Canopy Growth Comes Back To The Forefront As States Scramble To Find Revenue

Canopy Growth (CGC) recently announced earnings that could only be described as abysmal: a quarterly loss of C$1.3 billion, or C$3.72 a share. This was in comparison to a loss of C$379 million in the prior year-over-year quarter reported by CGC.

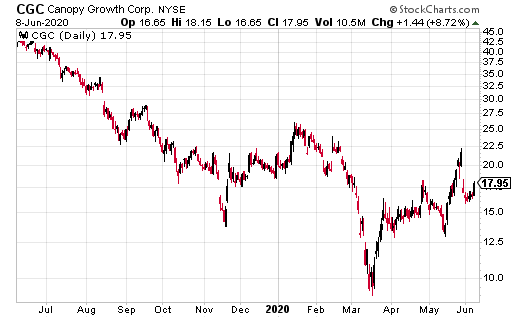

Not surprisingly, CGC stock, which had been moving substantially higher, took a major hit. The stock dropped from $22, to where it now trades, just below $17.

So, why might the cannabis stock, which reported lousy earnings, and has now dropped more than 23%, actually be a buy?

As we all know, the current health crisis caused by the coronavirus pandemic and COVID-19 infections has been a hardship on individuals and many companies. And some sectors, like the restaurant, travel, and leisure industries, have taken it on the chin harder than others. But, there is another victim of the virus, not exactly broadly represented in the stock market, we should be aware of.

States and municipalities have spent hundreds of millions of dollars to fight the pandemic, provide necessary services, and find new ways—such as new online services—to fulfill governmental responsibilities.

In order to refill governmental coffers, states will have to be creative. Raising taxes, which will likely happen, may provide a muted benefit as the unemployment rate has skyrocketed.

New Mexico’s governor, Michelle Lujan Grisham, directly addressed the possible legalization of recreational cannabis in a recent update on how the state is dealing with COVID-19. Grisham said cannabis tax revenue would mean: “…nearly $100 million of recurring revenue into the budget.”

I believe we’ll see this theme play out over and over in states that have to raise additional revenue. And the necessity of raising tax revenue should prove a boon to a number of cannabis companies.

Canopy Growth, as one of the largest cannabis producers in North America, may be a major beneficiary of this trend. The pullback after the CGC’s earnings announcement miss may turn out to be a major buying opportunity for investors to benefit from the trend.

It should also be noted that a large portion of the loss Canopy sustained in the quarter was due to a restructuring charge. In total, the company took a charge of C$743M in impairments during the quarter related to corporate restructuring.

And, as Canopy Growth CEO David Klein shared on the company’s earnings call, Canopy Growth’s new products are being well received by the market. The company’s drink brands are being very well received, and are actually rated as the number one cannabis drink in cities like Ontario.

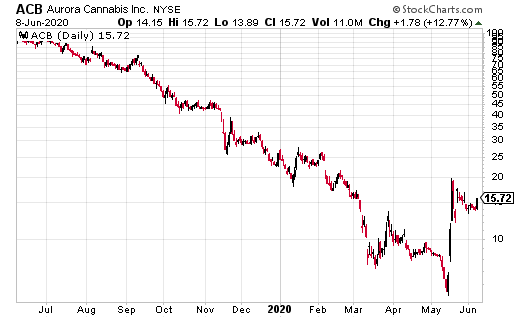

Aurora Cannabis (ACB) is another cannabis producer that may be giving investors a buy point following a major move upward after earnings.

ACB stock jumped from $6 to $19 on a good earnings report, but has since pulled back to just over $14. Aurora reported revenue increases quarter-over-quarter in both its consumer and medical lines, with consumer growing a very respectable 24%.

Aurora is an interesting play in that it currently has an interim CEO, Michael Singer. As the company navigates choosing a permanent CEO, there has been some concern that execution may falter.

Soon after earnings, Aurora announced it would be purchasing U.S.-based CBD company, Reliva, LLC for $40 million. While some analysts fear the combination of finding a new CEO, in conjunction with integrating a new acquisition, may hamper the stock, I think it could spell opportunity.

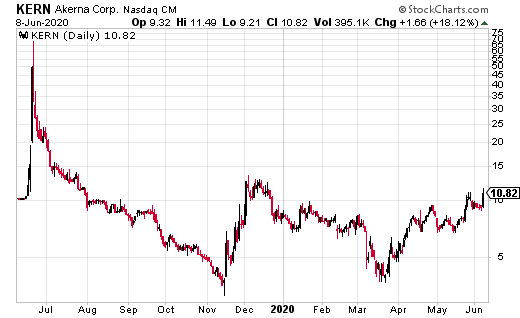

Finally, let’s look at an indirect cannabis play based here in the U.S. Akerna (KERN) is a software provider for the cannabis industry. The company’s products are specifically designed to run a cannabis operation’s back-office functions.

KERN went public last year, just before a decline in cannabis company stocks, and has languished since then.

But what I like about Akerna is the fact that it is a picks-and-shovels play. While the cannabis industry is competitive, Akerna is one of the few business software companies focused exclusively on cannabis. And, for those concerned with federal legal issues in the U.S., this is also the better play, as the company does not handle or grow cannabis.

Disclosure: None.

Thank you Eddy for this article. I could be wrong, but I was reading about how the different cannabis companies have actually done quite well during this Pandemic. Why you you think these 3 specific companies/their stocks have not done as well?