Carnival's Stock Sits Stagnant As Traders Await Earnings Print: What's Next?

Carnival Corp (NYSE: CCL) was trading higher Wednesday morning but sold off slightly from the highs intraday.

The cruise line announced it would add two additional ships to its fleet by 2023, signaling an expected surge in customers, but its upcoming second-quarter 2021 earnings print scheduled for Thursday morning weighed the stock down.

On April 7, Carnival reported a first-quarter 2021 loss of $2 billion compared to revenue of $150 million for the same quarter the year prior. The loss was expected because Carnival’s ships have been largely docked since the pandemic began and the stock shot up 7% following the company’s print before sinking about 17% over the following 10 trading days.

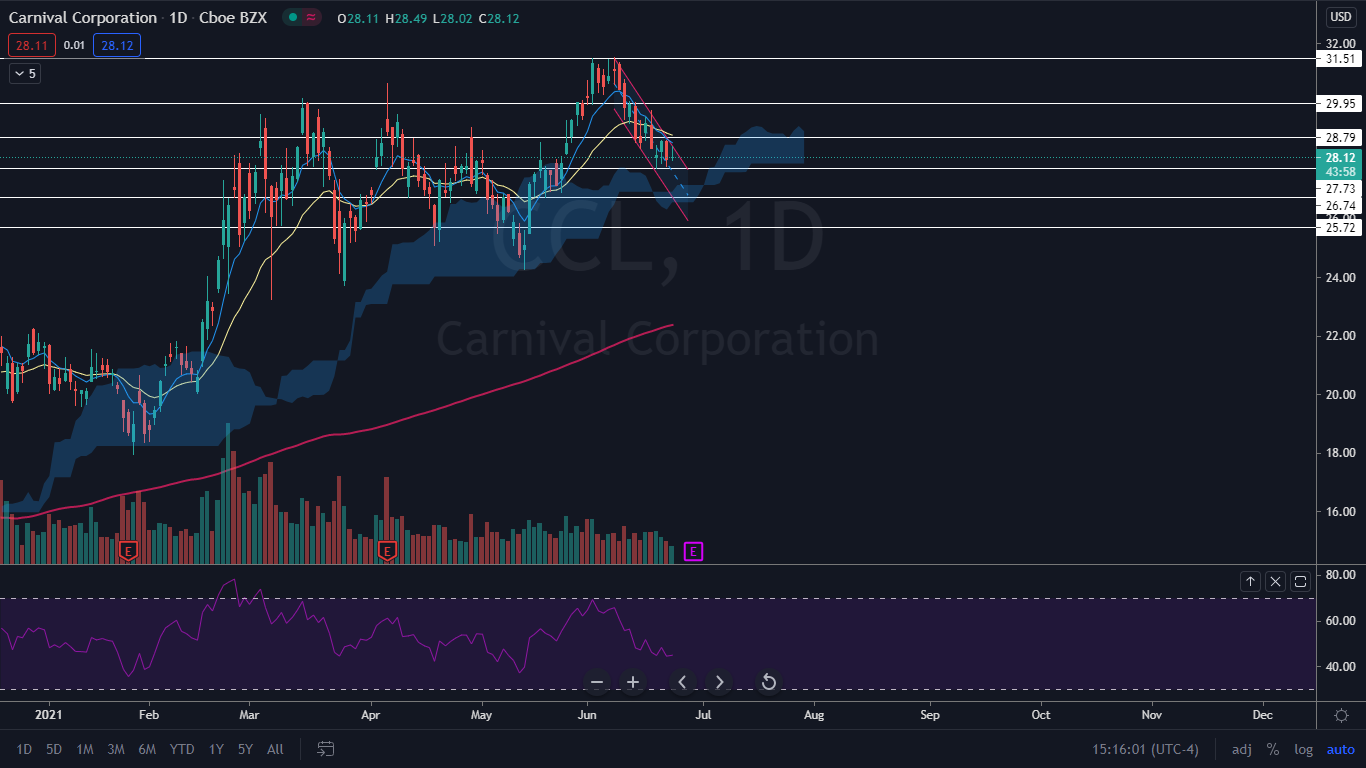

Carnival’s stock eventually recovered and made a new high of about $31.50 but was unable to break through the level despite trying on three separate occasions.

The Carnival Chart: The three attempts to break through the strong level of resistance created a bearish triple top pattern and the stock has lost about 11% of its value since. On June 18 and 19, Carnival found a bottom at $27.73 and created a bullish double bottom pattern indicating a bounce may be on the way. Since June 18, Carnival has been trading sideways unable to break through a resistance level at $28.79.

The downtrend from its new highs has also set Carnival’s stock into a bullish falling channel and on Wednesday it tried to break up above it but failed.

Bulls will want to see Carnival break up from below the top downward sloping line of the channel before it loses its lower support.

Carnival is trading below both the eight-day and 21-day exponential moving averages (EMA) and on June 17 increased selling pressure caused the eight-day EMA to cross below the 21-day EMA, all of which are bullish indicators in the short term. Carnival is trading above the 200-day simple moving average, which is bullish.

(Click on image to enlarge)

Bulls want to see bullish volume come in as a reaction to its earnings print for Carnival to pop above resistance at $28.79. If it can clear the level, it has room to move to motor toward $29.95.

Bears want to see a bearish reaction to earnings and for Carnival’s stock to continue trending down in the channel until it loses support at the $27.73 mark. If the stock drops below that level it could trade down to the $26.74 level.

CCL Price Action: Carnival Corp was trading up 0.32% at $28.15 at market close Wednesday.

© 2021 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.