Cannabis Central: Aurora Stock Jumps 15% On Favorable Q4 Financial Report

Aurora Cannabis Inc. (ACB) announced its Q4 financial results today for the period ended June 30, 2020. The highlights are as follows:

Q4 Financial Highlights (Unless otherwise noted, all results are presented in Canadian dollars (go here to convert into USD) and compared to the previous quarter.)

- Total Net Revenue: -5% to $72.1M

- Cannabis Net Revenue: -3% to $67.5M

- Adj. Gross Margin: increased to 50% from 43%

- Consumer Cannabis Net Revenue: -9% to $35.3M

- Adj. Gross Margin: increased to 35% from 29%

- Medical Cannabis Net Revenue: +4% to $32.2M

- Adj. Gross Margin: increased to 67% from 60%

- Cannabis Net Revenue: -3% to $67.5M

- SG&A (incl. R&D): -18% to $60.1M

- Adj. EBITDA: loss reduced by 31.3% to $(34.6M)

Operational Highlights

- Production Volume: +23%

- Production Cost/g of dried cannabis: -27% to $0.89/g

- Kilograms Sold: +32%

- Ave. net selling price of dried cannabis: -22% to $3.60/g

- Capital Expenditures: -77.7% to $16.4M

Guidance For 2021

- realize a 5-11% decline in Net Revenue in Q1 2021

- increase Adj. Gross Margin on cannabis net revenue to between 46% and 50% from current 35%

- achieve positive Adj. EBITDA for Q2

- reduce Capital Expenditures to $10M per quarter on average

- realize a decline in Debt and Interest Payments

Management Commentary

Stated Miguel Martin, recently appointed Chief Executive Officer of Aurora:

"...Our Q4 demonstrated:

- progress in rationalization of SG&A and cash burn along with continued leadership in both Canadian and international medical.

- However, Aurora has slipped from its top position in Canadian consumer, a market that continues to support material growth and opportunity.

My focus is therefore to re-position the Canadian consumer business immediately.

- We look to expand beyond the value flower segment,

- leverage our capabilities in science and product innovation

- and put our effort on a finite number of emerging growth formats.

This entails prioritizing our San Rafael, Aurora, and Whistler premium brands in flower, pre-rolls, and vapor, which will be shortly followed by strategic marketing and innovation efforts in concentrates and edibles..."

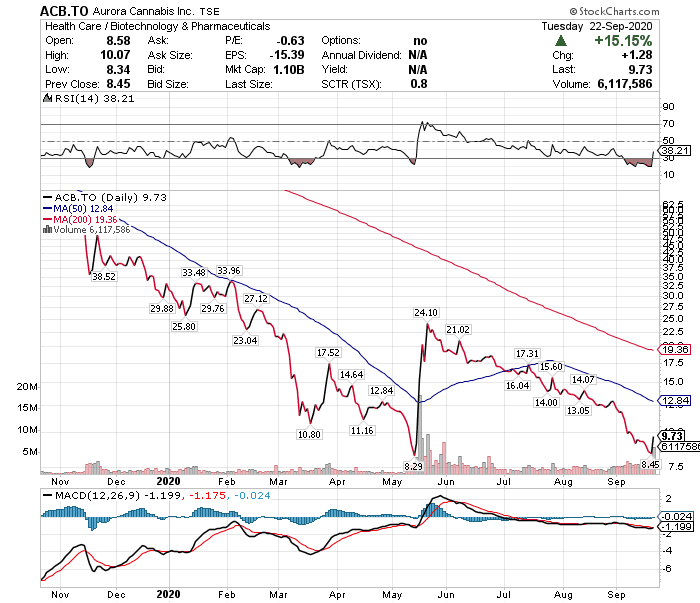

Stock Performance

The Aurora stock price as of yesterday was DOWN 75.6% YTD, DOWN 49.1% in the last 3 months, and DOWN 35.5% month to date. As can be seen in the chart below the Aurora stock price jumped 15% today (Tuesday) but has a long way to go to get back to anything representing its losses over the past 9 months. (Chart below is in Canadian dollars - go here to convert into USD).

(Click on image to enlarge)

Visit munKNEE.com and register to receive our free Market Intelligence Report newsletter (sample more

Nice headline, but you may want to double check that.