Cardiome Pharma: Why This Bio Gem Could Be An Easy Double This Year

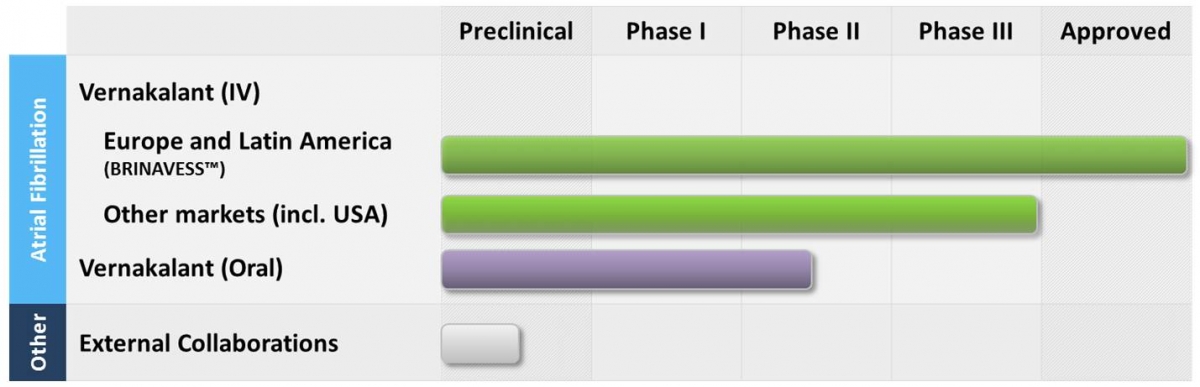

If you're the sort of person who loses interest rather quickly and won't read beyond the first few lines if it doesn't excite you, then before I go into any details about the company, what they do, and why you should invest in them, I refer you to the following progress chart of the company's pipeline:

It wouldn't take a genius to figure out that approval in the US would be a hugely positive catalyst for this company. But it may surprise you to know that the FDA have put this on clinical hold in the US since October 2010, around the same time it was approved in the European Union. More about the hold and why it is imminent to be lifted in the near future below.

Cardiome Pharma Corp (NASDAQ: CRME) is a biopharmaceutical company, engaged in the development and commercialization of cardiovascular therapies that enhance the life and health of patients.

They have two marketed products approved in Europe and other territories:

- BRINAVESS™ (Vernakalant IV), for the rapid conversion of recent onset atrial fibrillation (AF) to sinus rhythm in adults, and

- Aggrastat®, a reversible GP IIb/IIIa inhibitor for use in Acute Coronary Syndrome patients. (Aggrastat belonged to Correvio, an EBITDA positive company they acquired in November 2013 with an established sales and distribution network. More about the acquisition and how this benefited Cardiome below).

If you care to learn more about AF and the potential market for it, I refer you to this page of the company's website. The important part for the purpose of this article is:

There are approximately 2.5 million Americans and 4.5 million Europeans that suffer from AFib. Annual costs related to the management of AFib patients in the US are approximately $7 billion and roughly €13.5 billion in the European Union (estimated at $26 billion in total). These costs consistently rank AFib as a leading public health expenditure.

Due to an ageing population and higher survival rates amongst patients with underlying diseases associated with AFib, it is expected that the number of AFib sufferers will increase 3 fold over the next 50 years. Based on these figures, AFib, along with congestive heart failure and type 2 diabetes/metabolic syndrome make up the three fastest growing cardiovascular epidemics. AFib is expected to become one of the leading burdens on the global healthcare system in coming years.

(An article in PharmaTimes predicted AF drug sales to reach $6.1 billion by 2018)

Cardiome was once flying high, a rising star of a biopharma, they had the deal with the big pharma - Merck (NYSE: MRK). The future was bright and promising. Look at their 5 year chart for an idea of where their stock traded.

Their lead molecule, Vernakalant IV, was approved in September 2010 and launched in the European Union and other countries under the trade name BRINAVESS™ by Merck.

The collaboration traced its roots to April 2009, when Merck agreed to develop and commercialize BRINAVESS, gaining exclusive rights to an IV formulation outside of North America, and exclusive global rights to an oral formulation for the maintenance of normal heart rhythm in patients with AF. The IV formulation was approved and launched in Europe by Merck in 2010.

But in 2012, everything went wrong for Cardiome. In March 2012, Merck discontinued development of the oral version of BRINAVESS, and in September, it gave notice to terminate the license agreements for the drug.

The market reacted, or rather overreacted, negatively to this news and the company's stock price plummeted. Why did big pharma dump them? From my research, there was no reason given other than that Merck had other things in their pipeline they wanted to focus on. It is not unusual for a big company to mess the little one around. Unfortunately in such cases, the pain is inevitably all borne by the small company.

But the news wasn't all bad for Cardiome as it did rather well financially out of it. Merck gave Cardiome $20m in cash and also forgave them a $50m loan due to it as part of the deal. The company ended up with no debt and $30m in cash after the return of rights to the drug.

In June of 2013, there was a very good article written by Leonard Zehr, published on BioTuesdays.com, about how a hospital in Malmo, Sweden may turn around Cardiome's Brinavess following the collapse of the Merck agreement. The page has since been taken down, but may be viewed on scribd.com here. I have reproduced the article in part below.

...two developments near the end of 2012 convinced Dr. Hunter (current CEO) that Cardiome could make BRINAVESS succeed with a focused marketing plan.

First, the European Society of Cardiology issued new AF guidelines last fall, recommending BRINAVESS as a first-line therapy in haemodynamically stable patients with moderate or no structural heart disease.

"This was a significant piece of the puzzle, because the guidelines came out a couple of days before Merck stopped marketing the drug for us," Dr. Hunter recalls.

The second piece of the puzzle followed an analysis of Merck's data about the clinical usage of BRINAVESS and hospital sales patterns.

"What we saw was that in some places, hospitals were using a ton of BRINAVESS, and in other places, it wasn't being used at all," he remembers. "Clearly,somebody had figured out how to make BRINAVESS fit with their treatment practices.

"One of the places with a high usage of BRINAVESS was a hospital at Malmo, Sweden.

Dr. Hunter, a former practicing physician, says that when doctors at Malmo treated AF patients with BRINAVESS within the first 24 hours of being diagnosed with AF symptoms, they were able to convert nearly 80% of patients to normal sinus rhythm, a level well above the drug's label of a 50% conversion rate, within seven days of AF onset. And within the first 48 hours, the success level was about 70% at Malmo.

That, in turn, reduced the need for anti-coagulants and direct current cardioconversion, an electrical stimulation procedure to restore normal heart rhythm that also requires the presence of an anesthesiologist.

"Even if a patient wasn't successful with BRINAVESS, they were moved to the DC cardioconversion unit, without losing very much time," Dr. Hunter offers.

"The total treatment time in Malmo from the time that a patient arrives at hospital to discharge was about 3.5 hours when treated with BRINAVESS, compared with about 12 hours with DC cardioconversion," Dr. Hunter says. And the total treatment cost with BRINAVESS was about half of DC cardioconversion, he adds.

"So, now we thought we had a story to tell - new cardiology guidelines in Europe and cost savings of time in the ER," he points out. "If doctors use BRINAVESS in the right way, you get really good results, and there's a strong economic reason to use the drug, but you must understand how.

"More than 10,000 patients have been treated in Europe with BRINAVESS for recent onset AF and post-cardiac surgery AF, its two indications. "So we are not dealing with a broken asset here, " Dr. Hunter contends. "You start a patient on IV plus BRINAVESS in the ER, close the curtain, and come back in 10 minutes, and most of the time, the patient is out of AF. That's an attractive option in a busy ER.

"Dr. Hunter suggests there were probably several reasons that contributed to Merck's lack of success selling BRINAVESS. For one thing, the Merck sales staff doesn't specialize in hospital calls but has more of an in-office sales focus, "so maybe, we were marketing to the wrong cardiologists." In addition, he says BRINAVESS was sold alongside lipid-lowering drugs and hypertensives. "So it wasn't a focused call-point by a Merck sales rep.

After concluding his swing through Europe at the end of last year (2012), Dr. Hunter says he told the Cardiome board that he'd rather have "20 sales reps that wakeup in the morning and only worry about how to sell BRINAVESS instead of 150 sales reps where the drug is number three, or four, or five in a rep's bag.

Dr. Hunter figures the drug has a market potential of $50-million to $100-million a year in Europe and some $250-million a year in the U.S.

"The differences between with us and other biotechs is that we have the ability to generate cash. I don't want to start making predictions, but I think this is a better drug than people realize."

And true to their word, since Merck ditched them, Cardiome's management have done what any good management would do. They picked up the pieces and soldiered on. They have been busy launching the product in various countries, making strategic purchases and striking deals.

Their acquisition of Correvio in November 2013 was an astute and smart move. They not only added another product to their pipeline, one that complimented their existing product, but also gained access to Correvio's established production, sales and distribution network. To quote the CEO and Chairman of Cardiome and Correvio respectively:

"The acquisition of Correvio markedly accelerates Cardiome's recent transformation from a research and development-based company to an integrated, commercial, specialty pharmaceutical company. The Correvio acquisition fulfills many of our immediate strategic needs by providing an operational European platform, global distribution, complementary products and the financial flexibility required to accelerate the launch of BRINAVESS," stated William Hunter, M.D., Cardiome's president and CEO. "The cash contribution from synergistic sales of AGGRASTAT will lessen our reliance on external financing by providing low cost, ongoing funding while also shortening our road to profitability."

"We have worked hard over the years to build a scalable infrastructure to successfully promote and support AGGRASTAT sales worldwide," stated Bert Van Den Bergh, chairman of Correvio. "It's exciting to see a growing product like BRINAVESS able to leverage off of our existing hospital-based, cardiology platform and capitalize on significant operational efficiencies."

The press release with more info on the deal is found here.

In 2014, they made headway with Brinavess into the following additional countries (click on each to see the press release): China, South Africa, Italy, Argentina, France & Belgium. Also, they formed a partnership for their second product, Aggrastat.

Note that following the recent China launch news, the market hardly reacted to this, which shows how off the radar this company is.

As stated above, in November 2013, Europace published data supporting use of BRINAVESS™ (Vernakalant) as a first line agent for pharmacological cardioversion of atrial fibrillation. The authors concluded that BRINAVESS is an efficacious and rapid acting pharmacological cardioversion agent, for recent-onset atrial fibrillation (AF,) that can be used first line in patients with little or no underlying cardiovascular disease and in patients with moderate disease, such as stable coronary and hypertensive heart disease.

In November 2014, they announced more positive results from their Asia-Pacific Phase 3 Clinical Trial.

Good enough for Europeans but not Americans, you say?

On the one hand, the more intelligent Europeans approved this drug in Sep 2010, having incorporated it as a first measure in their algorithm for AF management, and there is a growing amount of real world data out there with over 10,000 cases successfully treated, and yet the FDA have put this on a prolonged clinical hold since around the same time (Oct 2010), denying over 2.5 million AF patients in the US?

Do the FDA think Europeans react differently to AF than Americans?

It doesn't make much sense to me either. And it will make less sense still when I tell you about the background to the hold.

I refer you to the following article. As stated, during the phase 3 ACT 5 trial, there was a single serious case of cardiogenic shock in a patient who received the drug in a trial centre in South America.

Note that the trial's data safety monitoring board (DSMB) reviewed the case and recommended continuation of the study, but the FDA disagreed, requesting full data on the particular patient and for enrollment to be paused while the agency reviewed the case.

So how long does it take for the agency to review a case? Four years and counting, apparently.

Note also that ACT 5 was the additional phase 3 study specifically requested of the drugmakers by the FDA in 2008; after the agency’s own advisory panel recommended approval of the drug in 2007!

It came as no surprise to me that there’s a whole wiki page about Criticism of the FDA, specifically about over and under-regulation. Prominent Economist Milton Friedman and others have argued that delays in the approval process of worthy drugs costs more lives than it saves.

I have no doubt that the FDA’s hold on Vernakalant has had just that effect. This drug could be making lives a lot easier for AF patients in the US and I strongly believe it is being unjustly held back. I have written to the FDA demanding an explanation for this farce. They are currently looking into my complaint.

One thing is certain though, they cannot withhold this drug indefinitely in the US and their hold must come off at some point.

As stated on the Company's website: Cardiome plans to work with the FDA to lift the hold and resume clinical development for the US market. I gather from their last few releases that they are actively engaged with the FDA on the subject.

The good news is that Cardiome are on track to achieve profitability without the US market and when, not if, US development resumes, it will be a huge boost for them.

It’s also no surprise to me that the company has received a number of recent analyst buy ratings, notably from Brean Capital, LB Securities and Laurentian Bank of Canada among others. Although the stock price, at the time of writing, is near the 52 week high, I believe this has the potential to go much higher.

Financials:

From the last ER, Cardiome were on track to record revenues of some $30m for fiscal 2014, as they had predicted at the start of year. And as strategized, they used Aggrastat sales to market and promote Vernakalant.

In July 2014, the Company closed a senior secured term loan facilty of $22m. As per the PR:

Cardiome currently intends to use the proceeds of the first tranche of $12 million for working capital and general corporate purposes, including the expansion of its sales and marketing efforts for BRINAVESS® and AGGRASTAT® in Europe and other parts of the world, and for clinical development and regulatory costs of vernakalant (IV) and vernakalant (oral). The second tranche of up to $10 million is available to support a product or company acquisition.

The last sentence was reiterated by the CEO in the last CC, that the Company was aggressively looking to acquire/add another product to their pipeline, one they could leverage off their existing sales force. I expect this to be another near term catalyst.

The term loan facility is their only debt and given they are cash-generating, I don't foresee any problems in them repaying this. As of Sept 30 2014, the company had cash and cash equivalents of $17.5m, sufficient for their foreseeable needs as stated in the last CC. They are expected to be profitable this year.

Conclusion:

The Biotech space is arguably filled with many clinical stage development companies with ridiculous valuations. They may have a promising drug or discovery, but they are cash burning and may be years away from generating any sort of revenue. I view many of them as just hot air, they carry significant risk and many of them soon crash back down to earth, particularly on any kind of adverse news. Even upon having a fully approved product, it is an uphill battle for a small company to successfully bring a product to market.

Cardiome, in this respect, sets itself apart from other Bio's and is significantly derisked. They found their big pharma partner who helped them launch their product, but then went through a bitter divorce. Nevertheless, it was a useful and worthwhile relationship and in hindsight, they fared well out of it.

Cardiome has shown that it can go it alone, without big pharma's help, and is doing just fine. They have two approved products successfully selling in Europe and other parts of the world and it is only a matter of time before approval in the US. They are looking to expand their product line and have the means to do so. They seem to have put the worst behind them and 2015 promises to be a good year. Merck may just look back one day and see their former young partner get snapped up by a competitor.

TM Editors' Note: This article discusses a microcap stock. Such stocks can be easily manipulated; do your own due diligence.

Disclosure: The author has a long position in CRME. The author wrote this article himself, and it expresses his own opinions. The author has no business relationship with any company whose stock ...

more

see how Cardiome for 2016?

You're always positive?

thank you.

Some numbers to support this stock choice:

Quarterly revenue growth (YOY): 15.37

Revenue (ttm): $26.93M

Great write-up, eager to see more by you. Added you to my follow list.

Fantastic article. In addition to Alexis' question, I have a few of my own. I would like to know more about your research on the license termination by Merck for the oral candidate. Any chance you could either construct another article discussing your research or elaborate here?

Also, let's say hypothetically that the FDA rejects the product. Is the company's business sustainable on alternative revenues alone?

4 years stretches far beyond the average review time for such products. Do you attribute this to a lapse in the regulatory process, or is there more to the story beyond the enrollment halt?

Thanks in advance.

Trevor, please see my reply to Mike Faragut below. In regards to your hypothetical question on rejection, note that the FDA's advisory board recommended approval of the drug back in 2007. The FDA then issued them an "approvable" letter in Aug '08. This is all before the partnership with Merck and the subsequent approval and launch in the EU. See:

www.cardiome.com/.../cardiome-and-astellas-announce-receipt-fda-approvable-letter-kynapid

Thanks very much! That helps.

I'm a little puzzled over the reasons Merck pulled out. What I can see in quick research is something about the size of the opportunity (ie not 'big enough' for Merck) and something about oral vs. intravenous. Is Cardiome focusing on one delivery method over the other now?

They're concentrating on IV for now as it as approved. Oral is the next step

Since FDA approval is still an uncertainty, the question which begs to be answered is, are there enough other market opportunities for this company to still make it a worthwhile investment.

The world outside the US is a big enough market. As stated in the article, the company is expanding in Europe, South America, China.. They don't need the US market to be profitable

Thank you, I'll be taking a closer look at this stock.

Enjoyed this article - really well done. Good questions below as well, eager to hear the answers.

"The more intelligent Europeans approved this drug... yet the FDA have put this on a prolonged clinical hold since around the same time."

Aren't you concerned that there could be a reason for the FDA not approving this drug other than a lack of intelligence? Perhaps their process is simply more stringent or thorough. But it could be that the FDA discovered something of concern that the Europeans missed.

I bet the author is European :-) we are smarter

No, I'd say it was firmly down to a lack of intelligence

The FDA often lags behind Europe in these approvals.

Sure but this isn't just a delay, this was put on a hold. FOUR years ago! I don't believe the FDA lags THAT far behind.

Loading comments, please wait...