Cannabis Central: Valens' Q4 Financials Justify Industry-Leading Stock Performance

Valens GroWorks Corp. (VLNCF) has reported extremely positive Q4 financial results this week which support its industry-leading stock market performance over the past year.

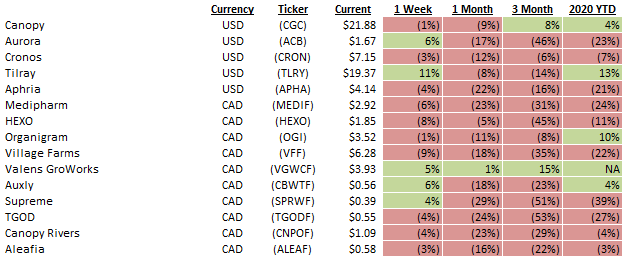

It has been a dismal 12 months for almost every pot stock except Valens which has outpaced all others as shown in the table below:

Q4 Financial Highlights (The comparisons below are made between Fiscal Q4 2019 and Q3 2019 results and are in millions of Canadian dollars unless otherwise stated. Go here to convert into USD.)

- Revenue: increased 86.0%

- as new and existing customers pushed to roll out Cannabis 2.0 oil-based products into the market

- Revenue/gram of input: increased 104.9%

- as a result of working with clients to process white label products in preparation for the launch of edibles and concentrates for Cannabis 2.0 and is expected to increase throughout 2020 as product development contracts grow in number, and revenue from extraction contracts contributes to a lesser proportion of total revenue.

- Gross Profit: increased 76.4%

- Gross Profit as % of Revenue: declined slightly to 73.8% from 77.8%

- as a result of the company's continuing shift to a more conservative margin profile of white label contracts vs. extraction contracts

- Adj. EBITDA: increased 80.8%

- Adj. EBITDA as % of Revenue: declined slightly to 57.7% from 59.4%

- as a result of the company's continuing shift to a more conservative margin profile of white label contracts vs. extraction contracts

- Net Income: declined 24.2%

- Diluted Income/Share: declined 20%

- Cash & Equiv.: declined 15.2% to $58.7M

Key Q4 Operating Highlights

- signed a multi-year white label agreement with BRNT Ltd. to provide high-quality cannabis extracts, filling services and national distribution of a line of custom-formulated BRNT-branded vape pens cannabis vape pens in Canada.

- acquired Pommies Cider Co. to accelerate its commercial-scale entry into the high-growth beverages and edibles market in Canada.

- signed an agreement to supply Shoppers Drug Mart, a major Canadian pharmacy chain, with cannabis oil products via its online medical cannabis eCommerce site.

- signed an agreement with Iconic Brewing to manufacture 2.5 million cannabis beverages over the term of the 5-year agreement.

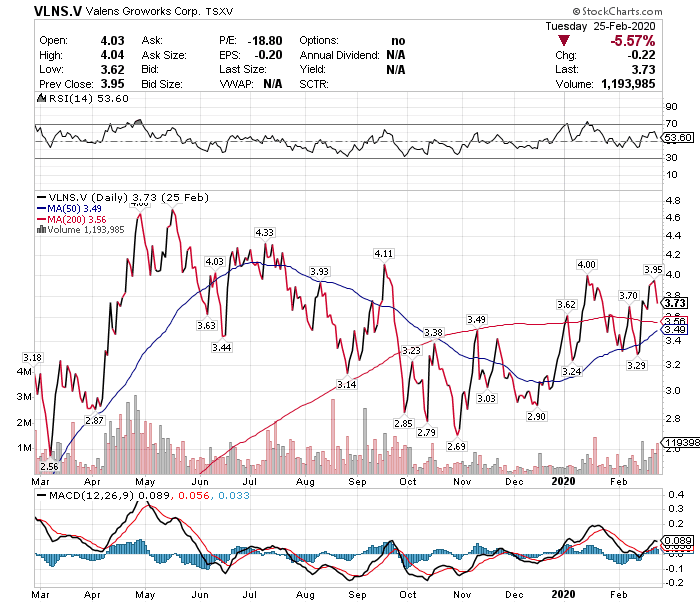

Stock Performance Over the Past 12 Months

This article may discuss small-, micro- and nano-cap stocks so do your own careful due diligence. Visit munKNEE.com (A ...

more

$VLNCF seems like a good pick based on your chart and the company's fundamentals. Are there specific cannabis market related reasons that these stocks are falling related to the Coronavirus or are they just caught up in the current market maelstrom like so many other stocks?

The cannabis industry sector has major cash flow and over-supply problems coupled with poor management, poor marketing and lack of financing with 99.9% of the companies which is contributing to the absence of positive sentiment in addition to the current market maelstrom. Valens, however, is one of the very few pot stocks that have their act together.