Can Tesla Make Winners Out Of These Lithium Players?

Tesla Motors Inc. (TSLA), long known for its ability to keep its buzz machine churning, gave lithium investors something to get excited about this weekend. On Friday, Bacanora Minerals Ltd. (BCN:TSX.V) (BCRMF) and Rare Earth Minerals Plc (REM:LSE), owners of the Sonora Lithium Project, announced that they had finalized a conditional, long-term lithium hydroxide supply agreement with the car and battery giant. The Energy Report reviewed the commentary of leading lithium experts Simon Moores and Chris Berry to anticipate what the new agreement may mean for the sector.

Bacanora and Rare Earth Minerals saw their stock take a nice bump upward as the news was announced on Friday. According to the news release, Tesla will buy lithium hydroxide to feed the manufacturing of batteries at its Nevada Gigafactory on the condition that the Sonora project reaches certain milestones and passes product specification qualifications. Though the press release did not specify how much material will go to Tesla, Bacanora estimates the Sonora project will have an initial production capacity of 35,000 tonnes per annum (35 Ktpa) lithium compounds with the potential to scale up to 50 Ktpa.

Simon Moores, managing director of London-based Benchmark Mineral Intelligence, estimates Tesla could consume as much as 80% of total output. In a recent interview with The Gold Report, Simon Moores correctly predicted that Tesla would be focused on supply security in H2/15. "If Tesla wants to drive down the price of batteries by 30% or more," he said, "it is going to have to go all the way to the raw materials to cut costs. . .this is where the company must start."

Chris Berry, co-author of The Disruptive Discoveries Journal, had this to say about the deal: "The agreement between the companies offers an interesting window into Tesla's supply chain strategy. What the company has done here has purchased an out-of-the-money call option on future lithium supply."

An Increasingly Lithium-Hungry World

For his part, Colin Orr-Ewing, chairman of Bacanora, is enthusiastic about what the deal means for his company and its partner: "This supply agreement with Tesla represents a vital and monumental step forwards in the commercialization of the large lithium resources that the company holds, together with its partner Rare Earth Minerals, in northern Mexico. We anticipate this contract to rapidly accelerate the development of the Sonora Lithium Project, which we expect will prove to be invaluable in an increasingly lithium-hungry world."

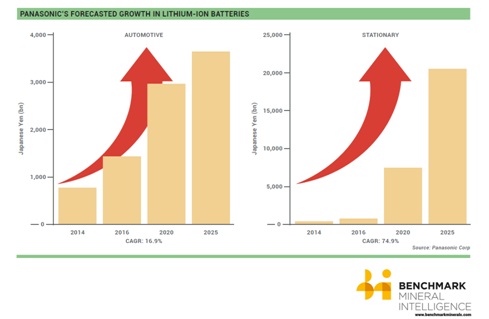

Leading battery manufacturer Panasonic Corp (PCRFF) is predicting powerful growth in emerging markets for lithium-ion batteries. The chart below shows Panasonic's expectations between 2014 and 2025.

Source: Benchmark Mineral Intelligence

Welcome Relief for Lithium Companies?

Tesla's supply chain strategy could have a positive effect on a lithium industry that badly needs new investment. The deal has piqued investors' sometime-waning interest in the lithium sphere. But Simon Moores warns there are challenges: "The biggest hurdle to the agreement is Bacanora's need to secure significant financing through debt and/or equity, which Tesla may itself be involved in."

And though Chris Berry calls the deal "an encouraging first step," he remains cautious, noting "while it likely won't breathe new life into the mining space (if Friday's closing prices of the 34 lithium plays I track are any indication), it is a signal of companies anticipating future demand. I would expect to see Tesla and perhaps other battery manufacturers undertake additional 'out-of-the-money call option'-type deals as the lithium market tightens over the next two years. This is also likely to be true for cobalt and graphite."

The Takeaway

Simon Moores stresses to investors that thinking long term is crucial. "The timing appears good for Bacanora, with lithium prices at five-year highs intensifying the need for new supply. Lithium hydroxide has risen as much as 25% this year, while carbonate is up as much as 15% on 2014 levels. A lack of new supply in the face of steadily increasing battery demand has seen the lithium industry fall into a supply shortage."

Chris Berry had this takeaway: "Perhaps the most significant conclusion is that you're just starting to see these next-generation value chains come to life."

Disclosure:

1) Claudia Avalos conducted this interview for Streetwise Reports LLC, publisher of more

Tesla’s “out-of-cash” option on lithium supply leaves more questions than hopes in the air. For one thing, it’s not clear why Tesla chose Bacanora instead of other operators to secure its future lithium requirements. The only reason I can think of for that decision is closeness to the Nevada giga-factory. For another, it seems quite unlikely that Bacanora will be able to supply in the next 2-3 years the kind of raw material required by Tesla because it doesn’t necessarily possess the best lithium resources in the world and is still in its very early stage of development. In this connection, one can indeed foresee a lithium supply crunch in the near future that could eventually force Tesla and other EV makers to search for alternative technologies, one example of which could be the fuel cells powering the Toyota Mirai. Note in this regard that as early as January 2012 (seekingalpha.com/.../316940-apple-takes-the-lead-laptops-ipads-and-iphones-without-lithium) I also envisaged use of fuel cells in Apple’s i-phones and only after 3 years and half both possibilities seem to have actually come into being (See: www.forbes.com/.../fuel-cells-from-the-toyota-mirai-to-apple-and-an-iphone-6/). Lastly, as I have argued in my latest piece published on Seeking Alpha (See: seekingalpha.com/.../3294695-battery-recharging-why-is-tesla-not-going-wireless), there might be another option for Tesla: Take wireless charging more seriously so that lithium-ion batteries become less crucial to increase EV range which would at the same time imply using less lithium in those advanced energy storage technologies.