Cannabis Central: Dismal Month For Every "Pot" Stock & ETF Except Neptune Wellness Solutions Inc.

TM Editors' Note; This article discusses one or more penny stocks and/or microcaps. Such stocks are readily manipulated; do your own careful due diligence.

Given all the interest in "pot" stocks and ETFs these days one would think that the cannabis sector was setting the world on fire but the truth of the matter is that the performance of almost 100% of the 135 "pot" stocks & ETFs that I follow are way down this month - way down - except this 1 stock. This article identifies that stock and provides a solid reason why that is the case.

As you are no doubt aware the sale of medical cannabis is now legal in Canada and recreational use marijuana becomes legal in Canada this October. What you may not know, though, is that the sale of medical cannabis is legal in 33 U.S. states and recreational marijuana is legal in 10 of those states and the MSO (Multi State Operators) U.S. companies that are distributing their products in one or more of those states are only trading on the Canadian Stock Exchange (CSE) and the fledgling NEO exchange.

To put things in perspective I checked out the performance of 7 ETFs specializing in the marijuana sector and found that they are:

- DOWN 11.1% on average (ranging from -6.5% to -14.7%) since July 1st and

- DOWN 26.0% on average (ranging from -24.4% to -36.5%) from their 5-month highs.

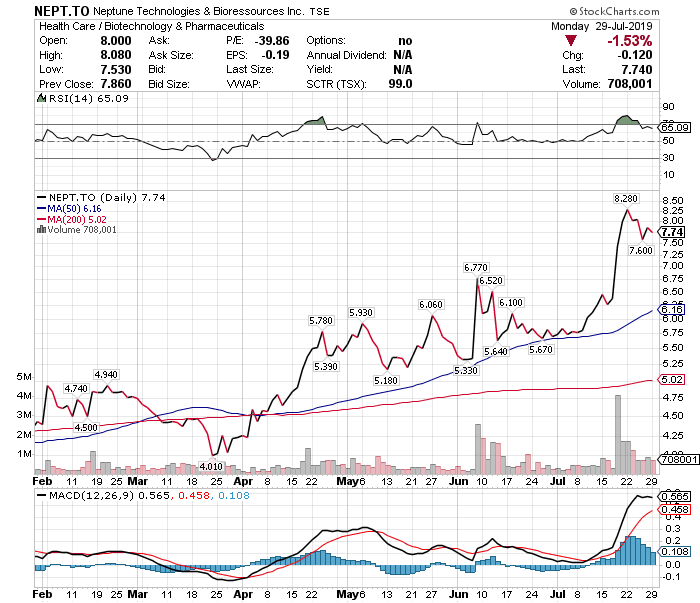

Conversely, I have only found 1 "pot" stock - only 1 - that is UP over both time periods i.e, UP 34.5% since July 1st and UP 90.8% since March 23rd. The stock is:

Neptune Wellness Solutions Inc. (TSX:NEPT; Nasdaq: NEPT) neptunecorp.com/en/

Neptune operates as a nutrition supplement company that develops and produces cannabis products, marine and seed oils and pet supplements for clients in Canada. It is a small-cap stock ($705M) with a current beta of 1.57 which is actually very low for the cannabis sector.

Such a one-of-a-kind performance begs the question : "Why?" Well, the mid-July spike occurred as a result of heightened consumer confidence given the fact that Neptune Wellness:

- secured $41.4 million in funding through a private placement which will help the company improve its cash positions which had recently dropped to only $9.8 million,

- plans to soon begin offering its extraction and purification services to American companies that want to create hemp-based consumer products for the rapidly developing U.S. hemp market and to fulfil that objective

- plans to acquire SugarLeaf Labs and Forest Remedies LLC, an American company, which will allow it to expand its capacity as a hemp-based CBD producer considerably upon completion of the acquisition on July 31st,

- intends to increase its extraction capabilities to 1,500 metric tons soon from its current capacity of 200 metric tons,

- has applied for an operating license from Health Canada so it can sell all the above mentioned 200 metric tons,

- has recently entered into a 3-year agreement with cannabis major Tilray (Nasdaq: TLRY) whereby Tilray will supply Neptune with 125,000 kilos of hemp and cannabis biomass for extraction and purification and

- has reached another multiyear extraction agreement with The Green Organic Dutchman (TSX:TGOD) (OTCQX: TGODF) whereby The Green Organic Dutchman company will supply Neptune with 230,000 kilos of cannabis and hemp biomass for extraction and purification. The said output will then be used to manufacture specific products by TGOD.

Given the above it is hardly surprising that investors are excited and that a dramatic increase in stock price has occurred.

Honourable mention goes to:

- Curaleaf Holdings Inc. (CSE:CURA, OTCQX: CURLF) whose stock is UP by 13.8% since July 1st although it is still DOWN by 30% from its 5-month high. It is a mid-cap stock ($4.9B).

- Curaleaf is the leading vertically integrated multi-state cannabis operator in the United States and solidified its position with the planned acquisition two weeks ago of the privately-held GR Companies which will close in early 2020 pending approval from shareholders as well as the board of directors from both companies.

- With the acquisition, Curaleaf is getting control of Grassroots’ 61 dispensary licenses, 20 of them currently in operation, as well as 17 cultivation and processing licenses. After the merger, Curaleaf’s presence will expand to 19 states, up from 12. The newly combined company will have 131 dispensary licenses, 68 physical locations, 20 cultivation sites and 26 processing facilities.

- Auxly Cannabis Group Inc. (TSXV:XLY, OTCQX: CBWTF) whose stock is UP 6.1% since the beginning of the month although it still DOWN 15.5% from its March high. It is a small-cap stock ($507M) with a high beta of 5.5.

- Last week the England-based tobacco company Imperial Brands (LSE:IMB,OTCQX: IMBBF) invested approximately C$123 million in Auxly by way of a debenture convertible into 19.9% ownership at a conversion price of $0.81 per share.

- As part of the deal, Auxly will gain immediate access to licenses for Imperial’s lineup of vape technology through subsidiary Nerudia, a vaporizer developer working on the design and production of next generation vaping products.

- Heritage Cannabis Holdings Corp. (CSE:CANN, OTCQX: HERTF) whose stock is UP by 6.3% since July 1st although it is still DOWN 27% from it 5-month high. It is a small-cap stock ($218M) with a 3.9 beta.

- Last week it completed its transaction to acquire 30% of Endocanna Health Inc., a company based in Los Angeles, CA that has developed Endocannabinoid DNA testing to assist individuals in taking control of their own health by utilizing cannabis products specifically suited for themselves.

- Heritage has recently entered into a Contract Manufacturing Agreement with Cronos Group Inc. (TSX:CRON, Nasdaq: CRON), for the filling and packaging of vaporizer devices for the Canadian cannabis adult-use and medical market which it expects will provide it with the quality and optionality for when they introduce their proprietary vape pen formulations.

- On May 31st Heritage signed a Processing and Supply Term Sheet with Canntab Therapeutics Limited (CSE: PILL, OTCQX: CTABF), a leading innovator in hard pill oral dose therapeutic cannabinoid and terpene blends, for the purpose of processing hemp supplied by Canntab into high quality CBD oil which it will transform into capsules required for the production of Canntab's planned roll out of their ingestible oral cannabis products and for Heritage, FSD Pharma Inc., and further white labelling opportunities.

Disclaimer: In spite of the positive outlook for the above stocks this article highlights the fact that "pot" stocks are very volatile so it imperative that any investor contemplating ...

more

Thanks Lorimer, if you could only invest in one cannabis company, which would it be?