Can These Consumer-Facing Companies Benefit From Valentine's Day?

Image Source: Unsplash

Valentine’s Day is just around the corner, undoubtedly in the back of many minds as they seek gifts and other experiences relevant to the day.

The holiday doesn’t represent anything notably important concerning the stock market, but several companies could see a short-term sales bump and attention amid a consistently strong consumer backdrop.

Let’s take a closer look at a few companies that could see their top line benefit from the holiday, including a travel stock like Royal Caribbean Cruises (RCL - Free Report) and a stock that can benefit from both singles and couples, Netflix (NFLX - Free Report).

Royal Caribbean Sees Record Bookings

Royal Caribbean Cruises is a cruise company that owns and operates three global brands: Royal Caribbean International, Celebrity Cruises, and Azamara Club Cruises. Its recent set of results were underpinned by continued strength in consumer demand, an established trend over the past few years overall.

Concerning headline figures in the release, adjusted EPS of $1.63 exceeded the company’s prior guidance, whereas sales of $3.8 billion grew 11% year-over-year. RCL’s sales growth has been stellar post-pandemic, as we can see in the annual chart below.

Image Source: Zacks Investment Research

The company provided positive guidance for its FY25, with WAVE season bookings off to a record start. Analysts have already dialed their earnings estimates higher following the favorable print, landing the stock into a bullish Zacks Rank #2 (Buy).

Image Source: Zacks Investment Research

Netflix Keeps Adding Subscribers

Like RCL, Netflix shares have been scorching-hot over the past year on the back of strong quarterly results, gaining nearly 80% compared to the S&P 500’s 23% gain. Its latest set of results added to the positivity, with continued user growth and tailwinds from ad-supported memberships pleasing investors.

The company’s top line strength has remained stellar, as shown in the chart below.

Image Source: Zacks Investment Research

Concerning key metrics, Paid Net Membership Additions throughout the period reached a sizable 18.9 million, crushing our consensus estimate of 9.1 million handily. As shown below, subscriber additions for Netflix have remained rock-solid, exceeding our consensus estimate in seven consecutive releases.

The favorable reads on subscriber additions have fueled the stock’s bullish run over the past year, with margin expansion also brightening its profitability picture.

Image Source: Zacks Investment Research

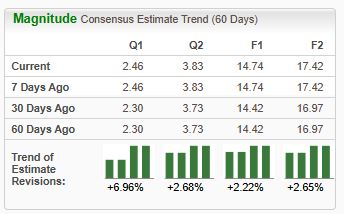

The stock currently sports a favorable Zacks Rank #2 (Buy), with the revisions trend for its current fiscal year moving higher following its latest results.

Image Source: Zacks Investment Research

Bottom Line

With a strong consumer, several companies – Netflix and Royal Caribbean Cruises – could see their top lines see a small bump from the upcoming Valentine’s Day holiday.

More By This Author:

Can Super Bowl Sunday Keep This Stock Hot?3 Stocks To Buy Following Blowout Quarterly Results

2 AI Stocks Investors Must Watch This Week

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more