Capital One - Chart Of The Day

Summary

- 100% technical buy signals.

- 13 new highs and up 16.16% in the last month.

- 152.67% gain in the last year.

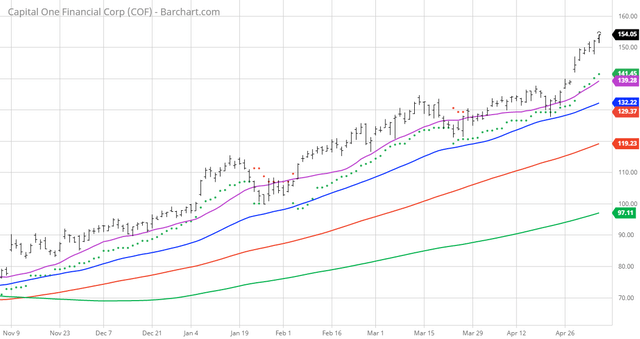

The Barchart Chart of the Day belongs to the financial services company Capital One Financial (NYSE: COF). I found the stock by using Barchart's powerful screening tools to find the stocks with the highest Weighted Alpha and technical buy signals. After I sorted for the most frequent number of new highs in the last month, I used the Flipchart feature to review the charts for consistent prices appreciation. Since the Trend Spotter signaled a buy on 3/26 the stock gained 16.16%.

Capital One Financial Corporation operates as the financial services holding company for the Capital One Bank (USA), National Association; and Capital One, National Association, which provides various financial products and services in the United States, Canada, and the United Kingdom. It operates through three segments: Credit Card, Consumer Banking, and Commercial Banking. The company accepts checking accounts, money market deposits, negotiable order of withdrawals, savings deposits, and time deposits. Its loan products include credit card loans; auto and retail banking loans; and commercial and multifamily real estate, and commercial and industrial loans. The company also offers credit and debit card products; online direct banking services; and treasury management and depository services. It serves consumers, small businesses, and commercial clients through digital channels, branches, and other distribution channels located in New York, Louisiana, Texas, Maryland, Virginia, New Jersey, and California. Capital One Financial Corporation was founded in 1988 and is headquartered in McLean, Virginia.

Barchart technical indicators:

- 100% technical buy signals

- 168.34+ Weighted Alpha

- 152.67% gain in the last year

- Trend Spotter buy signal

- Above its 20, 50 and 100 day moving averages

- 13 new highs and up 16.16% in the last month

- Relative Strength Index 79.62%

- Technical support level at 149.09

- Recently traded at 154.00 with a 50 day moving average of 132.22

Fundamental factors:

- Market Cap $69.42 billion

- P/E 9.51

- Dividend yield 1.07%

- Revenue expected to grow 1.20% this year and another 5.00% next year

- Earnings estimated to increase 264.50% this year, be down 15.60% next year but continue to compound at an annual rate of 4.19% for the next 5 years

- Wall Street analysts issued 12 strong buy, 8 buy, 3 hold and 1 underperform recommendation on the stock

- The individual investors following the stock on Motley Fool voted 852 to 416 that the stock will beat the market

- 30,220 investors are monitoring the stock on Seeking Alpha

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in COF over the next 72 hours.

The Barchart Chart of the Day highlights stocks that are ...

more