States is closing in on 20%, an 8% difference equal to $1.5 trillion, or a 40% more expensive healthcare system. These countries cover their entire populations and provide better healthcare in several major areas, including infant mortality.

Healthcare Investments

The big picture is that healthcare providers all drink from the same trough with the insurance companies in charge of the pump. The water (solid line on chart) has a long history of flowing freely and an unmatched record of growth over decades. In simple terms, the worst-case downside for healthcare providers and private insurers could be a 20% reduction in the water level (revenues) ten years after enactment of price controls as more fully described further on. Enough to remain healthy, but not enough to overindulge.

Look at the solid line on the chart above 12%. That is essentially the annual amount ($1.5 trillion) of revenue leverage that exists in the business of healthcare due to monopolistic pricing power. It is unsustainable.

Private health insurance companies, if prices are regulated like investor owned public utilities would have a vital role to play. The profits earned are outweighed by the motivation, efficiency, and financial control the private sector provides compared to government run services.

A so-called "single payer system" would largely eliminate private health insurance companies, leaving Congress in control of spending, insurance pricing and dependent on the desires of changing Congressional majorities and Presidential administrations.

Regulation of Provider Reimbursement Rates – How Would It Work

Creation of a government sponsored commission that is: 1) independent, 2) apolitical, and 3) accountable to citizens and 4) charged with reducing the cost of health insurance by 40% over 10 years, is essential.

Maintaining healthcare spending at no more than 12% of GDP means the commission would be permanent, like the Federal Energy Regulatory Commission, which regulates electric rates, but with greater independence.

Healthcare providers would be free to charge whatever they choose to people who can afford to self-pay. But if the commission of experts decides, after financial and other analysis, that a fair price for a new drug, for instance, including a good profit margin is $3,000, then that is the amount reimbursed.

Independently set uniform reimbursement rates would result in there being no appreciable difference between the premiums charged for private and government health insurance.

The point is that for national solvency and greater economic growth, health insurance prices must decline, not just stop increasing, to bring annual healthcare spending down to 12% of GDP. Whether achieved or not, the environment for future revenue/spending increases appears to be decidedly un-favorable.

In addition to the price of health insurance going down, there would be an equal reduction in reimbursement payments to hospitals, physicians, and prescription drug companies for services and products provided.

If insurance suddenly started costing less, would my insurance company or my coverage change? The answer is should be no.

Why is the price of health insurance not regulated by an independent national commission, whose members are sworn to provide the highest quality healthcare at the lowest possible price?

Price regulation does not require a major overhaul of the system. The players and roles would all stay the same. A fair and reasonable rate structure for insurance premiums could be determined by an independent, objective regulatory board, along with reimbursement rates for healthcare systems and individual providers.

With regulation, the price reduction would become a reduction in mandatory costs and would translate into an economic stimulus, just like a reduction in the tax rate, allowing people, companies, and government to spend their money elsewhere.

There is no question that Congress could implement the proposal made here. John Robert, Chief Justice of the U.S. Supreme Court, stated in one of the two challenges to the Affordable Care Act, that "Congress is free to regulate insurance companies as it sees fit

Hospital systems and drug companies would appear to be at greatest risk if price regulation was instituted. Hospital systems that have the capacity to shrink in size, assuming they are not over leveraged in terms of their own debt, should be able to manage through the revenue shrinkage. Companies dependent on one or two very high-cost drugs would likely be merged into the larger pharmaceutical firms.

The scenario described here is not a prediction, it is an alert about urgent financial demands that will likely be made on the overfunded business of American healthcare and the impact regulation could have on health insurers and healthcare providers.

Disclosure: No healthcare investments

Really good article. Would love to see some more of your work.