Cannabis Central: Jushi Holdings' Q2 Report Outpaces Other MSOs

Jushi Holdings Inc. (JUSHF), a constituent in the munKNEE Pot Stock Index, announced its Q2 financial results for the period ended June 30, 2020.

Q2 Financial Highlights (Unless otherwise noted, all results are presented in U.S. dollars and compared to the previous quarter.)

- Revenue: increased 73% to $14.9M

- Gross Profit: increased 80% to $7.5M

- Net Profit (Loss): reduced by 41% to $(9.3M)

- Loss/Share: reduced to $(0.10) from $(0.17)

- Adj. EBITDA: improved by 80% to $(1.2M)

- Cash Balance: $50.8M

Q2 Operational Highlights

- Closed equity acquisition of Pennsylvania grower-processor permit holder

- Announced debt financing of an additional US$33.31 million

- Opened 9th and 10th BEYOND/HELLO retail locations

- Announced closing of acquisition of Agape Total Health Care Inc, a Pennsylvania medical marijuana dispensary permit holder

- Launched adult-use sales at its Normal, IL dispensary

- Relaunched Beyond-Hello.com, providing "live" menus and real-time access to store inventory

Management Commentary

Jim Cacioppo, Chairman and CEO, had the following comments:

- “We’re thrilled with the ongoing performance of our operations in Pennsylvania and Illinois...

- With ten BEYOND/HELLO dispensaries now open, and several stores under development, we remain well positioned to continue [to] exceed patient needs as well as drive value for our shareholders.”

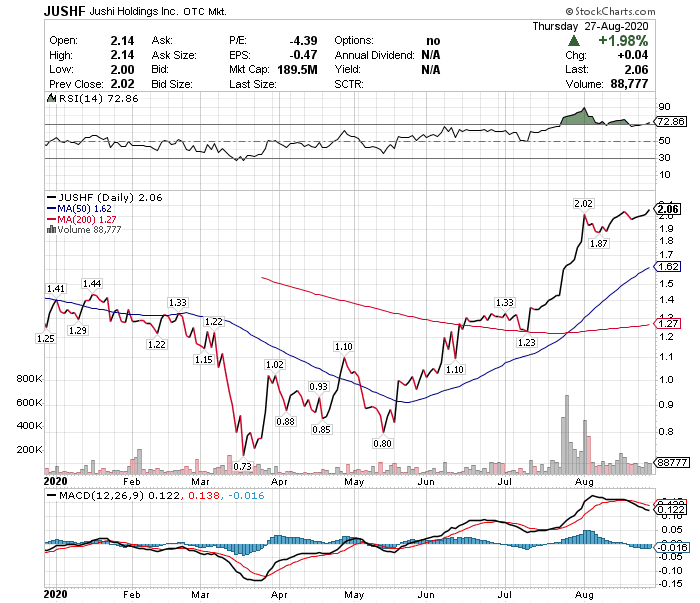

Stock Performance

Jushi is one of the 25 pure-play cannabis stocks that trade for at least US$1/share which our index follows. While the 12 multi-state operators (MSOs) in the index are UP 28.4%, on average, YTD, Jushi, itself a MSO, is UP 49.3% YTD (and UP 14.4% so far in August).

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more