Cannabis In Canada Update, August 2016

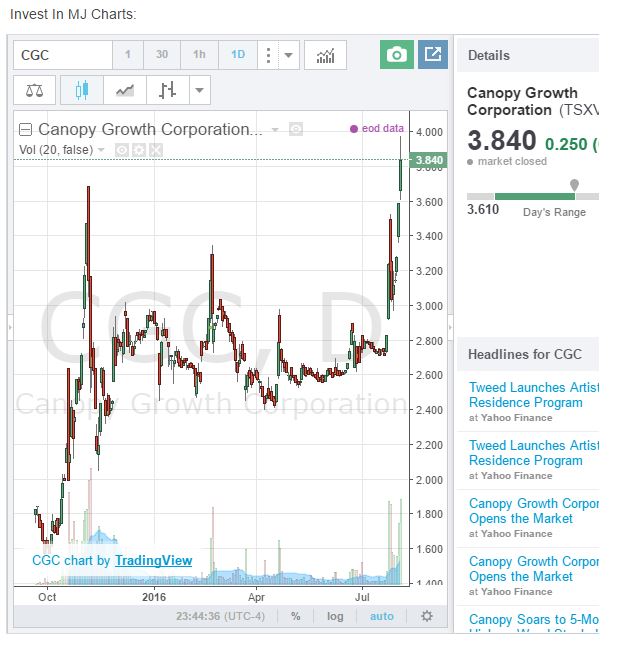

The Canadian cannabis sector has been blazing hot over the last year, especially in the last 2 months. Companies like Organigram (OGRMF) with a $143M market cap and Canopy Growth Corp (TWMJF). Canopy Growth, with a market cap that reached $440M during August 2016 has seen its share price rise significantly over the last few months. Can the stock price continue to rise given the recent court ruling that medical patients can now grow for themselves again, which is similar to the old MMAR program that Canada had until MMPR came into effect? Or will the stocks of licensed producers decline over the next six months?

I suspect their share price will come down over the next few months and probably into tax selling season in December. If you have made any good profits in the last year with any of the publicly traded cannabis companies in Canada, you may want to take some money off the table and look to buy back into the sector after a correction and pullback. There is a chance some of the stock prices may continue to rise if the market is adding expectations about the recreational market opening up in 2017. However that expectation and rise should come after a much needed correction and base building. We are in the process of putting together a special report on the Canadian cannabis sector and opportunities that are available both public and private, as well as a couple of interesting franchise opportunities.

One of the licensed producers we have been looking at lately is Emblem Corp. This private company is a leading marijuana producer, which has the potential to generate over $100 million in revenue and is led by a team of Health Care & Pharma Executives who have built & run multi-billion dollar companies.

Emblem has a clear strategy across three verticals of marijuana production, patient education, and pharmaceutical production. They are uniquely positioned within Canada’s large and growing medical and recreational marijuana industry. Emblem has a high quality, experienced management team who have aligned interests with shareholders by investing $6M and have a track record of building successful multi-billion dollar healthcare companies. With a state-of-the-art production facility in Paris, Ontario up and running, Emblem has generated its first sale in August and plans to sell to the public by October. The company has a planned expansion that will allow for a total production capacity of up to 16,000KG annually.

The company’s Pharmaceutical Division is led by John Stewart, ex CEO at Purdue Pharma, the largest private pharmaceutical company in the world. Under his leadership he developed and launched to market OxyContin, a $2 billion a year drug. His focus will be replacing chemically based opioids with natural based Medicinal cannabis.

After reviewing many marijuana producers, we think Emblem has one of the best management teams, a state of the art facility, which I recently visited, and a strategy which surely will make them a leading medical cannabis company. The company has the most blue sky potential with respect to production capacity, pharmaceutical capabilities, and one of the lowest cost indoor producers I have seen in the sector.

The company is planning on going public this fall and they currently have a very reasonable valuation compared to the other publicly traded companies in Canada. The company is currently looking to raise $3M before the public listing and accredited investor have an opportunity to participate in the upside and own shares at reasonable valuations.

If you would like more details on Emblem and the financing, please give myself or Danny Brody from Emblem investor relations a call or email (647-255-8106 ex 1810 , dannybrody@emblemcorp.com). ...

more

I bought TWMJF (Canopy Growth) and the price jumped from 3.09 to 4.06 and I sold. Now it continues to rise. Looking at the chart it seems it had a very steep rise and I am thinking it might fall back and, as mentioned in the article, establish a base. However, the US election is coming soon and I am not sure if there will be buying into the election and then perhaps a pull back later? While I don't think the Canadian companies can sell in the US, there would be some indirect benefits to US companies, such as technology transfer. Also, they can sell in other countries, like Germany.

Just wondering if anyone has a strategy for buying this stock (or similar stocks) over the comings weeks, through the end of the year? I agree that tax season could have an effect, so perhaps buying on dips and selling with any significant increases with a view of toward lightening up in December might be a strategy?

Thanks for your thoughts!