Canadian Cannabis LP Tilray Jumped 125% In August - Here's Why

Image source: Unsplash

An Introduction

Tilray (TLRY), listed on the Nasdaq, is a constituent in our Canadian Cannabis LP Stocks Portfolio and, while it has a diversified footprint in the U.S., its core cannabis operations are still primarily Canadian and international due to federal restrictions which prevent it from selling THC products in the U.S. market. As such, it has developed strategic investments and partnerships with U.S. cannabis companies, positioning itself for future expansion if federal legalization occurs.

Given the above, it is considerably influenced by catalysts that affect the U.S. cannabis market, namely:

- DEA Rescheduling Speculation:

- Donald Trump said on August 11th that his administration was “looking at” moving cannabis from Schedule I to Schedule III and would “make a determination over the next few weeks”. If that should happen it would dramatically reduce tax burdens under Section 280E by allowing MSOs to deduct normal business expense which would make them more profitable and drive up their stock prices.

- SAFE Banking Momentum:

- Trump's comments have made investors more hopeful that SAFE Banking legislation - which would allow cannabis firms access to traditional banking - might pass under the current administration enabling MSOs to lower financing costs, improve transparency and improve investor confidence in the category.

In addition, Tilray's stock surge was influenced by:

- Analyst Upgrade:

- Jefferies analyst Kaumil Gajrawala raised Tilray’s price target by 45%, and changed its rating to "Strong BUY' on August 25th, suggesting that Tilray would be the “biggest potential beneficiary” of cannabis rescheduling due to its liquidity, moderate debt, and strategic positioning.

- Technical Breakout & Momentum:

- TLRY stock broke above key resistance levels, including the 50-week EMA.

- Momentum indicators like MACD and RSI showed bullish signals, attracting short-term traders and retail investors.

- Nasdaq Compliance & Investor Sentiment

- Tilray regained compliance with Nasdaq’s minimum bid price requirement, restoring investor confidence

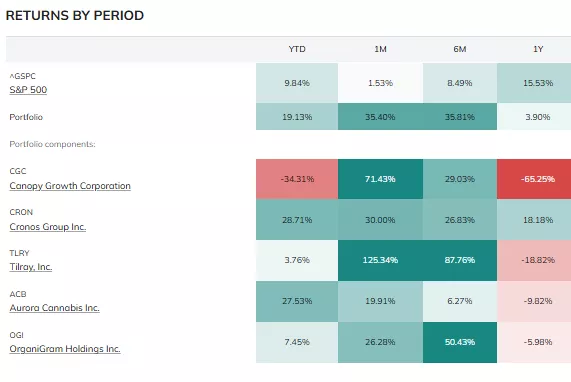

Table of Constituent Returns

As mentioned in the introduction, Tilray is just one of 5 constituents in our Canadian Cannabis LP Stocks Portfolio and below is a table of how they all performed in August, YTD, in the last 6 months and YTD provided by PortfoliosLab.com.

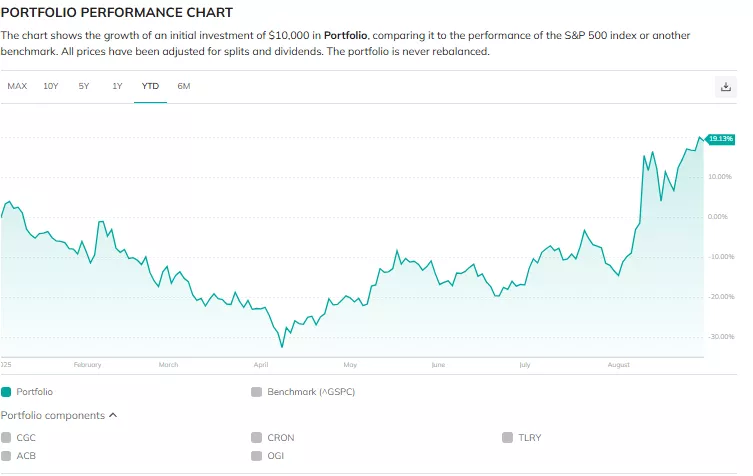

Chart of Portfolio's Returns

While there are many sites that provide charts of individual stocks none, to my knowledge, other than PortfoliosLab.com enable an investor to create a chart of the performance of a portfolio and I have gone there to create the following chart of the returns of our Canadian Cannabis LP Stocks Portfolio.

More By This Author:

These 10 AI Stocks Have The Lowest Fwd P/E Ratios - Which Are Hidden Gems?

AI-Focused Drug Discovery Stock RXRX Was Down 14% Last Week - Here's Why

Tower Semiconductor Was Up 17% Last Week - Here's Why

If you want to create your own portfolio chart read more