Cannabis Central: Curaleaf Q2 Financials

Curaleaf Holdings, Inc. (CURLF), a vertically integrated cannabis multi-state operator in the U.S., today reported its financial and operating results for the second quarter ended June 30, 2020.

Q2 Financial Highlights (All financial information is provided in U.S. dollars unless otherwise indicated and compared with the previous quarter.)

- Revenue: +22% to $117,480

- Gross Profit: +29% to $42,735

- Gross Margin: 43% vs. 40%

- Adj. EBITDA: +40% to $27,994

- Net Profit (Loss): loss reduced by 86.6% to $(2,029)

- Cash/Equiv.: $122.8M

- Outstanding Debt: $283.3M

Management Commentary

Joseph Lusardi, Chief Executive Officer of Curaleaf stated:

- "Curaleaf once again, delivered record quarterly results...

- After quarter end, we successfully completed the acquisition of Grassroots, expanding our presence into 6 new states, including the high-growth Illinois and Pennsylvania markets, affirming our position as the world's largest cannabis company when measured by both revenue and operating presence.

- Overall, Curaleaf remains well positioned for continued growth in the second half of 2020. This growth will be driven by organic initiatives, the integrations of the Select and Grassroots businesses, as well as, the closing of multiple strategic tuck-in acquisitions across a number of key states."

Mike Carlotti, Chief Financial Officer of Curaleaf, added:

- "Looking forward, we anticipate a continued rise in managed revenue and adjusted EBITDA leading to strong sequential growth in the third quarter and second half of 2020 driven by organic growth, continued investment in key states, as well as, the integration of Select, Grassroots, Arrow and BlueKudu into our portfolio.

- Finally, we continue to make progress in converting and consolidating our managed entities in Maine, New Jersey and Massachusetts. As of today, we have consolidated all of our managed entities except for ATG which we expect to consolidate in the third quarter."

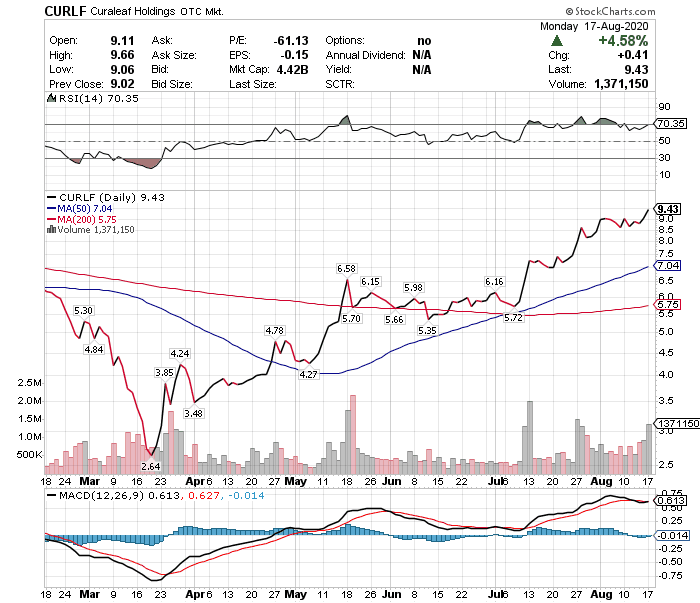

Stock Performance

The munKNEE.com Pot Stock Index consists of 25 pure-play cannabis companies that trade in excess of $US1/share and it is down 8.2% YTD but, while the American Multi-State Operators (MSOs) sector within the index is UP 28.6% YTD, Curaleaf, a MSO itself, is UP 49.4% YTD which demonstrates:

- how well managed,

- how well-financed and

- how well the company is executing its business plan.

In recognition of the company's outstanding Q2 performance its stock price continues to do extremely well (see how well Curaleaf is doing compared to its peers in this TalkMarkets exclusive) and was up 4.6% on Monday as illustrated in the chart below:

(Click on image to enlarge)

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more